Is CF Industries Fairly Priced After Recent Share Volatility and Fertilizer Market Uncertainty?

- If you are wondering whether CF Industries Holdings at around $77 a share is a bargain or a trap, you are not alone. This breakdown will walk through what the numbers are really saying about its value.

- The stock has been choppy lately, up about 1.1% over the last week but still down roughly 8.8% over the past month and 9.6% year to date, after what has been a very strong 138.8% gain over the past 5 years.

- Recent moves have been driven largely by shifting expectations around nitrogen fertilizer demand and pricing, as investors weigh how global farm economics and export dynamics will play out over the next few seasons. At the same time, policy discussions on food security and lower carbon ammonia are keeping CF on the radar of long term capital allocators who see it as a key player in future fertilizer and clean energy supply chains.

- On our scorecard, CF Industries Holdings clocks a valuation score of 3/6, which means it looks undervalued on half of the checks we run. Next, we will dig into what each method says, then finish with a more holistic way to think about valuation that goes beyond the usual multiples and models.

Approach 1: CF Industries Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today using a required rate of return.

For CF Industries Holdings, the model starts with last twelve month Free Cash Flow of about $2.0 billion. Analysts provide detailed forecasts for the next few years, and Simply Wall St then extrapolates those trends to extend the projection period. Under this 2 Stage Free Cash Flow to Equity approach, Free Cash Flow is expected to ease from current levels toward roughly $0.5 to $0.8 billion a year in the early 2030s, with 2029 projected at $804 million.

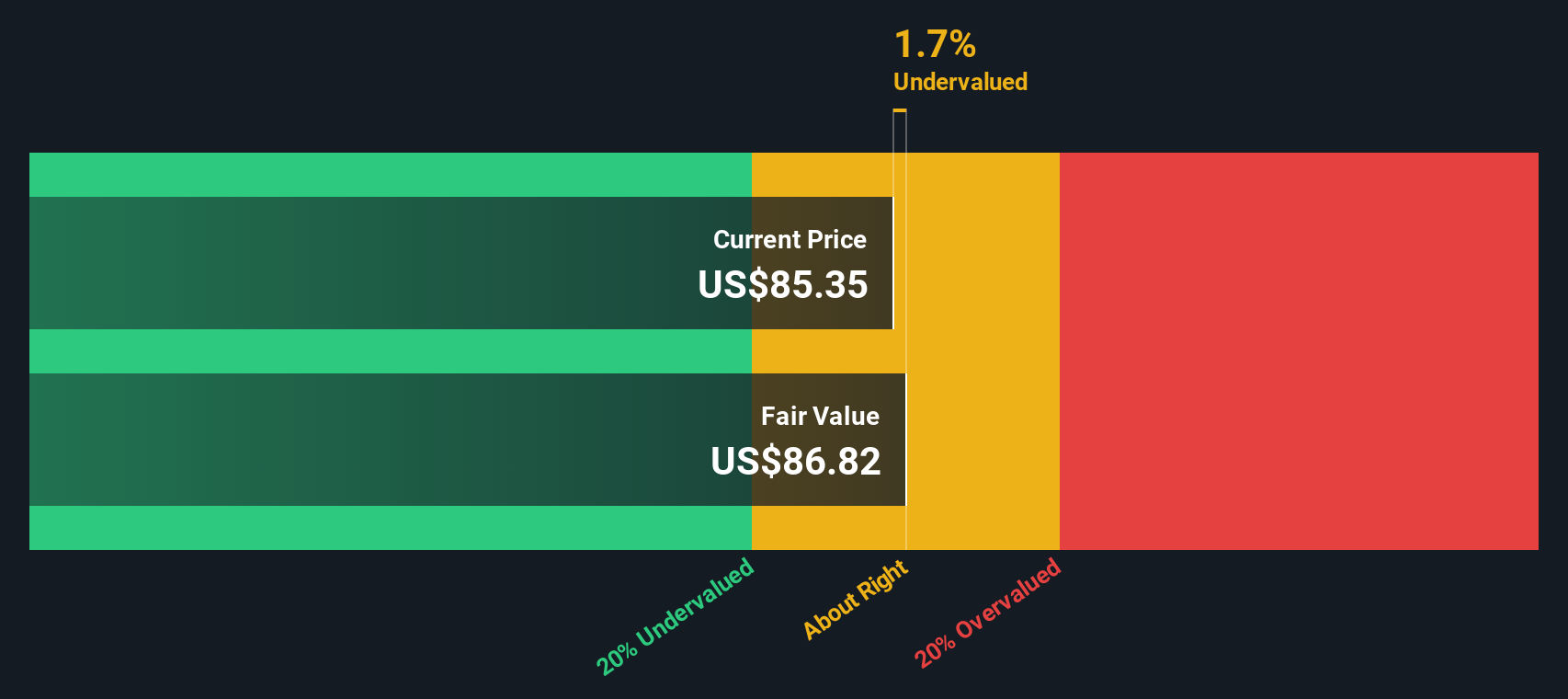

When all those future cash flows are discounted back, the DCF model arrives at an intrinsic value of about $70.54 per share. With the stock trading around $77, the implied valuation suggests CF Industries is about 9.9% overvalued. This is close enough to consider it fairly priced with a slight premium.

Result: ABOUT RIGHT

CF Industries Holdings is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: CF Industries Holdings Price vs Earnings

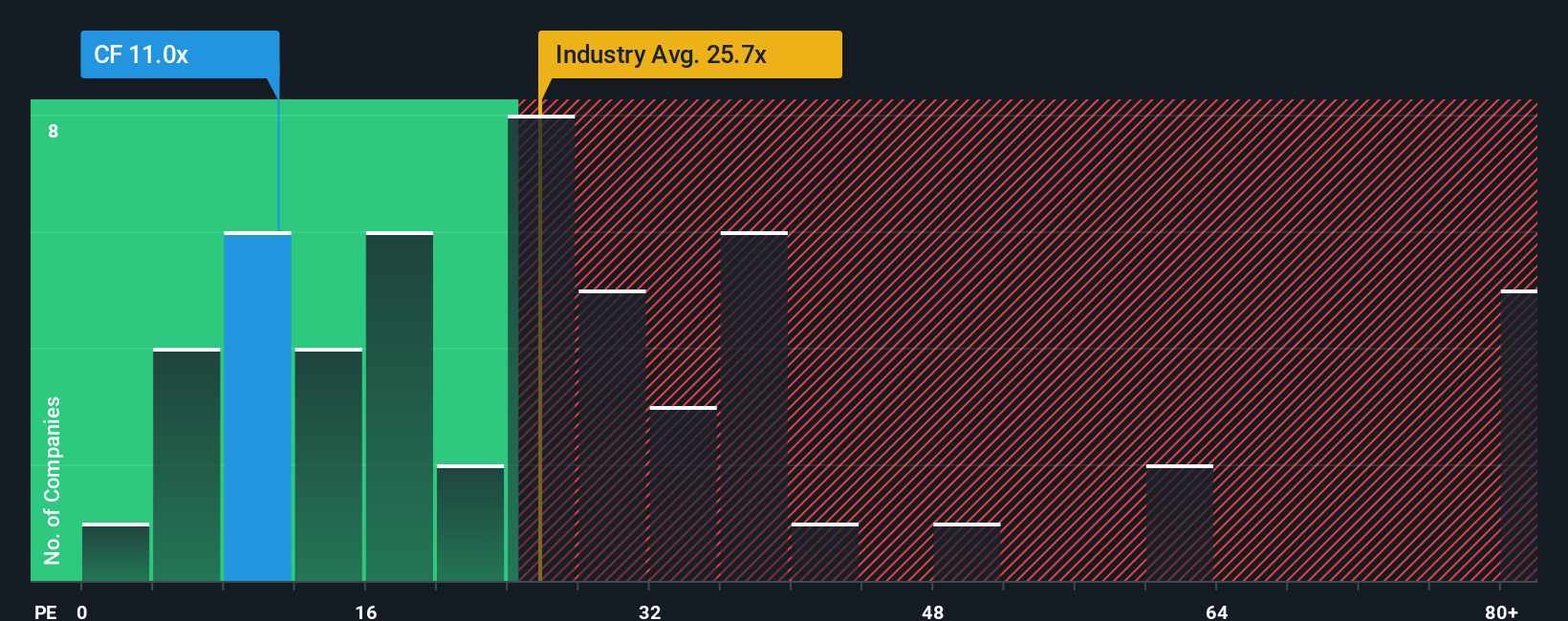

For profitable companies like CF Industries Holdings, the price-to-earnings (PE) ratio is a straightforward way to gauge whether investors are paying a reasonable price for each dollar of earnings. In general, faster growth and lower risk justify a higher PE, while slower growth or more uncertainty call for a lower multiple.

CF currently trades on a PE of about 8.8x. That is well below the wider Chemicals industry average of roughly 24.2x and also under the peer group average of around 18.3x, which may make the stock appear inexpensive at first glance. However, those simple comparisons do not fully capture CF’s specific growth outlook, cyclicality and risk profile.

Simply Wall St’s Fair Ratio aims to address this by estimating what PE multiple CF should trade on, given factors such as its earnings growth, margins, industry, market cap and risks. For CF, the Fair Ratio comes out at about 13.9x, which is a more tailored benchmark than broad industry or peer averages. With the actual PE at 8.8x, CF trades noticeably below this fair level, indicating that the market may be pricing the stock conservatively.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1461 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CF Industries Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your view of CF Industries Holdings’ future (its story, including revenue, earnings and margin assumptions) to a concrete forecast and Fair Value, then compare that Fair Value to today’s share price to decide whether CF looks like a buy, hold or sell, with the added benefit that your Narrative automatically updates as new news, earnings and analyst targets come in so different investors can easily see, for example, how a more bullish outlook that leans on tight nitrogen markets, clean ammonia growth and a fair value near $110 contrasts with a more cautious view that focuses on overcapacity, regulatory risk and a fair value closer to $78.

Do you think there's more to the story for CF Industries Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal