Kyverna Therapeutics (KYTX) Is Up 29.5% After Strong KYSA-8 Data And $100 Million Equity Raise

- Kyverna Therapeutics recently reported positive topline results from its registrational Phase 2 KYSA-8 trial of mivocabtagene autoleucel (KYV-101) in stiff person syndrome, showing statistically significant clinical benefits with a favorable tolerability profile and plans to submit a Biologics License Application in the first half of 2026.

- In parallel, the company moved quickly to reinforce its balance sheet with an underwritten follow-on equity offering of about US$100.00 million, highlighting how encouraging data in a rare autoimmune disease can directly influence funding capacity for a broader CAR T-cell pipeline.

- We’ll now examine how the strong KYSA-8 efficacy and safety profile could reshape Kyverna’s investment narrative in autoimmune cell therapy.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 33 companies in the world exploring or producing it. Find the list for free.

What Is Kyverna Therapeutics' Investment Narrative?

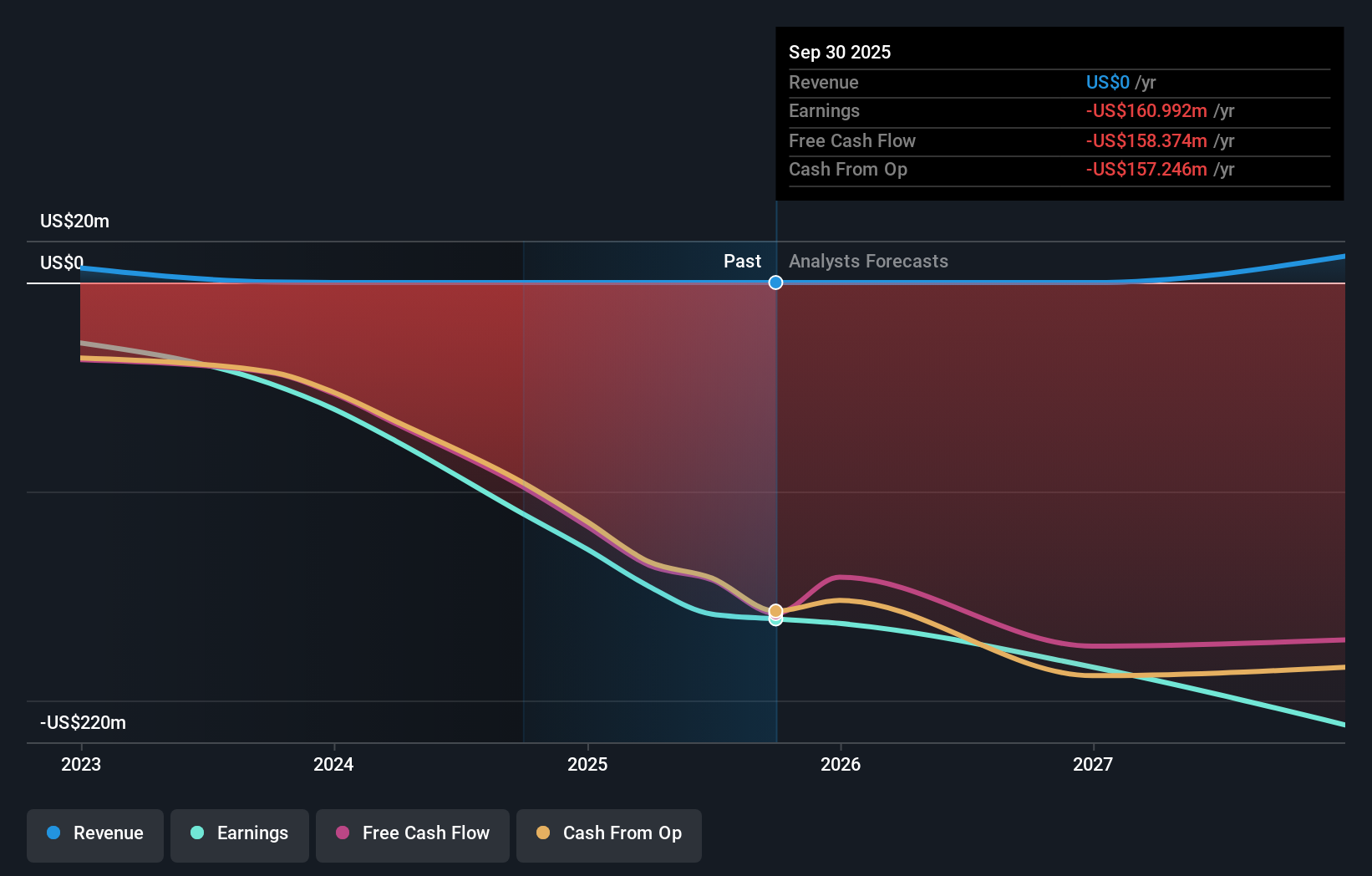

To own Kyverna today, you have to believe that CAR T-cell therapy can move from oncology into autoimmune diseases, and that KYV-101 can anchor a franchise across SPS, myasthenia gravis and lupus despite zero current revenue and rising losses of about US$161.0 million. The KYSA-8 readout and the rapid US$100.0 million equity raise look like a step-change for the near term, bringing a clearer path to a 2026 BLA filing and extending the cash runway, which may ease financing concerns that hung over the story before this data. Near term, the key catalysts now cluster around full KYSA-8 data, regulatory interactions and progress in KYSA-6, while the biggest risks shift toward regulatory outcomes, execution across multiple trials and the impact of shareholder dilution and the post-offering lock-up expiry on a share price that has already moved very sharply.

However, the combination of fresh equity and a looming lock‑up expiry is something investors should understand. Our comprehensive valuation report raises the possibility that Kyverna Therapeutics is priced higher than what may be justified by its financials.Exploring Other Perspectives

The single fair value estimate from the Simply Wall St Community sits at US$29.60, so you are comparing your own view against one concentrated benchmark. Set that beside the recent KYSA-8 data and funding raise, and it becomes clear that differing views on regulatory risk, dilution and commercial execution can lead to very different conclusions about Kyverna’s longer term potential, which is why exploring several perspectives can be helpful.

Explore another fair value estimate on Kyverna Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Kyverna Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kyverna Therapeutics research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Kyverna Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kyverna Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal