Children’s Place (PLCE) Q3 Loss Reinforces Bearish Narrative on Profitability and Turnaround Prospects

Children's Place (PLCE) just turned in a mixed Q3 2026 update, with revenue of about $339 million and a basic EPS loss of roughly $0.19 as the retailer continues to work through a difficult turnaround. The company has seen quarterly revenue move from around $320 million in Q2 2025 to $390 million in Q3 2025 and then to $339 million this quarter, while EPS has swung from a $2.51 loss in Q2 2025 to a $1.57 profit in Q3 2025 and back to losses of $0.24 in Q2 2026 and $0.19 in Q3 2026. This underscores how choppy profitability and margins remain for shareholders watching this reset story.

See our full analysis for Children's Place.With the hard numbers on the table, the next step is to see how this earnings print lines up against the dominant narratives around Children's Place, and where the data might be quietly reshaping the story investors are telling themselves.

Curious how numbers become stories that shape markets? Explore Community Narratives

LTM loss of $51.7 million keeps profitability under pressure

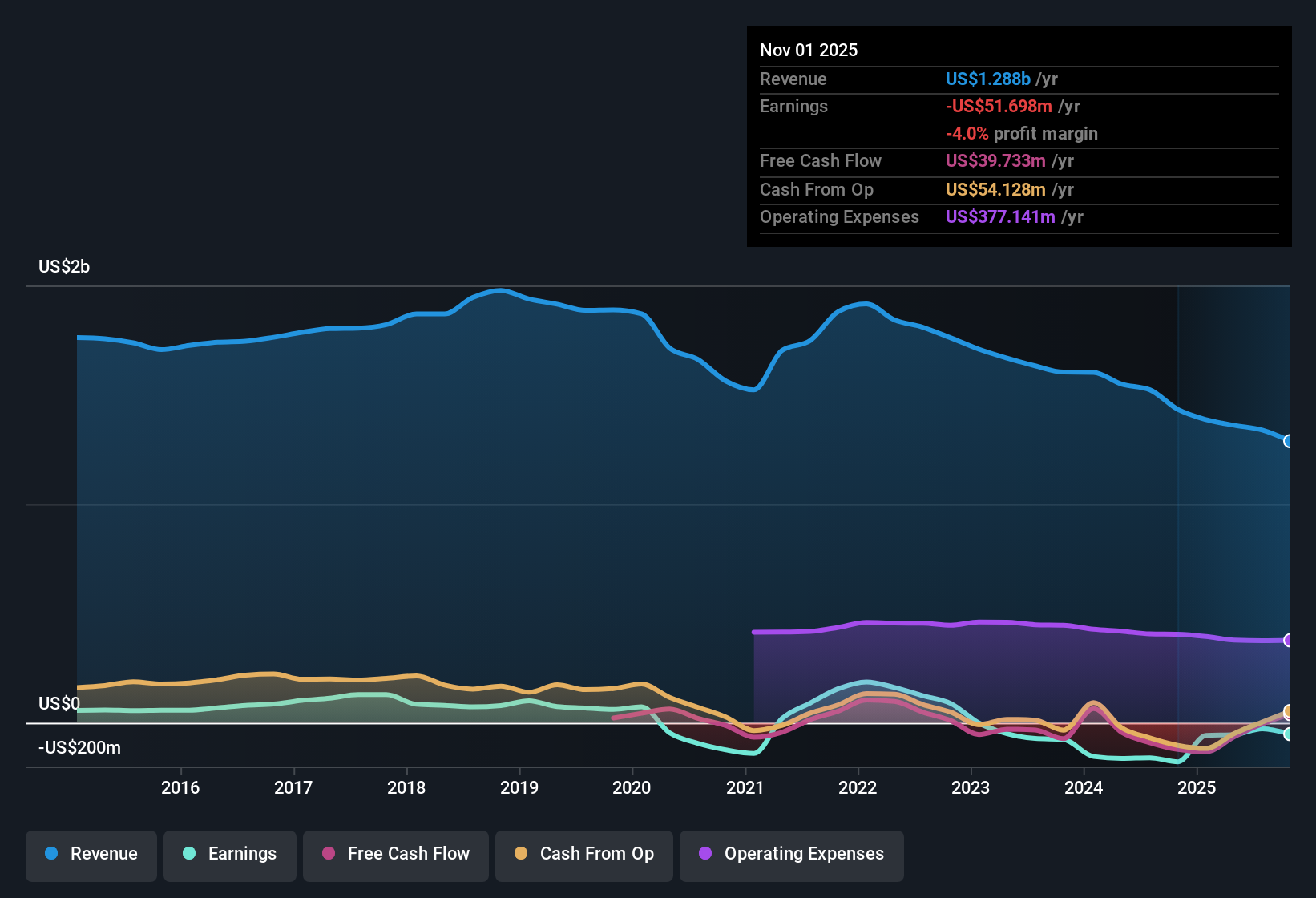

- Over the last twelve months, Children's Place booked about $1,288 million of revenue but still recorded a net loss of roughly $51.7 million, with trailing EPS at a loss of about $2.63 per share.

- Bears focus on that five year trend of losses worsening at about 25.8% a year, and this latest twelve month loss profile lines up with that concern rather than easing it

- Trailing revenue has slipped from about $1,523 million to $1,288 million over the past few twelve month snapshots, so the weak 1% annual growth rate is being measured off a shrinking base rather than a growing one.

- The combination of negative net income in every recent quarter, from a $34.0 million loss in Q1 2026 to a smaller $4.3 million loss in Q3 2026, still leaves the trailing period firmly in the red and does not yet contradict the multi year earnings decline story.

Same store sales trends still negative despite Q3 revenue lift

- Store level performance is improving off a low base, with same store sales down 13.6% in Q1 2026 and 4.7% in Q2 2026 while total quarterly revenue has moved from $242 million in Q1 2026 to $339 million in Q3 2026.

- What is striking for the bearish narrative is that even as quarterly revenue recovered from $298 million in Q2 2026 to $339 million in Q3 2026, the trailing twelve month revenue line is still only growing about 1% a year versus a 10.6% market benchmark

- This tension between short term quarterly improvement and weak trailing growth shows why critics emphasize structural challenges, since the better recent quarters have not yet translated into clear top line momentum over a full year.

- The fact that the strong Q3 2025 period with $390 million of revenue and $20.1 million of net income sits in the twelve month history but the last two twelve month snapshots still show sizeable losses underlines how rare the profitable quarters have been.

Cheap 0.1x sales multiple against a stressed balance sheet

- On valuation, the stock changes hands at about 0.1 times trailing sales, noticeably below both the 0.5 times sales average for US specialty retailers and the 0.2 times sales level for peers, while the share price sits around $4.64.

- Bears argue that this low multiple mainly reflects balance sheet strain, and the data supports that view rather than an overlooked bargain

- Negative shareholders' equity and recent substantial share dilution mean existing holders own a thinner slice of a business that is still posting trailing net losses of over $50 million.

- Interest payments are described as not well covered by earnings, so even with the discount versus peers, the combination of weak coverage, continued losses and a volatile share price makes the low 0.1 times sales look like compensation for risk rather than a clear upside signal.

With profitability still negative and the balance sheet under pressure, some investors will want to see how a full narrative pulls these pieces together before deciding whether the current 0.1 times sales multiple is a value opportunity or a value trap. 📊 Read the full Children's Place Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Children's Place's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Children's Place is wrestling with persistent losses, fragile margins, and a stressed balance sheet, which together make its ultra low sales multiple look more like a warning than an opportunity.

If this kind of financial strain feels too risky, use our solid balance sheet and fundamentals stocks screener (1942 results) to quickly shift your focus toward businesses with sturdier finances, healthier leverage, and more resilient earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal