Cheesecake Factory (CAKE): Reassessing Valuation After a 13% One-Month Share Price Rebound

Cheesecake Factory (CAKE) has quietly outperformed the broader market over the past month, climbing about 13%, as investors reassess the chain’s pricing power, traffic trends, and improving profitability.

See our latest analysis for Cheesecake Factory.

That recent 1 month share price return of 13.33% comes after a choppier quarter. However, with the stock now at $50.26 and a 3 year total shareholder return of 74.47%, momentum still looks more constructive than not.

If Cheesecake Factory’s rebound has you rethinking casual dining, it could also be a smart moment to scout fast growing stocks with high insider ownership for the next set of potential outperformers.

With earnings growing faster than sales and the share price still trading below consensus targets, investors now face a key question: is Cheesecake Factory undervalued after its rebound, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 31.9% Undervalued

Compared with the last close at $50.26, the narrative fair value of $73.83 points to sizeable upside if its long term growth path plays out.

The Cheesecake Factory is a stock that I believe most people do not understand its actual potential, or really what makes this stock so attractive for long term growth. Here is a brief description of the company according to Benzinga: "Cheesecake Factory Inc owns and operates restaurants in the United States and Canada under brands that include The Cheesecake Factory, North Italia, and a collection within the Fox Restaurants Concepts subsidiary. The company's international presence, in the Middle East and Mexico, is through licensing agreements with third parties."

Curious how steady earnings expansion, rising profit margins and a future premium multiple combine into that punchy upside case? The narrative spells out the full math.

Result: Fair Value of $73.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing same store sales, or higher labor and food costs, could easily compress margins and challenge assumptions behind that bullish valuation path.

Find out about the key risks to this Cheesecake Factory narrative.

Another View on Value

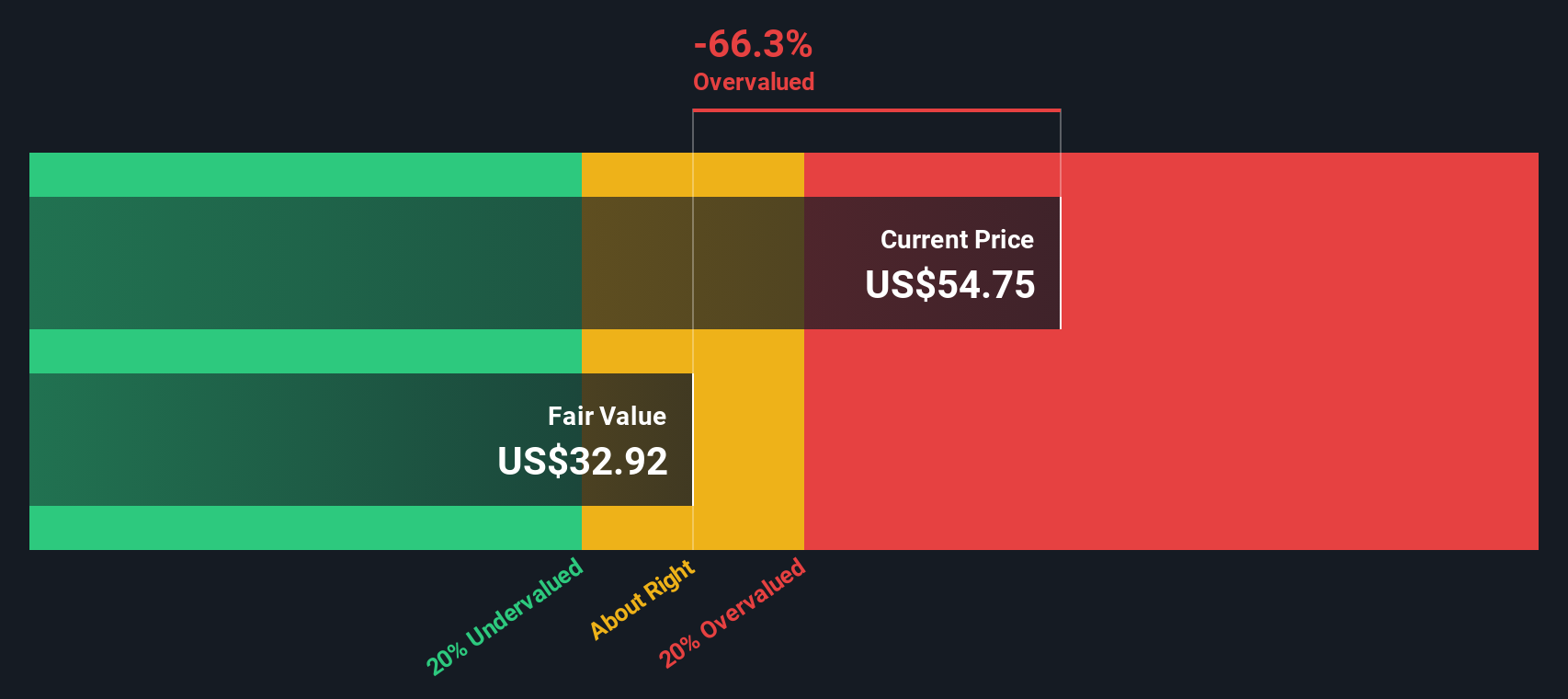

Simply Wall St’s DCF model paints a far cooler picture than the narrative fair value. It suggests Cheesecake Factory is trading above its estimated fair value of $29.88. If the cash flow assumptions prove closer to reality, is today’s price baking in too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheesecake Factory for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheesecake Factory Narrative

If you see the story differently, or just prefer digging into the numbers yourself, you can craft a personalized narrative in minutes using Do it your way.

A great starting point for your Cheesecake Factory research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market moves without you, put Simply Wall St’s screener to work and line up your next opportunities with the same clarity you brought to CAKE.

- Explore mispriced opportunities by targeting companies that appear inexpensive on a cash flow basis with these 912 undervalued stocks based on cash flows, before the broader market reacts.

- Participate in long-term trends in automation and machine learning by scanning these 26 AI penny stocks for businesses working on real world AI adoption.

- Seek potential income and stability by focusing on mature businesses offering established yields using these 12 dividend stocks with yields > 3% as your income-focused starting point.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal