Assessing BJ’s Wholesale Club (BJ) Valuation After Resilient Q3 Earnings and Fresh Analyst Revisions

BJ's Wholesale Club Holdings (BJ) just delivered third quarter earnings that met revenue expectations while topping its own profit guidance, a show of consistency that immediately prompted fresh analyst moves across the stock.

See our latest analysis for BJ's Wholesale Club Holdings.

The latest report seems to have nudged sentiment back in BJ's favor. The share price is at $95.91 and the 7 day share price return of 7.03% hints that near term momentum is improving. This comes even though the 1 year total shareholder return sits at a modest 1.69%, well below its strong 151.86% total shareholder return over five years.

If BJ's steady performance has you rethinking your watchlist, this could be a good moment to scout other retail adjacent names using fast growing stocks with high insider ownership.

With earnings still outpacing guidance and the stock trading at a near 14% discount to analyst targets, should investors treat BJ's as a quietly undervalued compounder, or assume the market has already priced in its next leg of growth?

Most Popular Narrative Narrative: 12.2% Undervalued

With BJ's Wholesale Club Holdings last closing at $95.91 against a narrative fair value near $109.26, the story positions the stock as modestly mispriced, hinging on durable membership economics and disciplined growth.

Ongoing investments in Fresh 2.0 (perishables, meat, and seafood), private label, and data driven merchandising are increasing customer loyalty, improving basket size, and lifting gross margin rates. All of these factors are likely to result in higher long term net margins.

Curious how recurring member fees, a measured store rollout, and improving margins are combined into one cohesive valuation case? The narrative reveals which growth levers matter most, which ones fade, and the earnings multiple this strategy is aiming to justify. Want to see the full blueprint behind that mid single digit growth story and premium valuation?

Result: Fair Value of $109.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer discretionary demand and persistent tariff related volatility could derail same store sales, compress margins, and challenge the market's appetite for a richer multiple.

Find out about the key risks to this BJ's Wholesale Club Holdings narrative.

Another Way To Look At Value

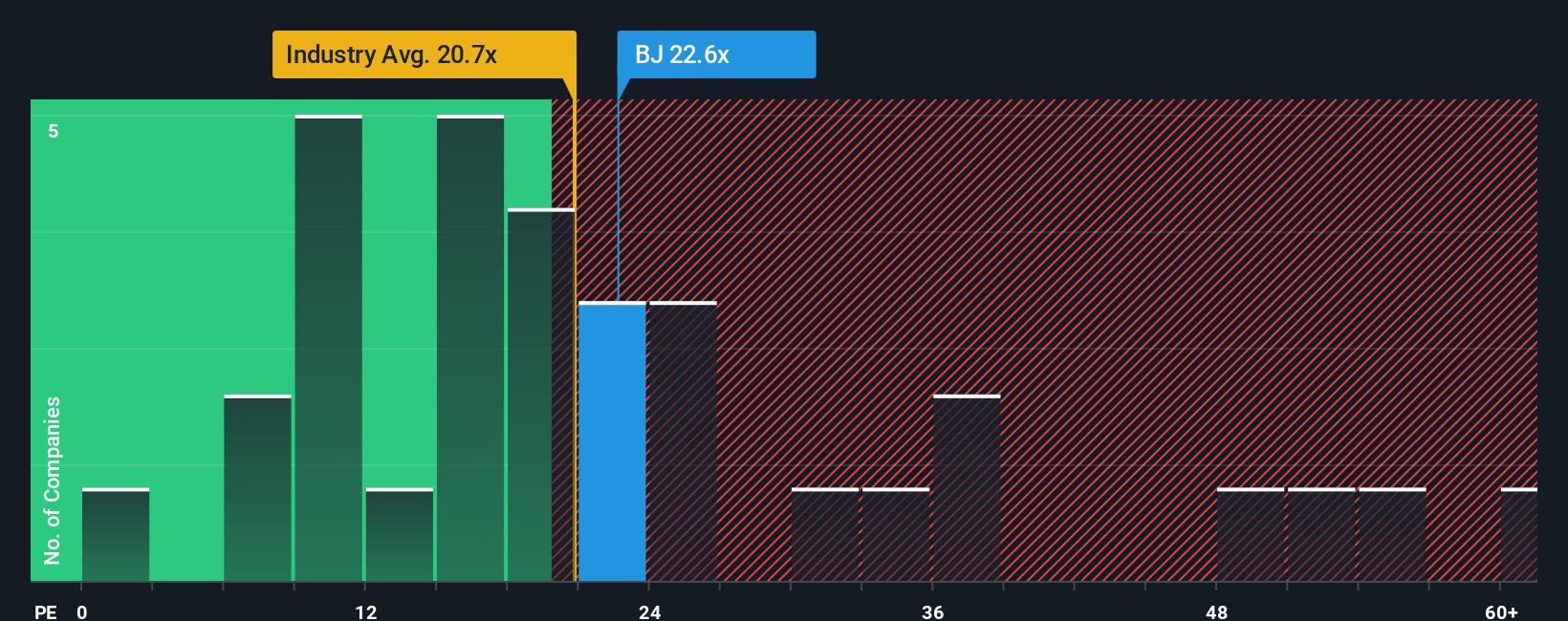

On earnings, BJ looks less forgiving. Its P E ratio of 21.8 times is slightly richer than peers at 21.1 times and well above a fair ratio of 18.3 times, suggesting less upside cushion if growth cools or warehouse club competition heats up from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BJ's Wholesale Club Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More High Conviction Ideas?

Do not stop at one opportunity when a whole watchlist of potential winners is a click away. Let the Screener quickly surface what others are missing.

- Capture early stage growth potential by reviewing these 3640 penny stocks with strong financials that pair small market caps with solid underlying fundamentals.

- Position your portfolio for the next productivity wave by targeting these 26 AI penny stocks powering automation, data intelligence, and real world AI adoption.

- Lock in stronger income streams by focusing on these 13 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal