Illumina (ILMN): Reassessing Valuation After a Quiet Share Price Rebound

Illumina (ILMN) shares have quietly turned a corner, with the stock up about 10% over the past month and nearly 28% in the past 3 months, drawing fresh attention to its valuation.

See our latest analysis for Illumina.

That backdrop makes the recent rebound more interesting. The stock has had a roughly flat year to date, a 1 year total shareholder return of about negative 2 percent, and a much weaker 3 year total shareholder return, reminding investors how sentiment has shifted from earlier pessimism toward cautiously rebuilding momentum.

If Illumina’s move has you rethinking the broader healthcare opportunity, it could be a good moment to explore other potential winners across healthcare stocks.

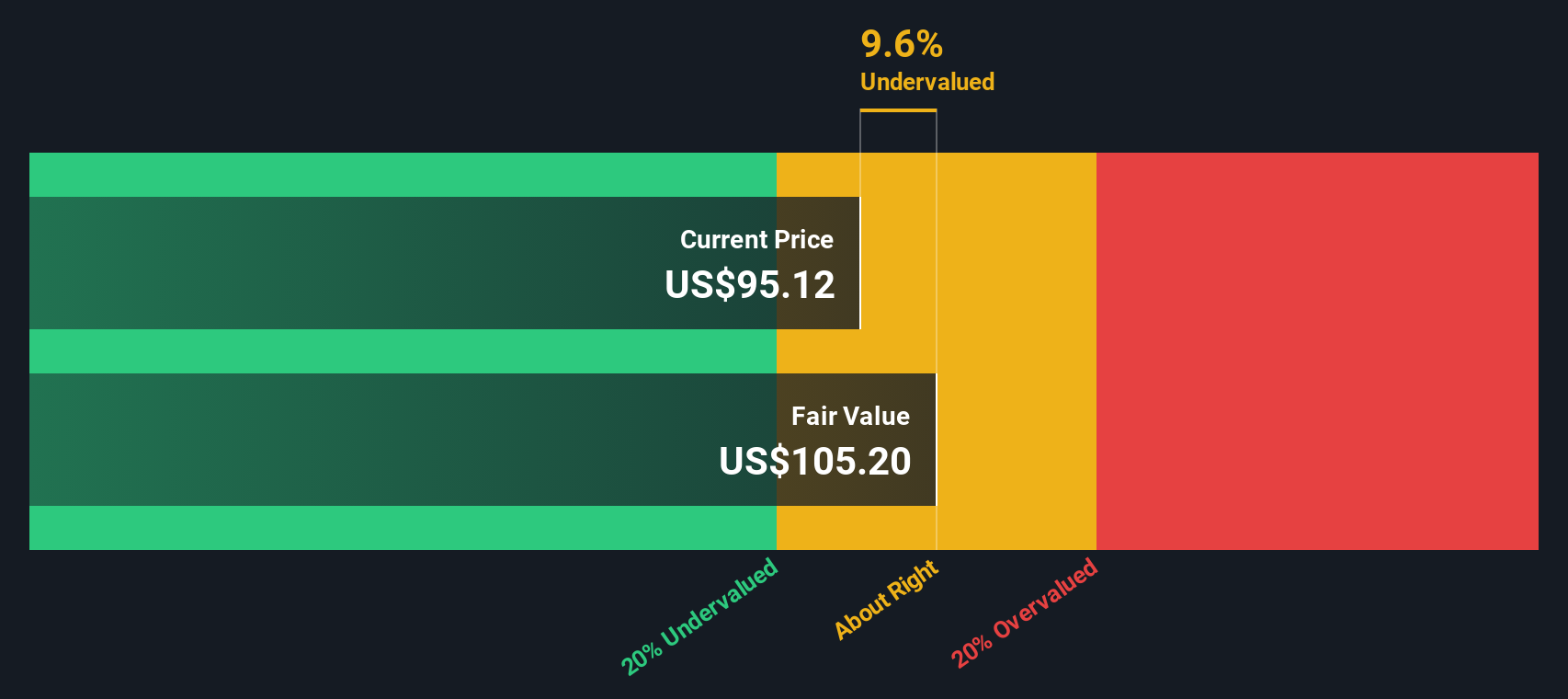

With shares still down sharply over three and five years but showing improving growth and a sizable intrinsic discount, investors are asking the key question: is Illumina now undervalued, or is the market already pricing in a turnaround?

Most Popular Narrative: 9.8% Overvalued

With Illumina closing at $131.56 against a most-followed fair value of $119.84, the narrative leans toward a premium that rests heavily on future execution.

Strategic expansion into multiomics, notably the planned acquisition of SomaLogic and integration of proteomics capabilities, creates incremental growth opportunities by increasing the breadth of Illumina's data and platform offerings, contributing to future revenue and operating margin expansion.

Curious why modest top line expansion, shifting margins, and a richer future earnings multiple still add up to a higher implied value than today’s price? Click through to see how these moving parts combine into one decisive valuation call.

Result: Fair Value of $119.84 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent China regulatory uncertainty and intensifying NGS competition could derail growth assumptions and force investors to reassess Illumina’s premium valuation.

Find out about the key risks to this Illumina narrative.

Another Angle On Value

While the narrative fair value points to a 9.8 percent premium, our DCF model tells a different story. It suggests Illumina is trading about 27 percent below its fair value of 181.21 dollars. That gap frames today’s price as a potential opportunity, but are the cash flow assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Illumina Narrative

If you see the numbers differently or want to dig deeper into the data yourself, you can build a full narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Illumina.

Looking for your next investing edge

Before you move on, lock in fresh ideas with targeted stock lists that spotlight momentum, value, and structural growth themes on Simply Wall St’s Screener.

- Capitalize on mispriced opportunities by tracking these 914 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Ride the next wave of innovation by focusing on these 26 AI penny stocks positioned at the heart of real world artificial intelligence adoption.

- Strengthen your income game by reviewing these 13 dividend stocks with yields > 3% that can potentially boost portfolio yield without abandoning fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal