Can GoDaddy’s Fallout Airo Showcase Reveal a New Edge in Its AI Strategy (GDDY)?

- GoDaddy announced that it brought an interactive Fallout-themed online experience to fans on Prime Video, using its Airo platform to turn Ma June's Sundries into a digital storefront timed with the Season Two premiere on December 17.

- This collaboration puts GoDaddy’s AI-driven small-business tools in front of a large entertainment audience, effectively turning fan engagement into a live case study of how a simple domain can evolve into a full online business.

- Now we’ll examine how this Fallout-inspired Airo showcase, and its emphasis on AI-powered, domain-led business creation, influences GoDaddy’s investment narrative.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

GoDaddy Investment Narrative Recap

To own GoDaddy, you generally need to believe it can turn its large base of domain customers into higher value, AI-enabled small business relationships. The Fallout-themed Airo experience is directionally aligned with that story but, on its own, does not appear to change the near term focus on executing AI product rollouts and managing competitive pressure from integrated website and commerce platforms, which remain the key catalyst and central risk right now.

The recent expansion of Airo.ai with six new AI agents is more directly relevant to GoDaddy’s catalyst of improving customer engagement and average revenue per user. Together with the Fallout activation, it reinforces that AI driven workflows and bundled services are becoming central to GoDaddy’s pitch, while also underscoring the execution risk if these tools fail to gain broad traction or are quickly matched by rivals.

However, investors should also be aware that rising competition from all in one website and commerce platforms could...

Read the full narrative on GoDaddy (it's free!)

GoDaddy's narrative projects $5.9 billion revenue and $1.3 billion earnings by 2028. This requires 7.7% yearly revenue growth and an earnings increase of about $0.5 billion from $808.5 million today.

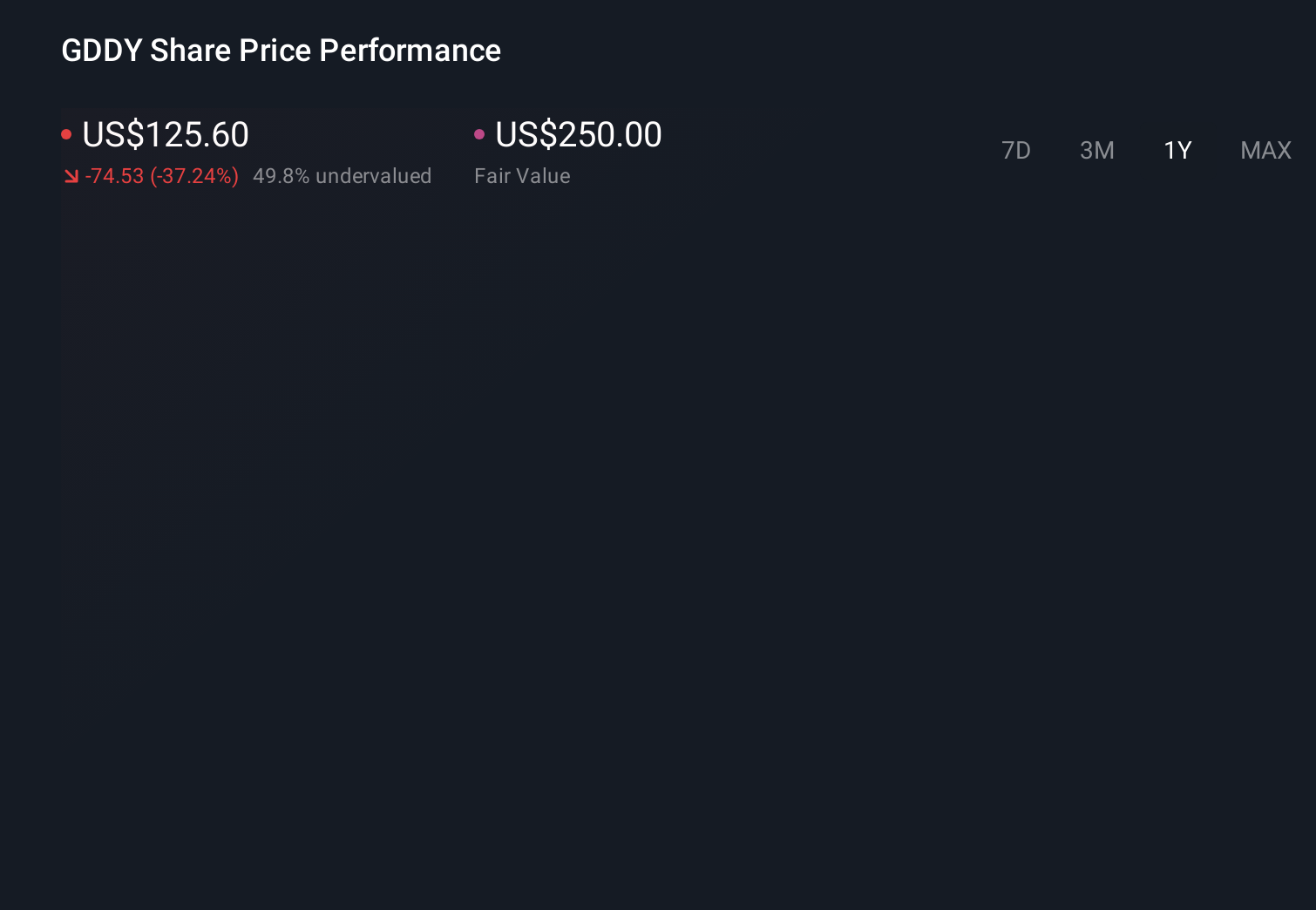

Uncover how GoDaddy's forecasts yield a $175.06 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community see GoDaddy’s fair value between US$175.06 and US$256.45, well above the recent share price. Set this against the execution risk around Airo and other AI tools, which could materially shape how effectively GoDaddy converts domains into higher margin, multi product customer relationships over time.

Explore 3 other fair value estimates on GoDaddy - why the stock might be worth over 2x more than the current price!

Build Your Own GoDaddy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoDaddy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free GoDaddy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoDaddy's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal