Asian Market: 3 Stocks That May Be Trading Below Estimated Value

As global markets experience fluctuations with interest rate adjustments and economic uncertainties, Asian stocks present unique opportunities for investors seeking value. In this context, identifying undervalued stocks involves assessing factors such as company fundamentals, market position, and the broader economic environment to uncover potential investments that may be trading below their estimated value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.67 | CN¥303.69 | 49.4% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.86 | CN¥25.28 | 49.1% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.24 | HK$16.21 | 49.2% |

| Mobvista (SEHK:1860) | HK$15.47 | HK$30.70 | 49.6% |

| KoMiCo (KOSDAQ:A183300) | ₩84300.00 | ₩166235.75 | 49.3% |

| JINS HOLDINGS (TSE:3046) | ¥5480.00 | ¥10936.95 | 49.9% |

| Global Security Experts (TSE:4417) | ¥2896.00 | ¥5752.68 | 49.7% |

| FIT Hon Teng (SEHK:6088) | HK$5.65 | HK$11.25 | 49.8% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥259.34 | CN¥517.30 | 49.9% |

| ActRO (KOSDAQ:A290740) | ₩12750.00 | ₩25049.37 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

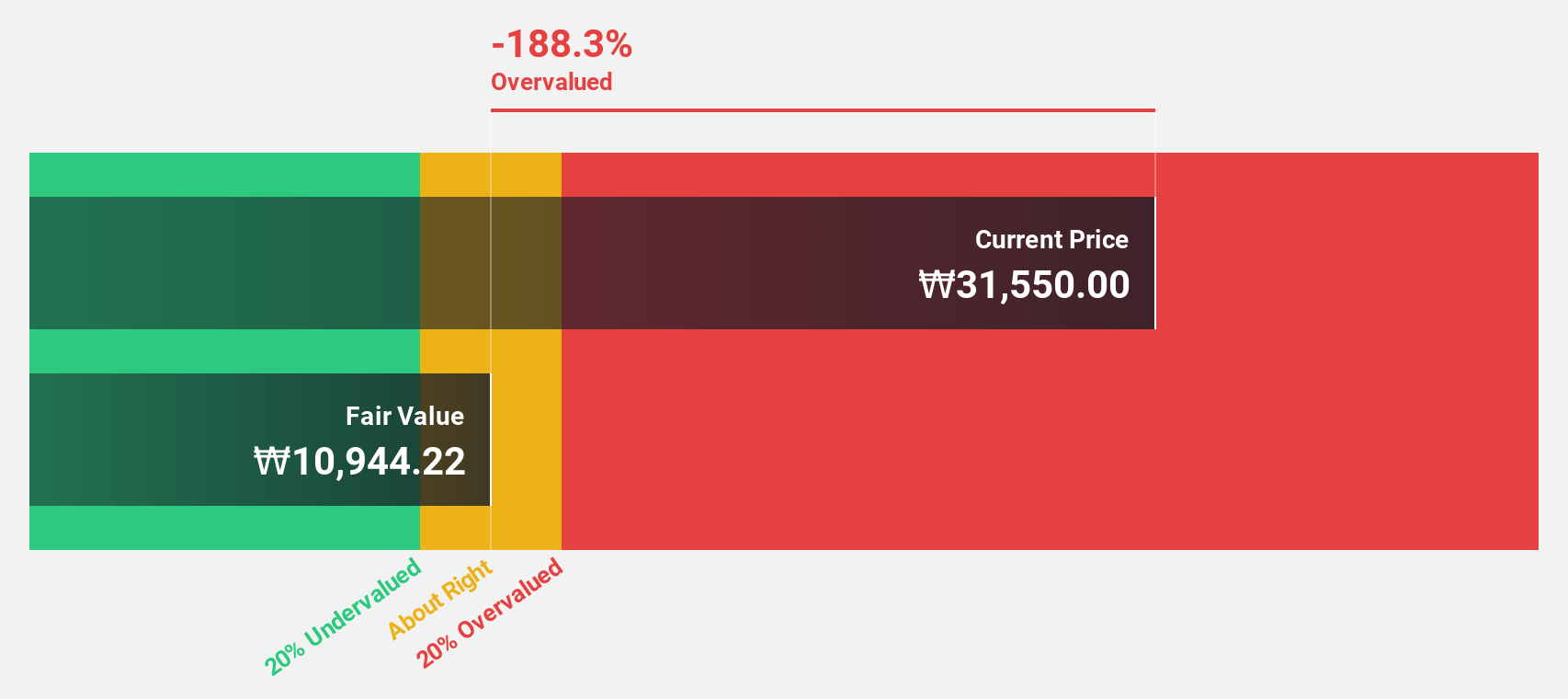

AprilBioLtd (KOSDAQ:A397030)

Overview: AprilBio Co., Ltd. develops long-acting biobetter and antibody biologics, with a market cap of ₩1.03 trillion.

Operations: AprilBio Co., Ltd. does not have specified revenue segments available in the provided text.

Estimated Discount To Fair Value: 26.4%

AprilBio Ltd. is trading at ₩44,300, which is 26.4% below its estimated fair value of ₩60,203.7, indicating it may be undervalued based on cash flows. Despite recent share price volatility, the company is expected to achieve profitability within three years with earnings projected to grow by a very large margin annually and revenue growth forecasted at 79.2% per year—significantly outpacing the Korean market's average growth rate of 10.6%.

- The analysis detailed in our AprilBioLtd growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of AprilBioLtd.

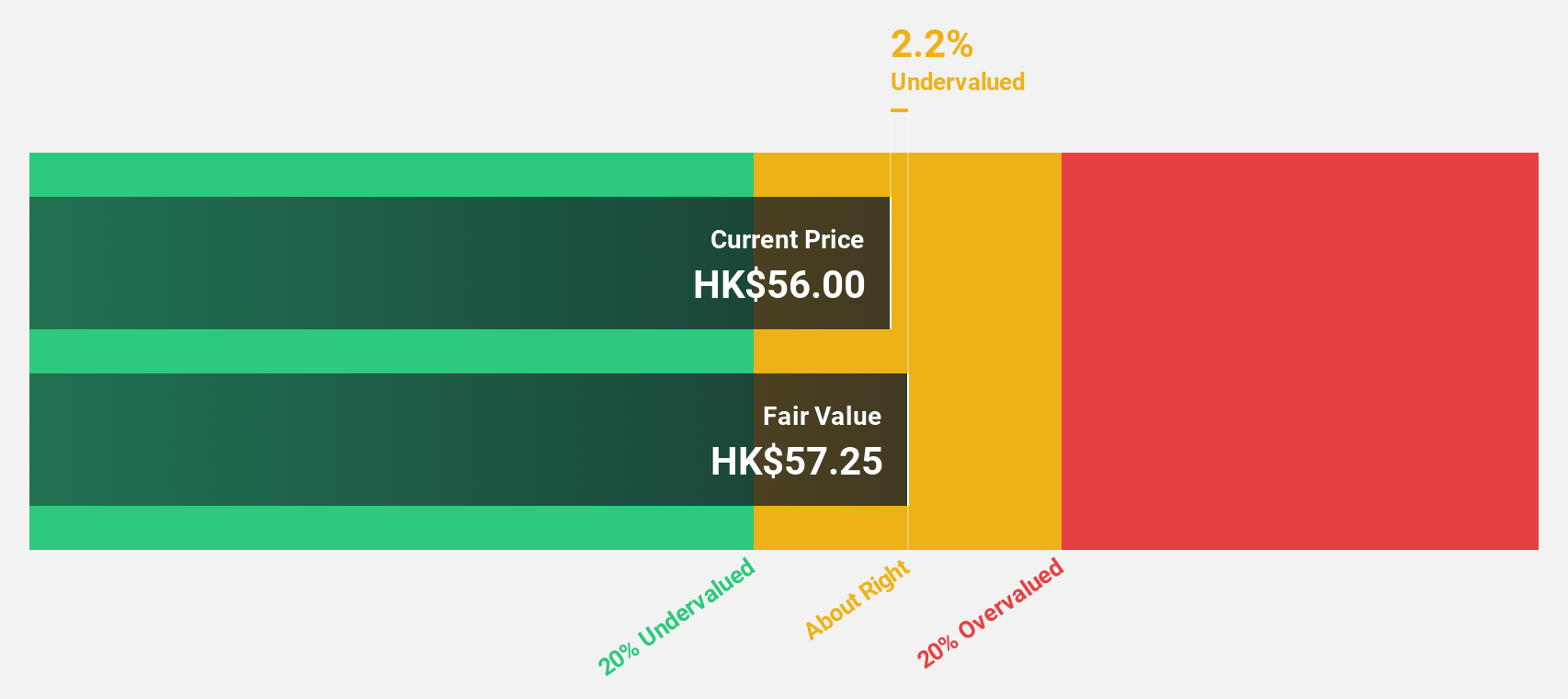

Angelalign Technology (SEHK:6699)

Overview: Angelalign Technology Inc. is an investment holding company that specializes in the research, design, manufacture, sale, and marketing of clear aligner treatment solutions both in the People’s Republic of China and internationally, with a market cap of approximately HK$10.44 billion.

Operations: The company's revenue is primarily derived from its Dental Equipment & Supplies segment, which generated $308.87 million.

Estimated Discount To Fair Value: 10.1%

Angelalign Technology is trading at HK$61.15, slightly below its estimated fair value of HK$68.01, suggesting potential undervaluation based on cash flows. The company's earnings are forecasted to grow significantly faster than the Hong Kong market, supported by strategic partnerships and technological advancements in 3D printing for orthodontics. Recent innovations like the iOrtho® platform expansion and new materials enhance treatment efficiency and patient experience, despite ongoing legal challenges from competitors.

- According our earnings growth report, there's an indication that Angelalign Technology might be ready to expand.

- Click here to discover the nuances of Angelalign Technology with our detailed financial health report.

GEM (SZSE:002340)

Overview: GEM Co., Ltd. operates in the waste resource comprehensive utilization industry both in China and internationally, with a market cap of CN¥37.67 billion.

Operations: The company's revenue segments include cobalt products (CN¥6.12 billion), nickel products (CN¥4.56 billion), battery materials (CN¥3.78 billion), and recycling services (CN¥2.34 billion).

Estimated Discount To Fair Value: 40.2%

GEM Co., Ltd. is trading at CN¥7.4, significantly below its estimated fair value of CN¥12.38, highlighting potential undervaluation based on cash flows. Despite a forecasted low return on equity of 12.2% in three years, earnings are expected to grow substantially at 39% annually, outpacing the Chinese market's growth rate. However, the dividend yield of 0.89% is not well covered by free cash flow and debt coverage remains a concern despite robust revenue growth projections.

- Our growth report here indicates GEM may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of GEM stock in this financial health report.

Summing It All Up

- Reveal the 282 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal