How Marina Square Redevelopment and Capital Recycling Will Impact UOL Group (SGX:U14) Investors

- DBS Research recently issued a positive report on UOL Group Limited, highlighting the company’s active capital recycling, prudent gearing and operational momentum, including strong residential sales and competitive land bids.

- The report also underlined the progress of land consolidation at Marina Square, positioning its potential redevelopment as a key source of future value creation for UOL.

- We will now examine how Marina Square’s redevelopment prospects shape UOL Group’s investment narrative in light of this latest research commentary.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is UOL Group's Investment Narrative?

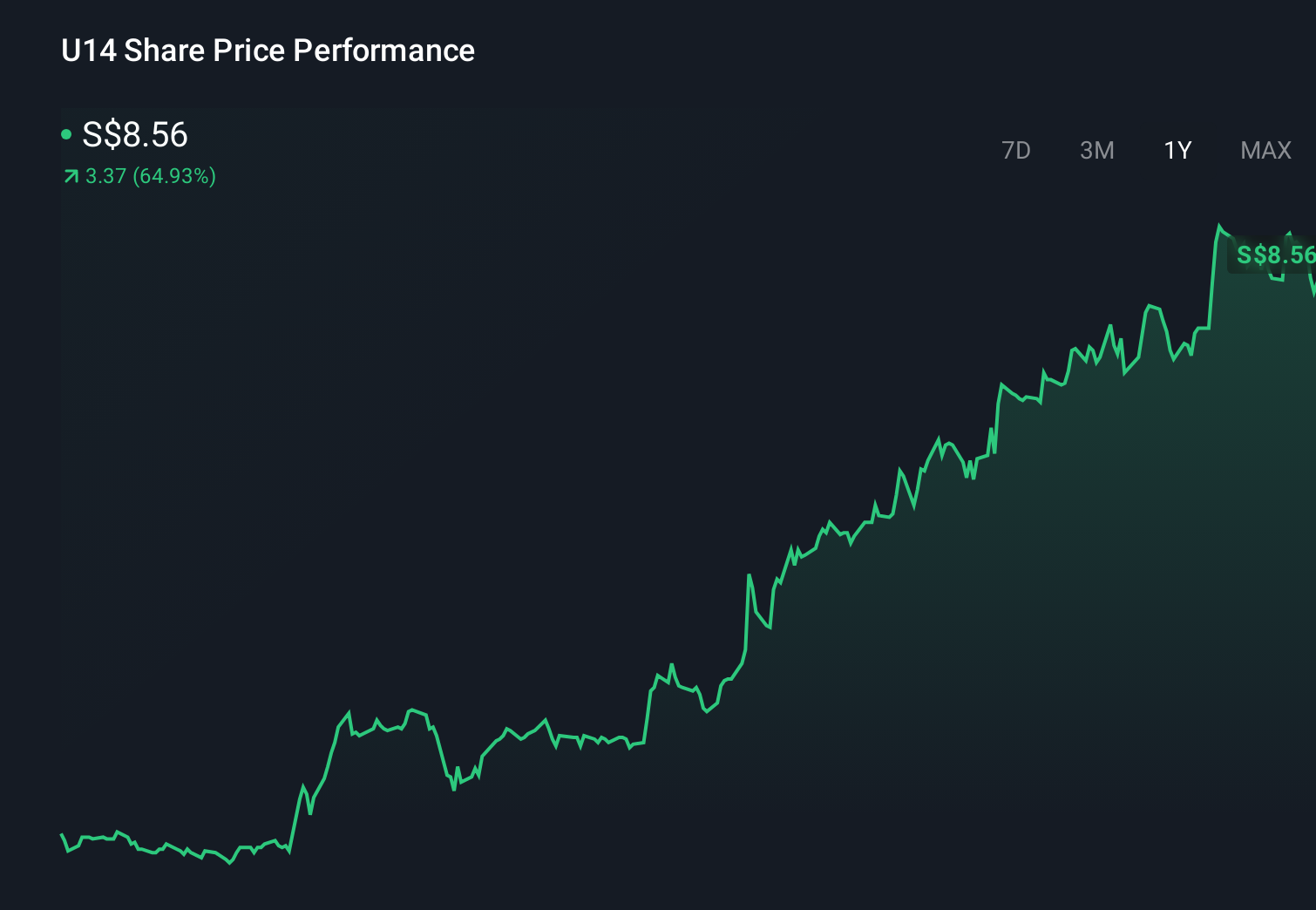

To own UOL Group, you need to believe in a disciplined property developer that can recycle capital, grow recurring income and unlock value from its landbank, even as earnings and revenue are forecast to ease. The recent DBS Research report, with its focus on active capital recycling, prudent gearing and Marina Square’s redevelopment, reinforces that story rather than changing it, but it does sharpen the near term catalyst set around asset monetisation and planning progress at Marina Square. Against a strong 1 year share price run and mixed earnings trends, the lower interest rate backdrop and first PBSA investment in Brighton may help support cash flow resilience, while risks such as low forecast returns on equity and soft revenue expectations stay firmly on the radar.

However, one key risk around future earnings trends is easy to overlook. UOL Group's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on UOL Group - why the stock might be worth over 4x more than the current price!

Build Your Own UOL Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UOL Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free UOL Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UOL Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal