Is Diageo’s Recent Share Price Slide Creating a Long Term Opportunity?

- If you have been wondering whether Diageo is a bargain or a value trap at today’s price, you are not alone. This article is going to walk through the numbers in plain English.

- Despite a rough longer term stretch, with the share price down about 30.5% over the past year and roughly 50.0% over three years, the stock has shown a 4.8% bounce in the last week even after a 5.5% dip over the last month.

- That recent volatility has come against a backdrop of shifting investor sentiment around global spirits demand and Diageo’s positioning in premium brands. Markets are weighing slower growth in some regions against the resilience of its core franchises. At the same time, ongoing portfolio optimisation and cost discipline have kept the company firmly in the conversation as a long term compounder, even as the share price has reset.

- On our checks, Diageo currently scores a valuation score of 5/6, suggesting the market may be underestimating its value. Next we will break down what that means across different valuation approaches before finishing with a smarter way to think about valuation altogether.

Find out why Diageo's -30.5% return over the last year is lagging behind its peers.

Approach 1: Diageo Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to a present value.

For Diageo, the latest twelve month free cash flow is about $2.8 billion. Analysts provide detailed forecasts for the next few years. Beyond that, the model extrapolates a slower, more mature growth path. Under this 2 stage Free Cash Flow to Equity framework, Diageo’s free cash flow is projected to rise to roughly $4.8 billion by 2035, reflecting steady, not explosive, growth in its global spirits portfolio.

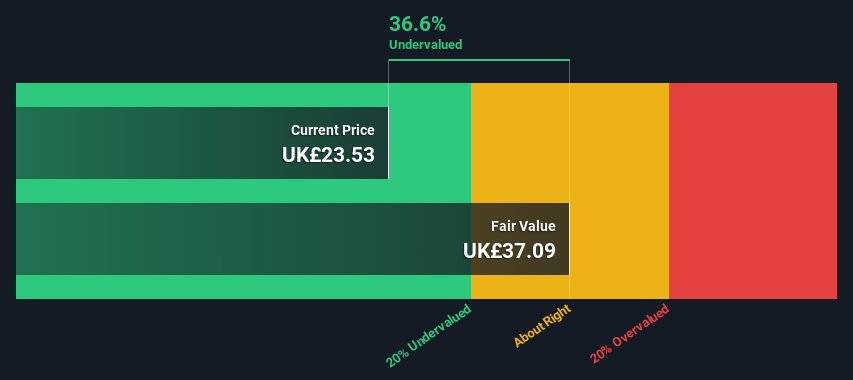

When all those projected cash flows are discounted back to today, the model arrives at an estimated intrinsic value of about $30.04 per share. Compared with the current share price, that implies the stock is roughly 44.1% undervalued, indicating the market may be pricing Diageo’s future cash generation too cautiously.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Diageo is undervalued by 44.1%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Diageo Price vs Earnings

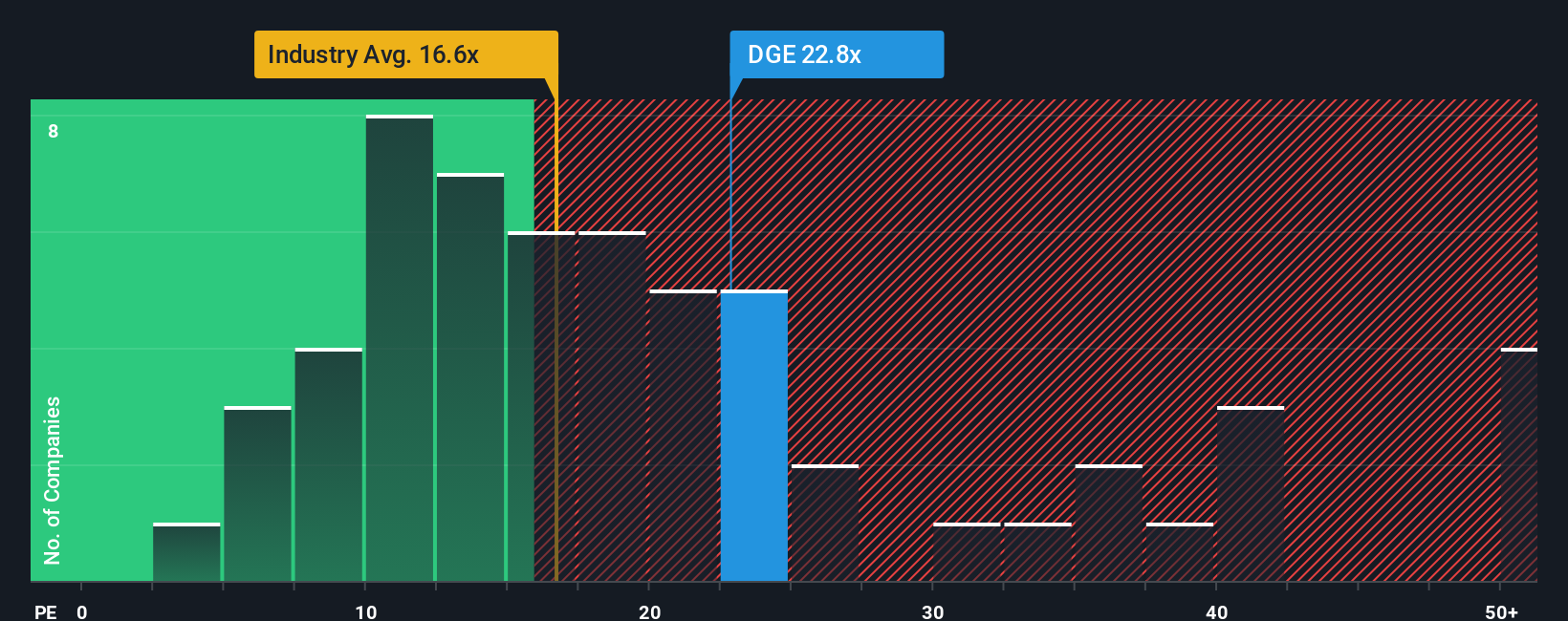

For established, profitable businesses like Diageo, the price to earnings (PE) ratio is a useful shorthand for how much investors are willing to pay for each unit of current earnings. It naturally captures both what the company is earning today and what the market expects those earnings to do over time.

In broad terms, faster growth and lower perceived risk justify a higher PE, while slower or more volatile earnings usually command a lower multiple. Diageo currently trades on a PE of about 21.1x, a small discount to its Beverage peer average of roughly 21.7x and a premium to the wider industry average of around 17.4x, which reflects its stronger brands and profitability profile.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE Diageo should trade on, given its earnings growth outlook, margins, industry, market cap and risk profile. For Diageo, that Fair Ratio is about 25.7x, meaning the stock is trading below the multiple implied by those fundamentals. Because this approach incorporates more than just simple peer comparisons, it offers a more rounded view, and on that basis Diageo appears undervalued on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1461 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Diageo Narrative

Earlier we mentioned that there is an even better way to understand valuation, and on Simply Wall St this takes the form of Narratives. These let you attach a clear story about Diageo’s future to the numbers you care about by turning your assumptions for revenue, earnings, margins and risk into a forecast, a Fair Value, and a simple buy or sell signal you can track on the Community page used by millions of investors.

Do you think there's more to the story for Diageo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal