Central Bancompany (CBC): Valuation Check After Bullish Post‑IPO Analyst Initiations

Central Bancompany (CBC) is suddenly on a lot more watchlists after a wave of upbeat initiations from Morgan Stanley, Bank of America, Piper Sandler, and Stephens following its recent IPO.

See our latest analysis for Central Bancompany.

Those bullish initiations are landing on a stock that already has strong momentum, with a year to date share price return of roughly 74 percent and a one year total shareholder return near 84 percent. This hints that investors are steadily repricing its growth and balance sheet strength.

If Central Bancompany's early post IPO run has your attention, this is a good time to explore fast growing stocks with high insider ownership for other fast moving names backed by committed insiders.

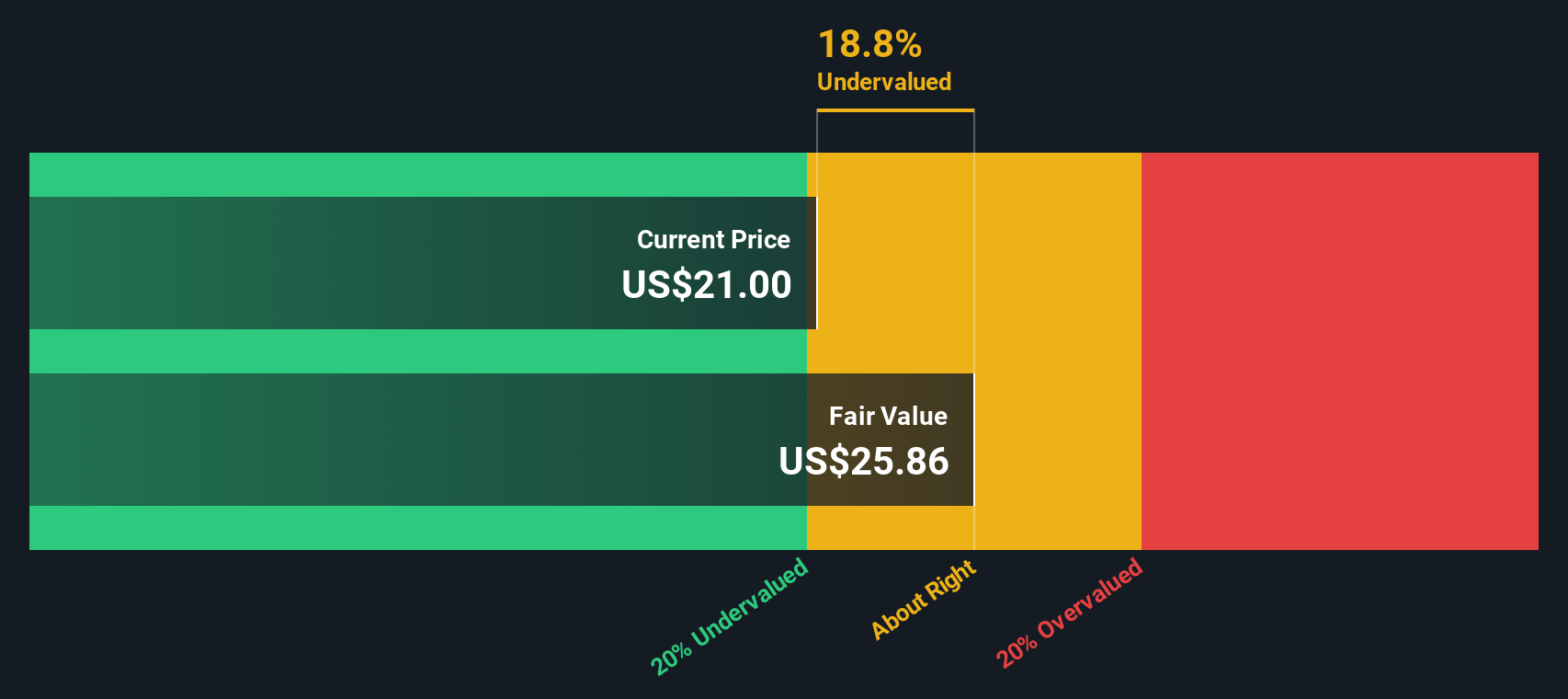

With analysts flagging more than 20 percent upside and the stock already up sharply since its IPO, the key question now is whether Central Bancompany is still undervalued or if the market has already priced in its future growth.

Price-to-Earnings of 16.1x: Is it justified?

Central Bancompany is trading on a 16.1x price to earnings multiple, above peers and the broader US banks group at the latest close of $23.31.

The price to earnings ratio compares what investors pay today with the company’s current earnings, a key yardstick for profitable, established banks.

At 16.1x earnings, the market is assigning Central Bancompany a richer valuation than both the US Banks industry average of 12x and its peer group at 11.6x. This suggests investors are willing to pay a premium for its earnings stream even though our estimated fair price to earnings ratio stands lower at 14.3x.

This premium is significant. The current multiple stands well above both the industry and peer benchmarks and even above the level our fair ratio model indicates the market could eventually gravitate toward.

Explore the SWS fair ratio for Central Bancompany

Result: Price-to-Earnings of 16.1x (OVERVALUED)

However, Central Bancompany still faces risks from a higher rate or a turning credit cycle, which could pressure loan growth, margins, and asset quality expectations.

Find out about the key risks to this Central Bancompany narrative.

Another View: DCF Signals Deep Undervaluation

While the earnings multiple makes Central Bancompany look expensive, our DCF model paints a very different picture, suggesting fair value closer to $39.48 versus today’s $23.31. If that gap narrows even part way, is the market underestimating this bank’s long term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Central Bancompany for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Central Bancompany Narrative

If you see the numbers differently or prefer to dig into the data on your own, you can build a complete view in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Central Bancompany.

Looking for more investment ideas?

Before you move on, you may want to consider using the Simply Wall St Screener to spot opportunities most investors are still missing.

- Explore consistent cash flow potential with these 13 dividend stocks with yields > 3% that can help anchor your portfolio when markets turn.

- Look into transformative innovation by screening these 26 AI penny stocks that could reshape entire industries.

- Research potential mispriced opportunities using these 912 undervalued stocks based on cash flows before the rest of the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal