Sands China (SEHK:1928) Valuation Check After Citi’s Bullish 2026 Macau Growth and Market Share Outlook

Citi Research has put Sands China (SEHK:1928) in the spotlight after projecting 6% Macau gaming revenue growth and 10% EBITDA growth for 2026, while flagging the operator as its preferred market share winner.

See our latest analysis for Sands China.

That upbeat call comes after a choppy stretch, with the share price at HK$20.06 and a 1 year total shareholder return of minus 3.76% hinting that long term sentiment is still rebuilding even as growth expectations improve.

If this Macau story has you thinking about where else momentum and ownership conviction might be lining up, it could be worth exploring fast growing stocks with high insider ownership next.

With Citi expecting Sands China to grab the most market share and earnings to accelerate, while the stock is still trading below analysts’ targets, is this a mispriced Macau recovery story or is future growth already baked in?

Price-to-Earnings of 22.8x: Is it justified?

On a price-to-earnings basis, Sands China trades at 22.8x, which leaves the HK$20.06 share price looking expensive relative to peers and the wider hospitality space.

The price-to-earnings ratio compares the current share price to per share earnings, so a higher multiple effectively means investors are paying more today for each dollar of current profit.

For Sands China, the market is assigning a richer multiple than both the Hong Kong hospitality industry average of 17x and the peer average of 14.7x. This suggests investors are willing to pay up for its earnings power and recovery profile even though its recent earnings growth has been negative and its net margins have slipped. That premium also places the stock above our estimated fair price-to-earnings ratio of 22.7x. This indicates there may be limited room for further multiple expansion if fundamentals do not accelerate as expected.

Explore the SWS fair ratio for Sands China

Result: Price-to-Earnings of 22.8x (OVERVALUED)

However, risks remain, including potential policy shifts in Macau and a slower than expected tourism recovery, which could pressure valuations and stall earnings momentum.

Find out about the key risks to this Sands China narrative.

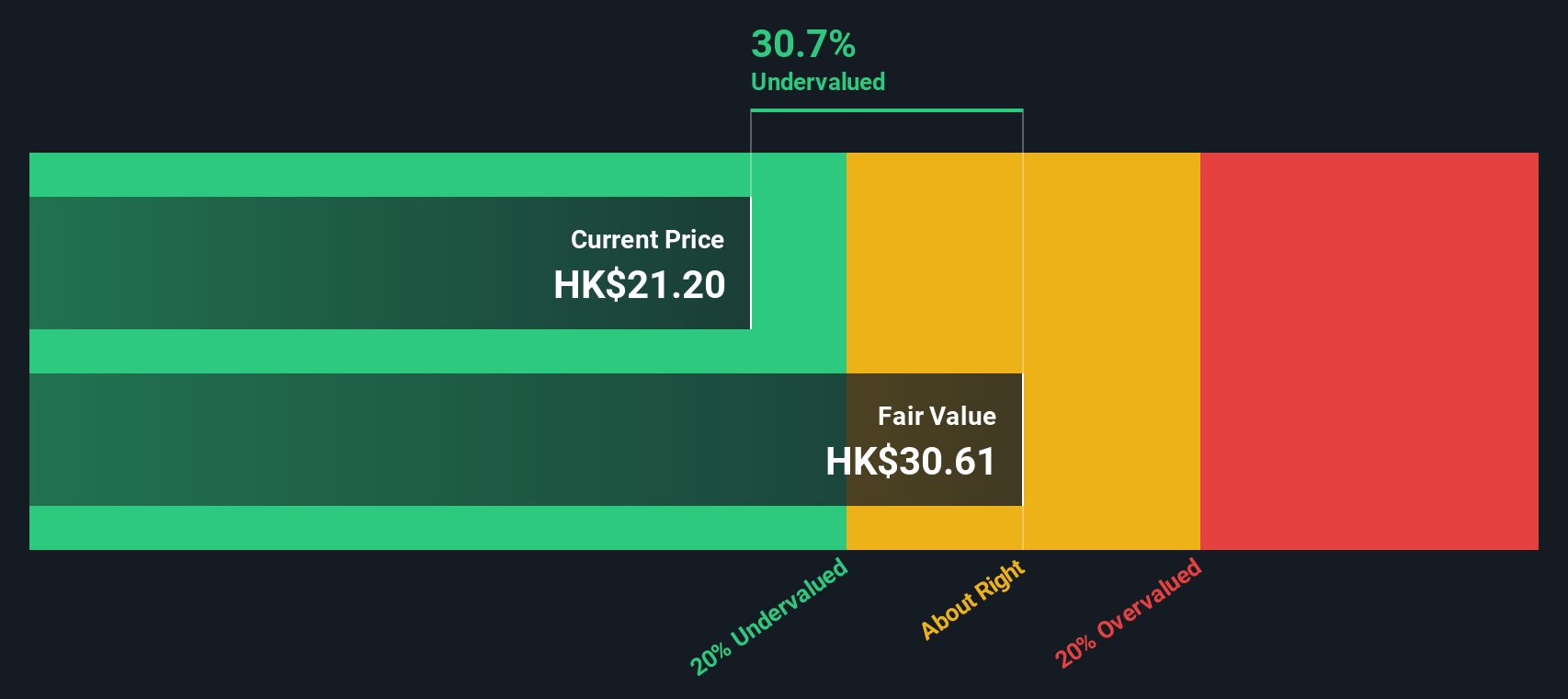

Another View: SWS DCF Says Undervalued

While the price to earnings ratio paints Sands China as expensive, our DCF model suggests the shares are trading around 31.5% below their fair value at about HK$29.30. If cash flows are anywhere near those forecasts, is the richer multiple really a deal breaker?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sands China for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sands China Narrative

If this framework does not fully align with your view or you would rather dive into the numbers yourself, you can build a custom story in minutes: Do it your way.

A great starting point for your Sands China research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by using the Simply Wall St Screener to uncover fresh, data backed ideas that others may be overlooking.

- Target reliable income by checking out these 13 dividend stocks with yields > 3% to help anchor your portfolio with stronger, more predictable cash returns.

- Ride structural growth by assessing these 30 healthcare AI stocks, which is transforming diagnostics, treatment outcomes and operational efficiency across the medical ecosystem.

- Position yourself early by scanning these 80 cryptocurrency and blockchain stocks and capture the shift toward digital assets, tokenized networks and blockchain enabled infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal