Emerson Electric (EMR): Is the 12.7% Undervaluation Story Still Intact After Recent Share Price Strength?

Emerson Electric (EMR) has quietly outperformed many industrial peers this year, and with the stock hovering near 52 week highs, investors are asking whether current pricing still leaves enough upside on the table.

See our latest analysis for Emerson Electric.

The latest pullback sits against a solid backdrop, with a roughly 8 percent year to date share price return and an 82 percent five year total shareholder return suggesting momentum is cooling rather than breaking.

If Emerson’s run has you thinking about where to position for the next leg of the cycle, this is a good moment to explore fast growing stocks with high insider ownership.

With shares still trading below consensus targets and intrinsic value screens flagging a sizeable discount, the key debate now is simple: is Emerson mispriced for its quality, or is the market already baking in years of growth?

Most Popular Narrative Narrative: 12.7% Undervalued

With the narrative fair value sitting meaningfully above Emerson Electric’s last close, the story hinges on whether its growth and margin ambitions truly stick.

The company's transformation toward a pure play automation leader emphasizing innovation, commercialization of new products, and operational excellence continues to yield improved profitability (e.g., margin expansion, higher free cash flow) and positions Emerson to capitalize on long term modernization and infrastructure trends.

Want to see how steady double digit earnings growth, expanding margins, and a premium future multiple all plug into one cohesive valuation story? Read on.

Result: Fair Value of $150.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering FX and tariff headwinds, plus execution risk around large-scale software integrations, could quickly challenge expectations for seamless margin expansion.

Find out about the key risks to this Emerson Electric narrative.

Another Lens on Valuation

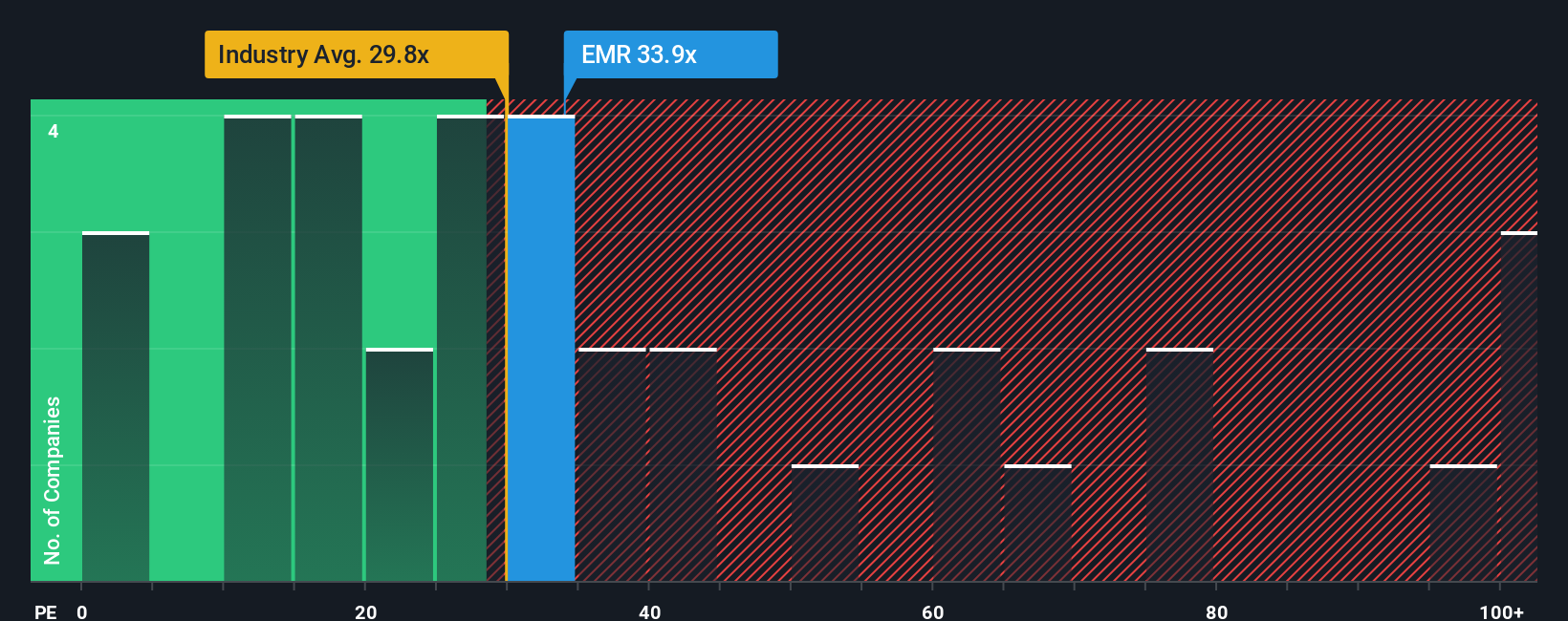

Step away from the narrative fair value and the picture gets murkier. On a simple price to earnings basis, Emerson trades at about 33 times earnings, richer than the US Electrical industry at 31.8 times and above its own 31.9 times fair ratio, hinting at limited margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Emerson Electric Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities with focused stock lists built from real fundamentals, so you are not left chasing yesterday’s winners.

- Target resilient income potential by scanning these 12 dividend stocks with yields > 3% that can support your portfolio through different market cycles.

- Capitalize on transformative innovation by evaluating these 26 AI penny stocks at the forefront of automation, data intelligence, and next generation software.

- Strengthen your long term returns by zeroing in on these 913 undervalued stocks based on cash flows that still trade at a meaningful discount to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal