Berkshire Hathaway (BRK.B): Taking Stock of Valuation After a Steady Multi‑Year Climb

Berkshire Hathaway (BRK.B) has quietly inched higher this week, and that modest move is enough to get investors asking a familiar question: is the stock still reasonably priced after its long multiyear climb?

See our latest analysis for Berkshire Hathaway.

At around $504 per share, Berkshire’s latest uptick adds to an already strong run, with an 11.8% year to date share price return and a hefty 5 year total shareholder return of roughly 125 percent, suggesting momentum is still firmly on the side of long term holders.

If Berkshire’s steady compounding has you thinking bigger, now could be a smart time to scan the market for fast growing stocks with high insider ownership.

Yet with shares hovering just below analyst targets and profitability dipping even as revenue climbs, investors face a familiar puzzle: is Berkshire quietly undervalued here, or is the market already baking in the next leg of growth?

Price-to-Earnings of 16.1x: Is it justified?

Berkshire Hathaway’s valuation story starts with earnings, with the stock trading at a 16.1 times price to earnings multiple near its recent $504 close.

The price to earnings ratio compares the current share price to the company’s per share earnings and is a common way to benchmark mature, profitable businesses like Berkshire against peers and history.

On one hand, Berkshire screens as good value versus its estimated fair price to earnings ratio of 16.9 times and the broader peer average of 26 times, which implies the market is not assigning a premium despite its scale, diversified operations and long term earnings track record.

On the other hand, that 16.1 times multiple now sits above the US diversified financials industry average of 13.6 times, which signals that investors are already willing to pay more per dollar of current earnings than for the typical sector name if future compounding stays on course.

Explore the SWS fair ratio for Berkshire Hathaway

Result: Price-to-Earnings of 16.1x (ABOUT RIGHT)

However, softer net income, despite rising revenue and shares already near analyst targets, leaves less room for error if growth expectations cool.

Find out about the key risks to this Berkshire Hathaway narrative.

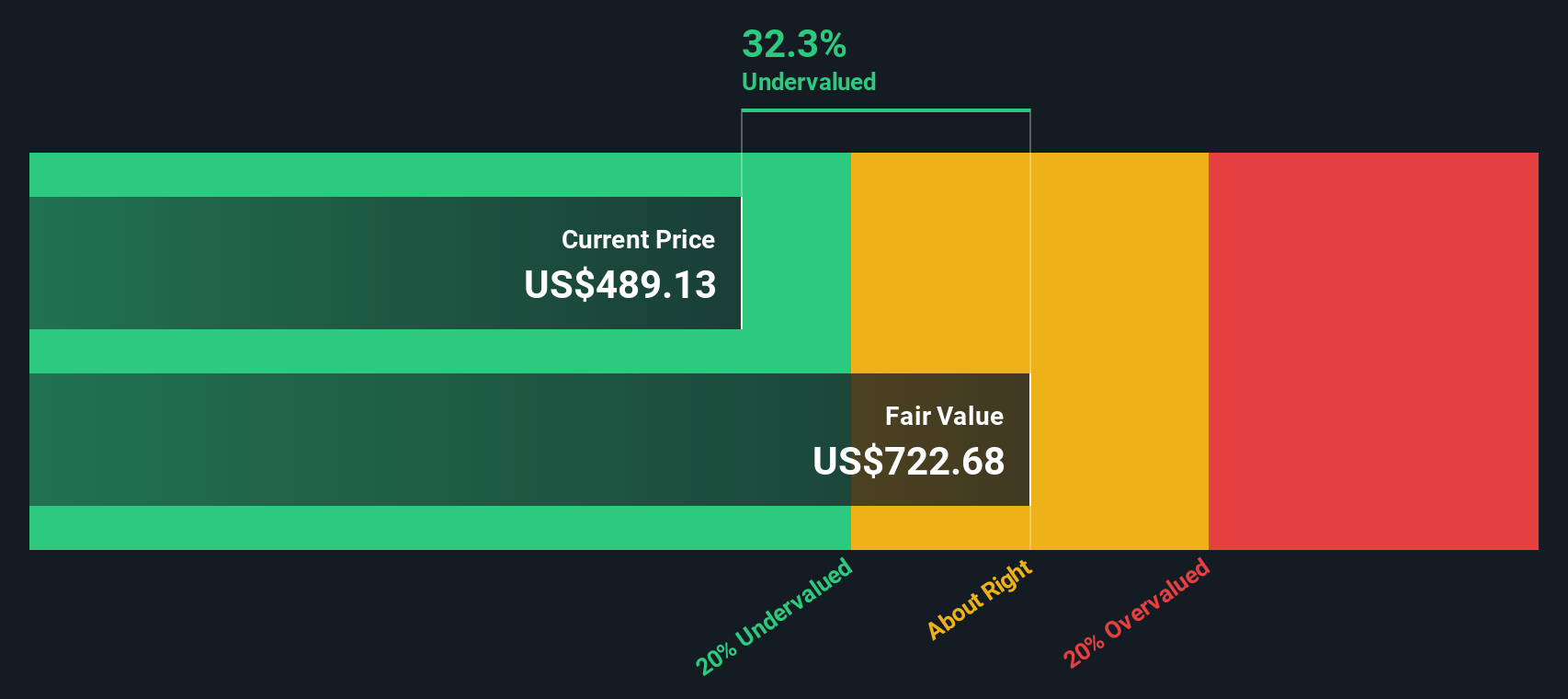

Another View: Our DCF Signals Deeper Value

While the 16.1 times earnings multiple looks roughly fair, our DCF model paints a different picture, suggesting Berkshire’s shares may trade around 34 percent below an estimated fair value of roughly $766. That gap could be a cushion or a value trap, depending on how future earnings evolve.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Berkshire Hathaway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Berkshire Hathaway Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can craft a personalized view in just minutes: Do it your way.

A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next smart idea?

Do not stop at Berkshire; your next edge could be waiting in plain sight, and skipping it now might mean watching tomorrow’s winners from the sidelines.

- Tap into potential multi-baggers by targeting these 3640 penny stocks with strong financials that already show strong balance sheets and healthy underlying fundamentals.

- Ride structural growth trends by focusing on these 25 AI penny stocks powering breakthroughs in automation, data intelligence, and productivity gains across industries.

- Lock in potential bargains by screening for these 907 undervalued stocks based on cash flows where cash flow strength and valuations still leave room for meaningful upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal