Is Sezzle’s Surging 60% Rally in 2025 Still Supported by Its Fundamentals?

- Wondering if Sezzle at around $73 a share is getting ahead of itself or still quietly undervalued? Let us unpack what the recent price action and fundamentals are really saying about where value might lie from here.

- Over the last week the stock is up 5.4%, it has surged roughly 40.1% over the past month, and is still sitting on a 60.6% gain year to date after a 39.0% rise over the past year. This tells you investor sentiment has shifted dramatically.

- Those moves have come as buy now, pay later names have returned to the spotlight and investors have rotated back into fintechs with improving growth narratives and tighter underwriting. At the same time, renewed debate about regulation and credit quality has kept risk perceptions in flux, which helps explain some of the volatility around Sezzle.

- On our framework Sezzle scores just 2 out of 6 on valuation checks, suggesting the market may already be pricing in a lot of good news and forcing us to be selective about which metrics we trust. Next we will walk through those valuation approaches in detail, then finish with a more holistic way to judge what Sezzle is really worth over the long run.

Sezzle scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sezzle Excess Returns Analysis

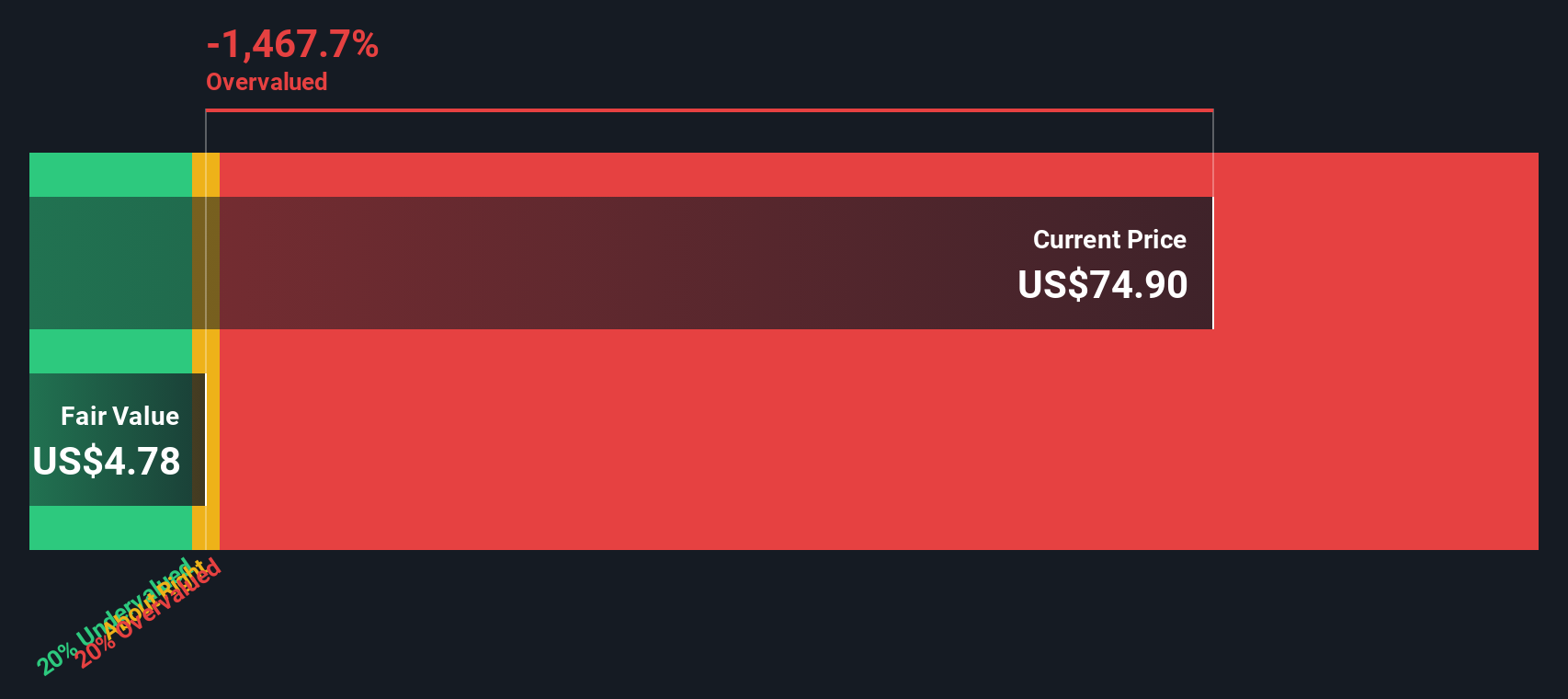

The Excess Returns model looks at how much profit a company can generate above the return investors demand on its equity, then capitalizes those surplus profits into a per share value today. It is less about short term earnings and more about the sustainability of value creation over time.

For Sezzle, the model starts with a Book Value of $4.55 per share and a Stable EPS of $0.40 per share, based on the median return on equity from the past 5 years. With an Average Return on Equity of 45.18% and a Cost of Equity of 0.06 per share, the implied Excess Return is a sizeable 0.33 per share. The Stable Book Value used is $0.88 per share, drawn from the median historical book value.

Despite these strong excess returns, the model translates this into an intrinsic value well below the current share price. This implies Sezzle is 726.3% overvalued on this basis. In other words, the market already seems to be paying a very rich premium for future value creation.

Result: OVERVALUED

Our Excess Returns analysis suggests Sezzle may be overvalued by 726.3%. Discover 910 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sezzle Price vs Earnings

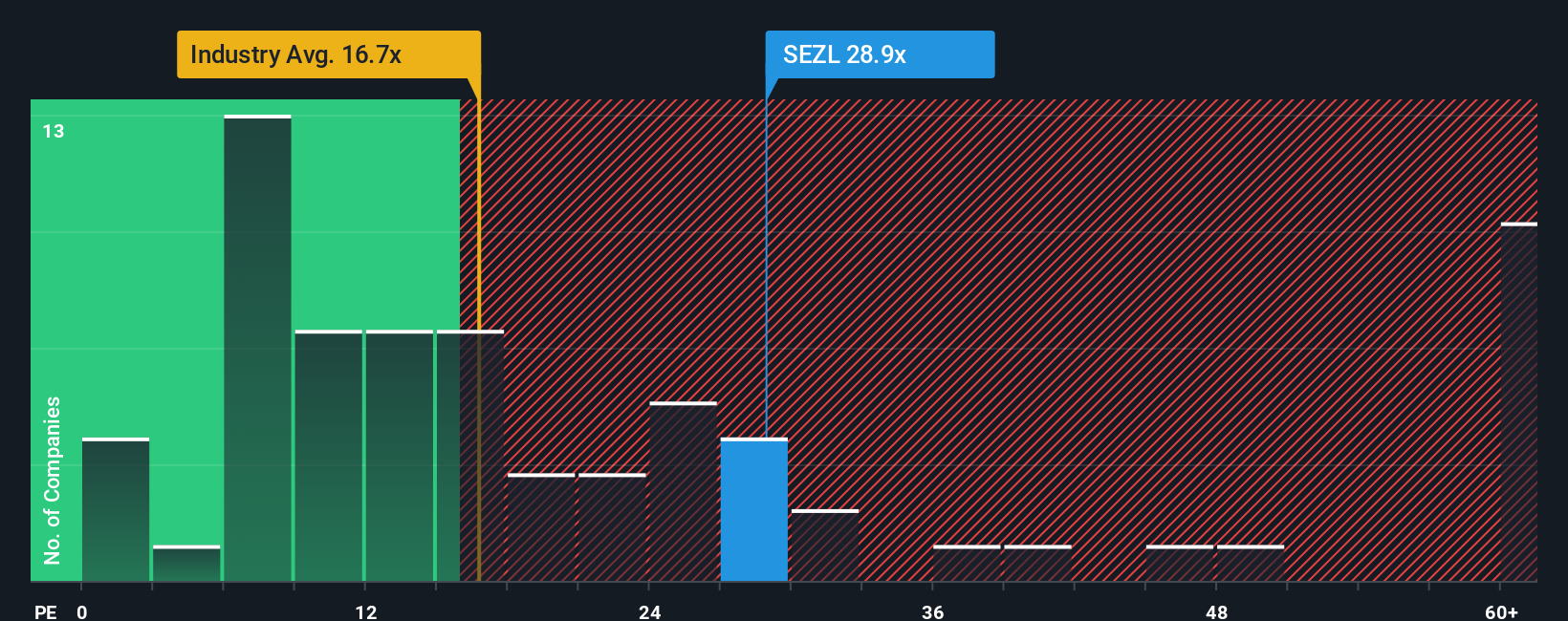

For a profitable business like Sezzle, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. It captures not only today’s profitability, but also what the market is incorporating for future growth and the risks around those expectations.

In broad terms, faster growing and more resilient companies can justify higher PE multiples, while slower or riskier ones warrant lower multiples. Sezzle currently trades on a PE of 21.54x, which is above the broader Diversified Financial industry average of about 13.59x, but below the peer group average of 61.77x for comparable names. That gap suggests the market sees Sezzle as higher quality than the typical financial stock, but not in the same league as the most richly valued fintech peers.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a reasonable PE should be once you adjust for Sezzle’s specific earnings growth profile, margins, industry, market cap and risk factors. On this basis, Sezzle’s Fair Ratio is 30.64x, meaning the stock trades at a discount to what those fundamentals might justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sezzle Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you tell the story behind your numbers. You can link your view of Sezzle’s business, its future revenue, earnings and margins to a financial forecast and fair value, then compare that fair value to today’s share price to decide whether to buy or sell. The platform keeps your Narrative dynamically updated as new news or earnings arrive. One investor might build a bullish Sezzle Narrative around rapid user growth, expanding products and a fair value near $150 per share. Another might focus on credit losses, legal risks and a tighter market opportunity to arrive at a more cautious fair value closer to $111. Both of those perspectives are made transparent, comparable and easy to track over time.

Do you think there's more to the story for Sezzle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal