Westlake (WLK) Valuation Check as Capacity Cuts and Plant Closures Reshape Its Profitability Outlook

Westlake (WLK) just made a big capacity call, approving closures at multiple chlorovinyl and styrene facilities in Mississippi and Louisiana as part of a broader profitability push in a tough commodity chemicals environment.

See our latest analysis for Westlake.

The restructuring news lands after a volatile stretch for Westlake, with a roughly 26 percent 1 month share price return but a sharply negative year to date share price return and weak multi year total shareholder returns. This suggests sentiment is improving off a low base rather than entering a fresh uptrend.

If you are weighing how other materials and industrial names are repositioning for profitability, this could be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

With the stock still down sharply over one and three years but trading only modestly below analyst targets, are investors being compensated for the restructuring risk here, or is the market already pricing in a cleaner, higher margin Westlake?

Most Popular Narrative: 9% Undervalued

With Westlake's fair value pegged around 81.29 dollars versus a 73.98 dollars close, the most followed narrative points to upside grounded in long term earnings recovery.

Westlake's focus on structural cost reductions in the PEM segment (targeting 150 million dollars to 175 million dollars in 2025 and an additional 200 million dollars by 2026) and footprint optimization, including the Pernis plant closure, is expected to drive margin recovery and improved earnings as global manufacturing stabilizes and plant reliability issues subside.

Curious how modest top line growth and a major swing in profitability can still support a richer multiple than today? The full narrative unpacks the earnings bridge, margin reset and valuation math driving that 81 dollar handle.

Result: Fair Value of $81.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global oversupply and higher North American feedstock costs could keep PEM margins under pressure, challenging the earnings recovery reflected in today’s valuation.

Find out about the key risks to this Westlake narrative.

Another Angle on Value

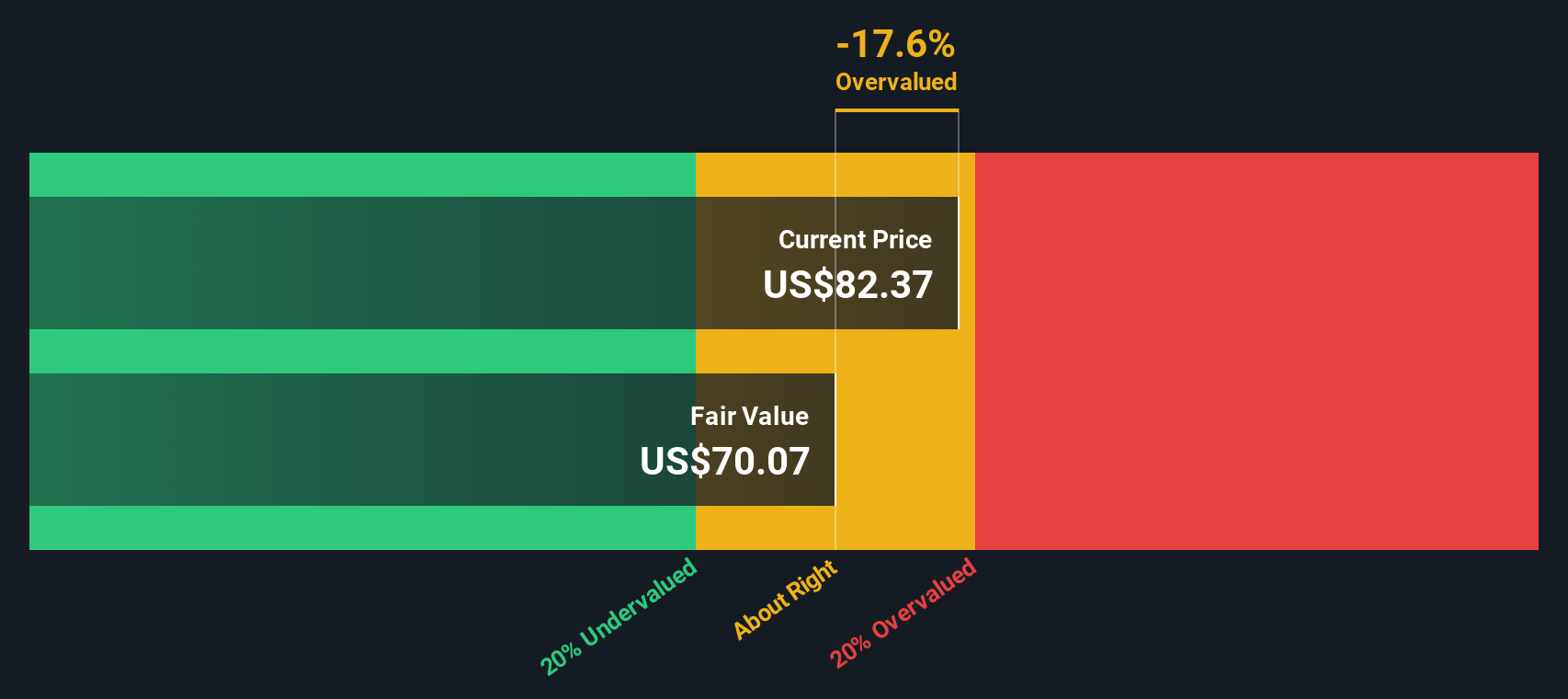

Our DCF model paints a very different picture, suggesting Westlake is overvalued, with fair value closer to 54.90 dollars versus the 73.98 dollars share price. If the cash flow path disappoints, today’s apparent upside could instead represent downside risk.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Westlake Narrative

If this view does not quite align with your own, or you would rather interrogate the numbers yourself, you can easily build a custom story in just a few minutes, starting with Do it your way.

A great starting point for your Westlake research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, explore your next potential opportunity by scanning curated stock ideas that match how you actually like to invest.

- Seek growth potential while keeping risk in check by reviewing these 3639 penny stocks with strong financials that pair smaller size with improving fundamentals.

- Align your portfolio with emerging innovation by assessing these 26 AI penny stocks involved in automation and intelligent software.

- Focus on these 13 dividend stocks with yields > 3% that provide cash distributions supporting income-focused strategies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal