Asian Market Insights: Ever Sunshine Services Group And 2 Other Promising Penny Stocks

As global markets navigate a landscape of interest rate adjustments and economic uncertainties, Asia's financial scene continues to capture attention with its diverse investment opportunities. Penny stocks, while often overlooked, represent a unique segment where smaller or newer companies can offer significant growth potential at lower price points. In this article, we explore several promising penny stocks in Asia that combine solid financial health with the potential for impressive returns.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.09 | SGD441.77M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.103 | SGD53.92M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.92 | THB882M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.78 | HK$21.14B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 984 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ever Sunshine Services Group Limited is an investment holding company offering property management services in the People's Republic of China, with a market cap of HK$2.96 billion.

Operations: The company's revenue is primarily derived from its property management services segment, totaling CN¥6.93 billion.

Market Cap: HK$2.96B

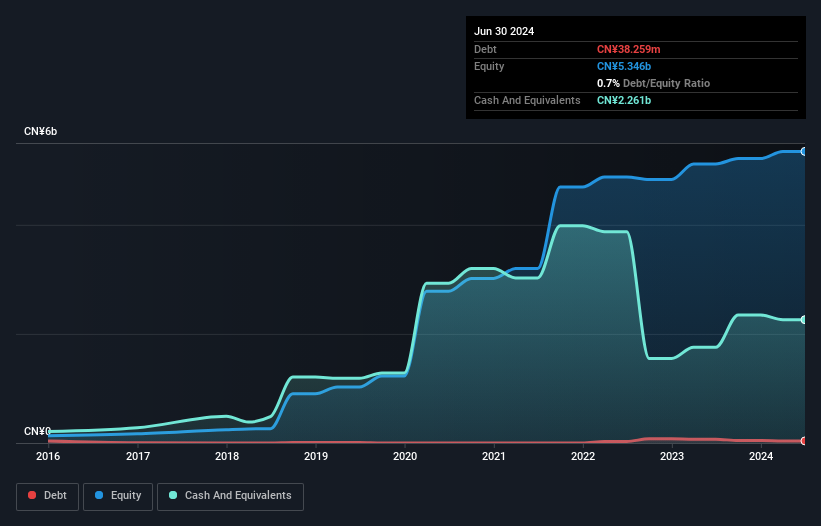

Ever Sunshine Services Group, with a market cap of HK$2.96 billion, offers property management services in China and is trading at a favorable price-to-earnings ratio of 6.3x compared to the Hong Kong market average of 12.1x. Despite negative earnings growth last year, its earnings are forecast to grow by 7.89% annually. The company maintains high-quality earnings and has more cash than total debt, with short-term assets covering both short and long-term liabilities comfortably. A recent M&A transaction involving an 8.24% stake acquisition by LMR Partners highlights investor interest but does not alter management control or strategy significantly.

- Click to explore a detailed breakdown of our findings in Ever Sunshine Services Group's financial health report.

- Gain insights into Ever Sunshine Services Group's future direction by reviewing our growth report.

Tong Tong AI Social Group (SEHK:628)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tong Tong AI Social Group Limited is an investment holding company that provides commercial factoring and financial services in the People's Republic of China, with a market cap of HK$1.13 billion.

Operations: The company's revenue primarily comes from its digital content ecosystem business, generating CN¥265.14 million.

Market Cap: HK$1.13B

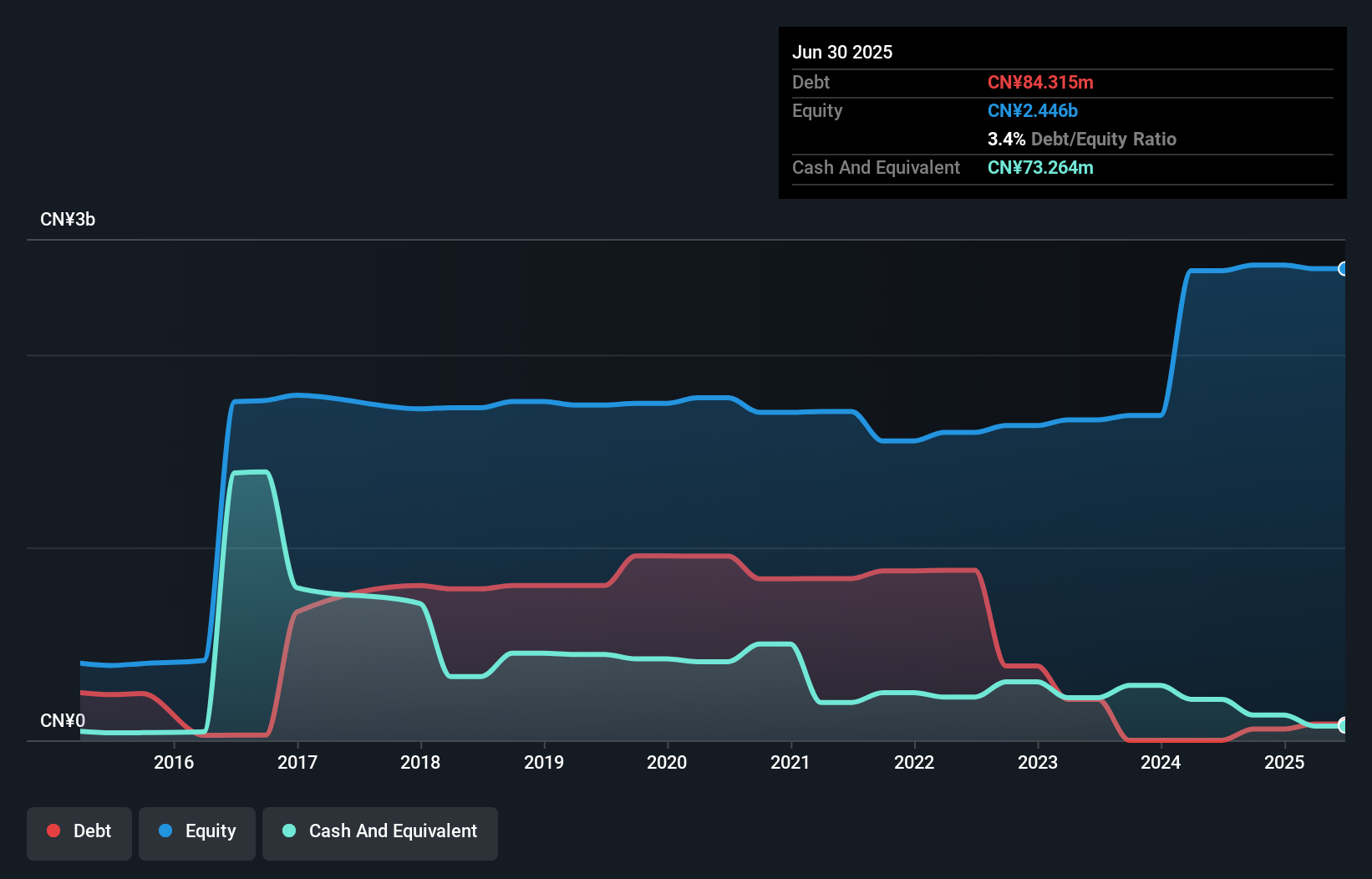

Tong Tong AI Social Group Limited, with a market cap of HK$1.13 billion, has become profitable over the past five years despite recent negative earnings growth. Its net debt to equity ratio is satisfactory at 0.5%, and short-term assets of CN¥1.5 billion comfortably cover both short- and long-term liabilities. However, the company faces challenges with low return on equity at 1.5% and negative operating cash flow that doesn't cover debt well. While profit margins have decreased from last year’s 58.5% to 11.3%, interest payments remain well covered by EBIT at a multiple of 13.7 times.

- Click here to discover the nuances of Tong Tong AI Social Group with our detailed analytical financial health report.

- Explore historical data to track Tong Tong AI Social Group's performance over time in our past results report.

UMS Integration (SGX:558)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: UMS Integration Limited, with a market cap of SGD980.54 million, is an investment holding company that manufactures and markets precision machining components while also offering electromechanical assembly and final testing services.

Operations: The company generates its revenue primarily from the Semiconductor segment, which accounts for SGD215.36 million, followed by Aerospace at SGD25.39 million.

Market Cap: SGD980.54M

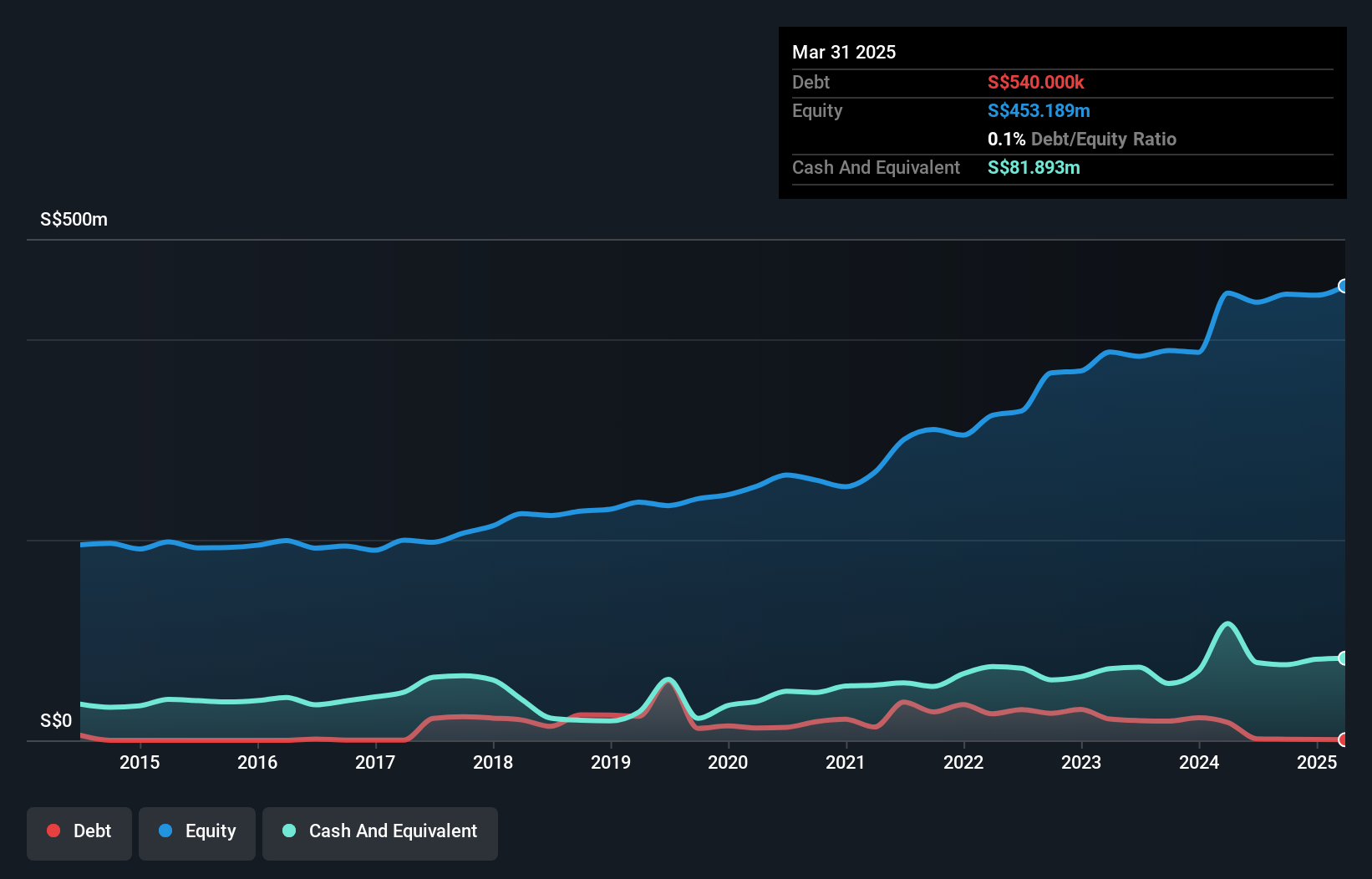

UMS Integration Limited, with a market cap of SGD980.54 million, primarily generates revenue from its Semiconductor segment, contributing SGD215.36 million. Despite experiencing a decline in earnings over the past year and five years, the company remains financially stable with short-term assets of SGD241 million exceeding both short- and long-term liabilities. The firm is debt-free and has not diluted shareholders recently. However, its dividend yield of 3.77% is not well covered by free cash flows. Recent earnings reports show steady net income growth despite lower sales compared to last year’s third quarter results at SGD59.25 million down from SGD64.94 million.

- Click here and access our complete financial health analysis report to understand the dynamics of UMS Integration.

- Gain insights into UMS Integration's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Click here to access our complete index of 984 Asian Penny Stocks.

- Interested In Other Possibilities? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal