Remitly (RELY) Valuation After Investor Day’s Updated Long-Term Growth and Margin Expansion Outlook

Remitly Global (RELY) just refreshed its long term roadmap at Investor Day, projecting high teens revenue growth in 2026 and targeting up to 3 billion dollars in annual revenue by 2028.

See our latest analysis for Remitly Global.

The upbeat long term roadmap seems to be stabilising sentiment, with the share price at 14.48 dollars after a recent 1 month share price return of 14.9 percent. The year to date share price return is still down sharply, but the 3 year total shareholder return remains strongly positive, suggesting long term momentum is intact while confidence is rebuilding rather than surging.

If Remitly’s growth story has your attention, this could be a good moment to see what else is out there and explore fast growing stocks with high insider ownership.

With shares still trading well below bullish analyst targets despite fresh multiyear growth guidance, is Remitly quietly undervalued today, or has the market already started to price in that future expansion?

Most Popular Narrative Narrative: 33% Undervalued

With Remitly last closing at 14.48 dollars and the most followed narrative pointing to fair value near 21.50 dollars, the gap implies meaningful upside if its growth path plays out.

The analysts have a consensus price target of $28.6 for Remitly Global based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $25.0.

Are you wondering what kind of revenue trajectory, margin uplift, and future earnings multiple could be used to justify this potential upside? The narrative presents growth assumptions that project today’s profit base into a larger future earnings profile. If you are curious which assumptions have the biggest impact on the implied fair value, you can review the full framework behind that target.

Result: Fair Value of $21.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory scrutiny of stablecoins and tougher competition from rival fintechs could squeeze margins and stall the growth story that underpins this upside case.

Find out about the key risks to this Remitly Global narrative.

Another Way To Look At Valuation

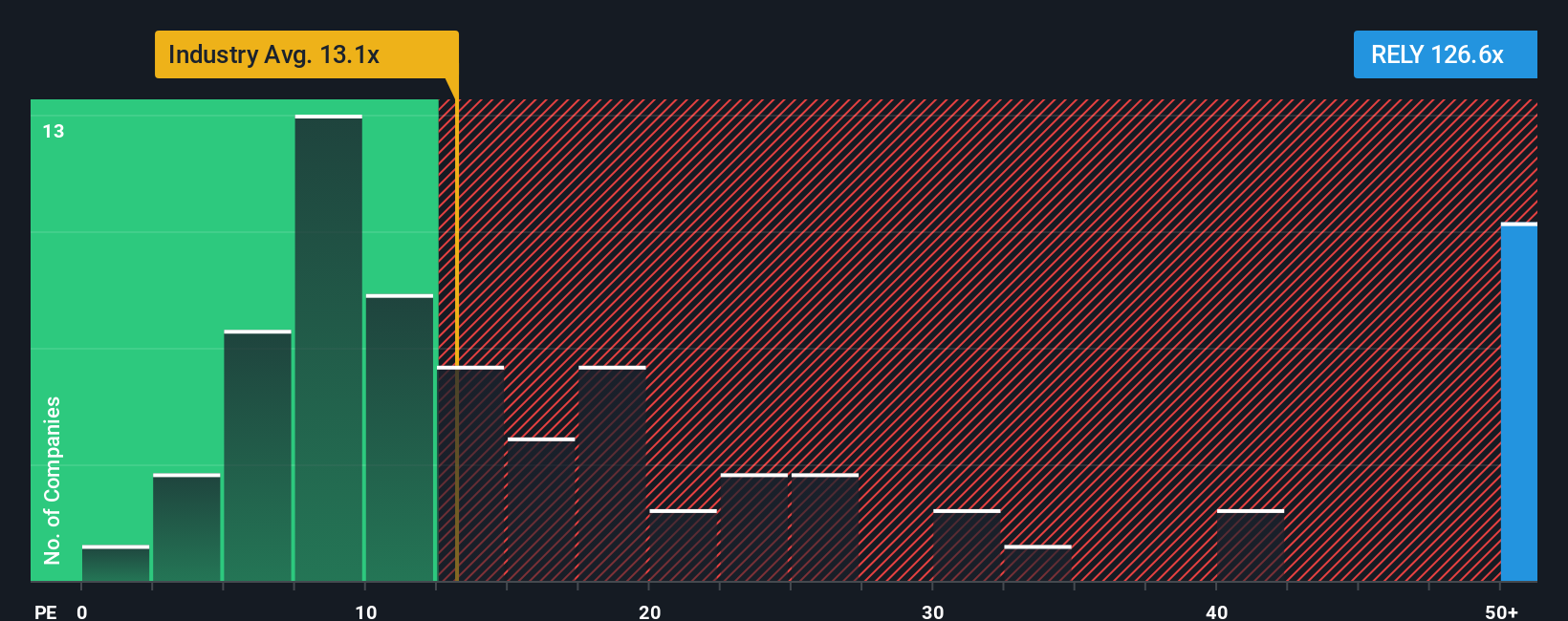

While the narrative framework points to Remitly being around 33 percent undervalued, its 140.3 times price to earnings ratio paints a very different picture. That is far above both the estimated fair ratio of 32.2 times and the industry average near the mid 10s, which suggests substantial valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Remitly Global Narrative

If you see things differently or want to stress test the assumptions yourself, you can build a personalised Remitly thesis in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Remitly Global.

Looking for more investment ideas?

Smart investors rarely stop at one opportunity, so use the Simply Wall St Screener now to uncover fresh stocks that could sharpen your next move.

- Explore the potential for higher income by targeting reliable payers through these 12 dividend stocks with yields > 3% and avoid leaving attractive yields on the table.

- Capture tomorrow’s innovation today by zeroing in on breakthrough companies using these 26 AI penny stocks before the crowd fully catches on.

- Strengthen your portfolio’s resilience by focusing on quality bargains surfaced in these 914 undervalued stocks based on cash flows while others overlook mispriced cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal