Furukawa Electric (TSE:5801) Valuation After Board-Backed Shenyang Furukawa Cable Equity Transfer

Furukawa Electric (TSE:5801) just put a spotlight on its China strategy, with the board meeting on December 11 set to approve transferring all equity in subsidiary Shenyang Furukawa Cable, a move investors are watching closely.

See our latest analysis for Furukawa Electric.

The upcoming divestment news lands after a choppy stretch, with a 7 day share price return of minus 7.57 percent and 30 day share price return of minus 10.91 percent. Yet a strong year to date share price return of 30.61 percent and a standout 3 year total shareholder return of 292.59 percent show that longer term momentum is still very much intact.

If this kind of portfolio reshaping has you thinking more broadly about where growth and conviction overlap, it could be worth exploring fast growing stocks with high insider ownership.

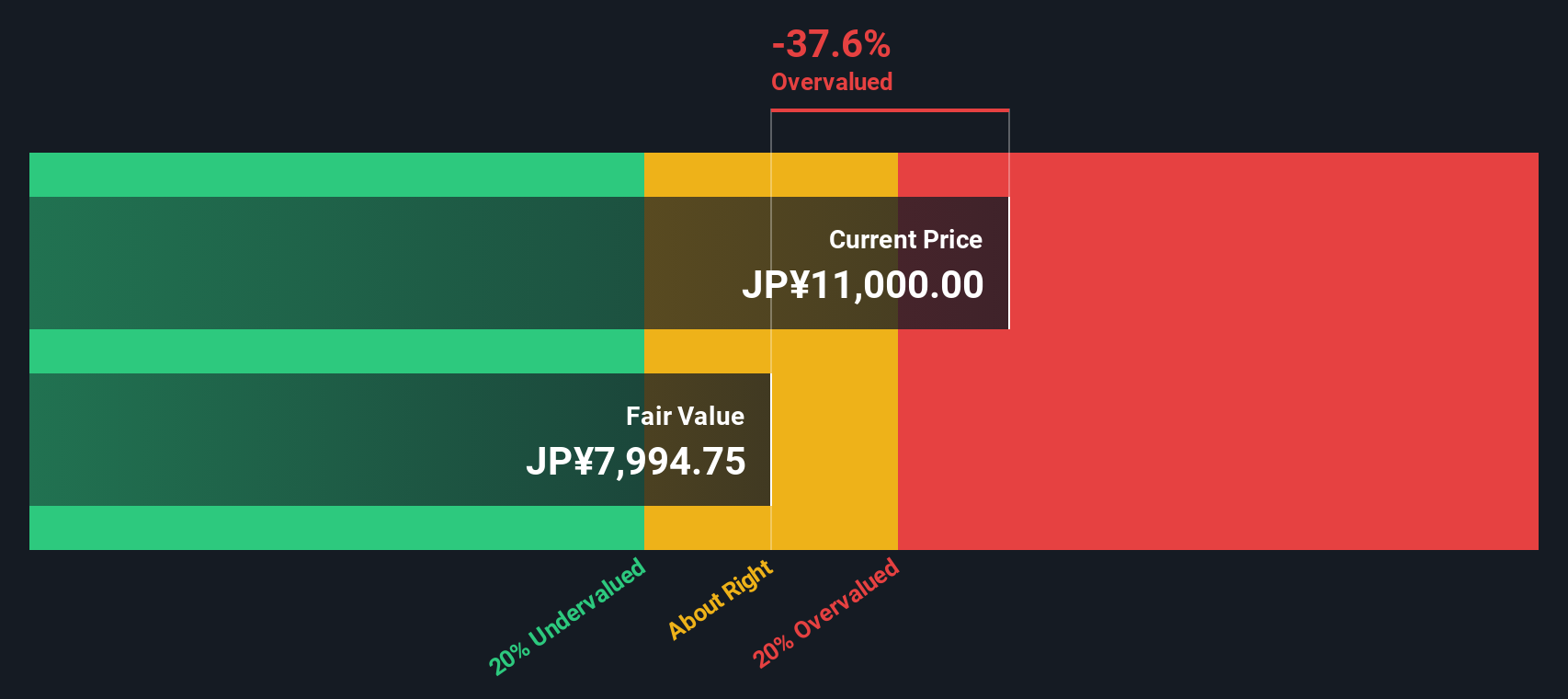

With analysts still seeing upside to the current share price and profitable growth ticking higher, investors now face a key question: Is Furukawa Electric still trading below its true value, or has the market already priced in its next leg of growth?

Price to Earnings of 18.4x: Is it justified?

Furukawa Electric trades on a price to earnings ratio of 18.4 times, a level that points to modest undervaluation versus its own earnings power and peer group.

The price to earnings multiple links the current share price to the company’s per share profits, making it a core yardstick for mature industrials like Furukawa Electric.

Here, the market is paying less than the 29.3 times earnings suggested by our fair price to earnings estimate, even though earnings have grown strongly and are forecast to keep rising solidly.

Against that backdrop, the stock looks expensive relative to the broader Japanese electrical industry average multiple of 13.9 times. However, the gap to the higher 29.3 times fair ratio implies meaningful room for rerating if profit growth and returns hold up.

Explore the SWS fair ratio for Furukawa Electric

Result: Price-to-Earnings of 18.4x (UNDERVALUED)

However, near term setbacks in China execution and any slowdown in infrastructure or auto demand could quickly cool enthusiasm around Furukawa Electric’s rerating potential.

Find out about the key risks to this Furukawa Electric narrative.

Another Angle on Value

Our DCF model points to a fair value of ¥9457.83 per share, only about 2.7 percent above the current ¥9203 price, suggesting Furukawa Electric is just modestly undervalued. If the upside is this tight, how much margin of safety do investors really have?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Furukawa Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Furukawa Electric Narrative

If you see the outlook differently or would rather dig into the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A great starting point for your Furukawa Electric research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity; use the Simply Wall Street Screener to pinpoint fresh stocks that match your strategy before the market catches up.

- Capture potential mispricings by targeting companies trading below intrinsic value using these 913 undervalued stocks based on cash flows before sentiment turns and prices adjust.

- Position yourself early in transformative technology by focusing on these 28 quantum computing stocks that could reshape entire industries over the next decade.

- Lock in reliable cash flows by zeroing in on these 13 dividend stocks with yields > 3% that can boost your portfolio’s income and stability through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal