Paramount Skydance (PSKY): Reassessing Valuation After the Recent Share Price Pullback

Paramount Skydance (PSKY) has been a roller coaster for investors this year, with the stock climbing strongly year to date but sliding sharply over the past 3 months as sentiment cools.

See our latest analysis for Paramount Skydance.

The latest pullback, including a 30 day share price return of minus 11.67 percent and a 90 day slide of minus 22.71 percent, comes after a strong year to date share price return of 30.91 percent and a 1 year total shareholder return of 29.02 percent. This suggests momentum is cooling as investors reassess how much near term streaming risks should offset the longer term turnaround story.

If this reset has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas alongside media names.

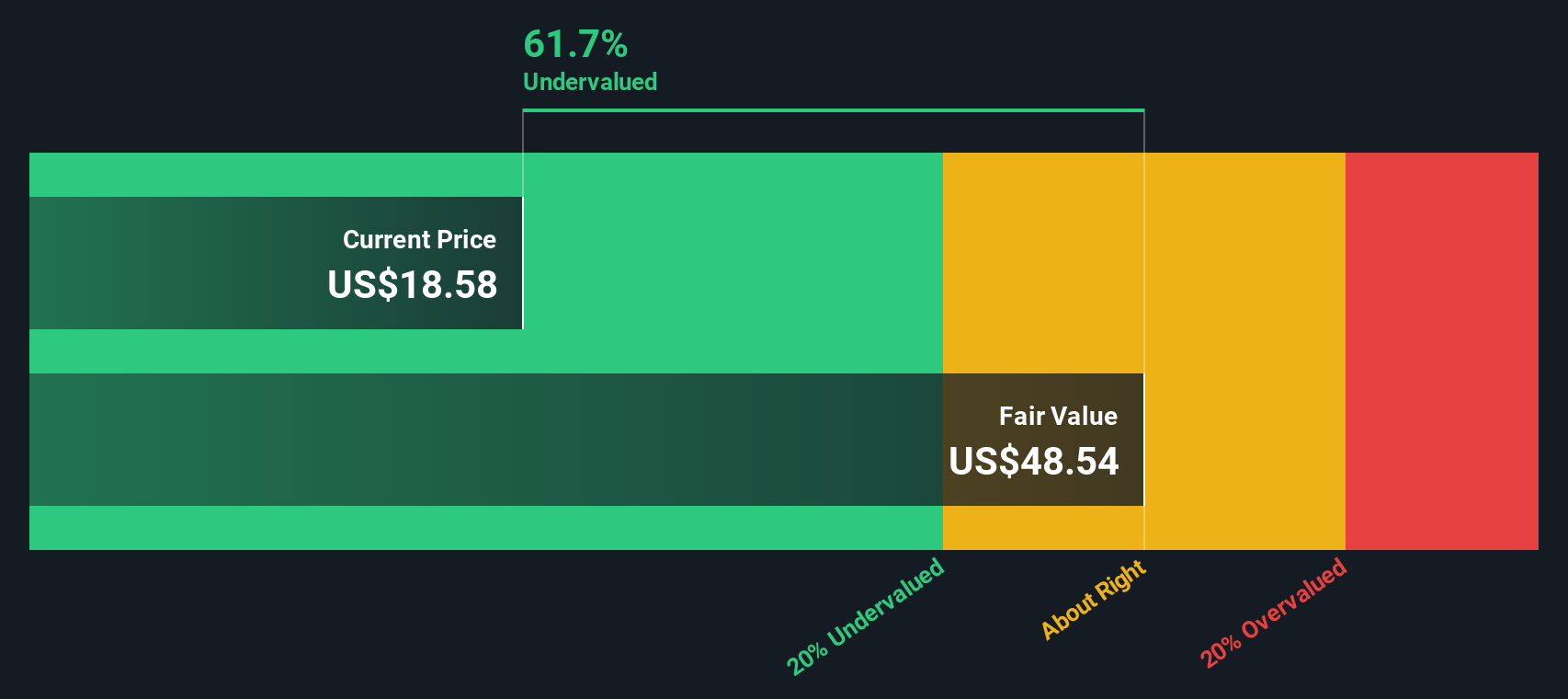

With shares still trading at a sizable discount to some intrinsic estimates, but only modestly below analyst targets, is Paramount Skydance an overlooked value story, or is the market already discounting all the future growth?

Price to sales of 0.5x, is it justified?

On a price to sales basis Paramount Skydance looks cheap, with the stock at 0.5 times sales despite a solid 13.85 dollars last close.

The price to sales multiple compares the company’s market value to its revenue. This is often a useful lens for media businesses where profits are currently depressed or volatile. For Paramount Skydance, trading at good value versus peers and the broader industry suggests that investors are reluctant to pay up for the turnaround potential just yet.

Relative to the US Media industry average of around 1 times sales and an estimated fair price to sales ratio of 1.5 times, the current 0.5 times level indicates a steep valuation gap. This gap could narrow if the profitability story develops in line with current expectations.

Explore the SWS fair ratio for Paramount Skydance

Result: Price-to-sales of 0.5x (UNDERVALUED)

However, streaming losses, negative net income, and fragile ad markets could persist longer than expected and delay any meaningful rerating in Paramount Skydance’s valuation.

Find out about the key risks to this Paramount Skydance narrative.

Another view: what does the DCF say?

Our DCF model paints a similar picture, suggesting fair value around 18.65 dollars, roughly 25.7 percent above the current 13.85 dollars. That still hints at undervaluation, but if growth or margins disappoint, how much of that potential upside would really materialize?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Paramount Skydance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Paramount Skydance Narrative

If you see the outlook differently, or simply want to dig into the numbers yourself, you can easily build a custom view in under three minutes: Do it your way.

A great starting point for your Paramount Skydance research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with just one opportunity. Use the Simply Wall Street Screener to spot other high conviction setups before the crowd rushes in.

- Capture potential bargain entries with these 909 undervalued stocks based on cash flows, which pairs attractive prices with strong underlying cash flows and resilient fundamentals.

- Capitalize on rapid innovation by scanning these 26 AI penny stocks, which may include businesses working on real world artificial intelligence applications.

- Explore income-focused opportunities through these 13 dividend stocks with yields > 3%, which highlights companies that currently pay dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal