Is Equity Residential Now an Opportunity After a 13% Slide Amid Rate Pressure?

- Wondering if Equity Residential is quietly becoming a bargain, or if the market is rightly cautious about this apartment REIT at around $60.73 a share?

- The stock has inched up about 1.1% over the last week and 2.2% over the last month, but it is still down roughly 13.3% year to date and 13.1% over the last year. This naturally raises questions about whether sentiment has overshot fundamentals.

- Recent headlines have focused on shifting demand in coastal rental markets and the impact of elevated interest rates on real estate investment trusts, which helps explain some of the pressure on Equity Residential and its peers. At the same time, coverage has highlighted ongoing resilience in occupancy and rent collection, suggesting the core business may be sturdier than the share price implies.

- Right now, Equity Residential scores a 5/6 valuation check, which hints that the market might be underestimating it. In the next sections we will walk through the main valuation methods, then finish with a more nuanced way to think about what the stock is really worth.

Approach 1: Equity Residential Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what Equity Residential is worth today by extrapolating its adjusted funds from operations into the future and discounting those cash flows back to their value in dollars today.

Equity Residential currently generates about $1.47 billion in free cash flow, and analysts expect this to rise gradually over time, with Simply Wall St extrapolating out beyond the initial analyst window. On this basis, projected free cash flow reaches roughly $1.90 billion by 2035, with interim estimates such as $1.35 billion in 2026 and $1.48 billion in 2028 helping to shape the trajectory.

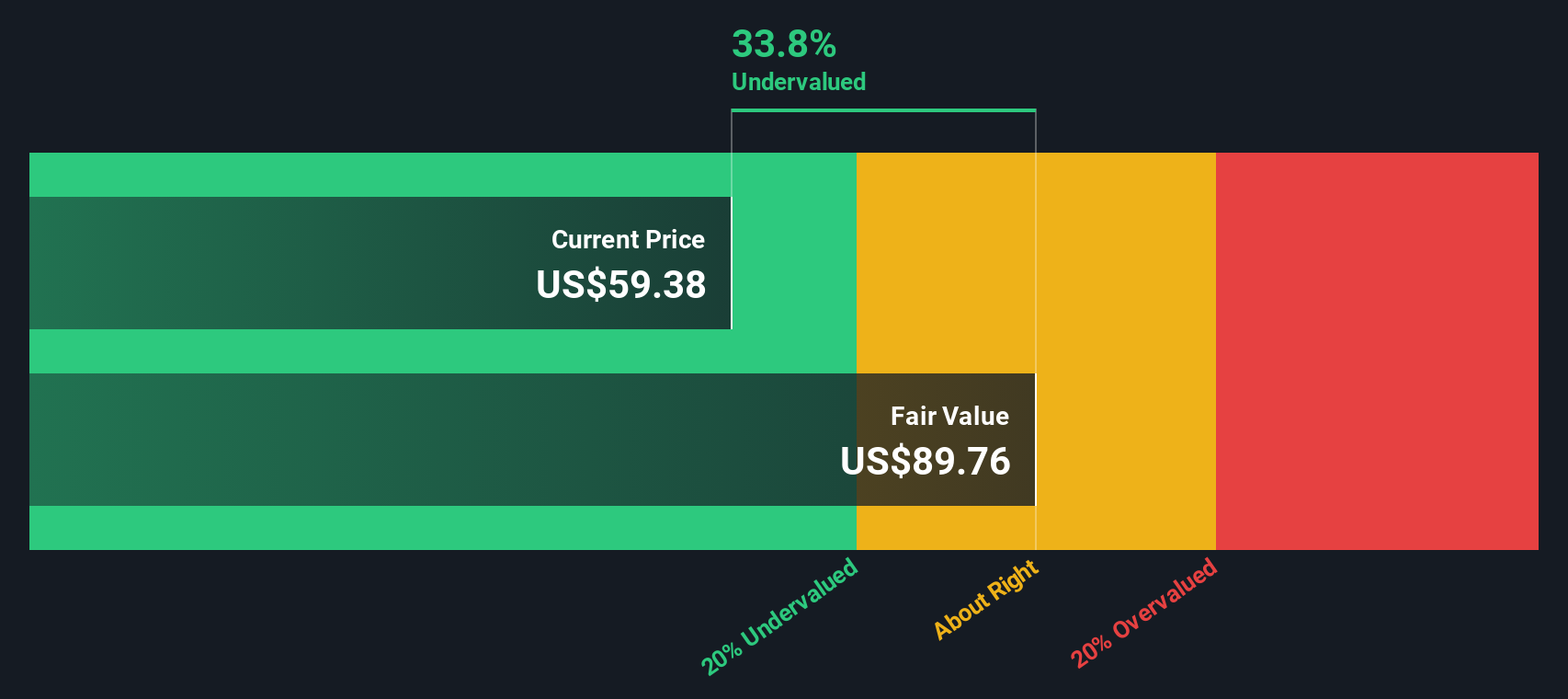

Feeding these cash flows into a two stage Free Cash Flow to Equity model using adjusted funds from operations produces an estimated intrinsic value of about $91.92 per share. Compared with the recent share price around $60.73, the model implies Equity Residential is trading at roughly a 33.9% discount, indicating potential undervaluation if the cash flow outlook occurs as modeled.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equity Residential is undervalued by 33.9%. Track this in your watchlist or portfolio, or discover 915 more undervalued stocks based on cash flows.

Approach 2: Equity Residential Price vs Earnings

For consistently profitable businesses like Equity Residential, the Price to Earnings ratio is a useful shorthand for how much investors are willing to pay today for each dollar of current earnings. In general, faster growing, less risky companies tend to justify higher PE ratios, while slower growth or higher risk should translate into a lower, more conservative multiple.

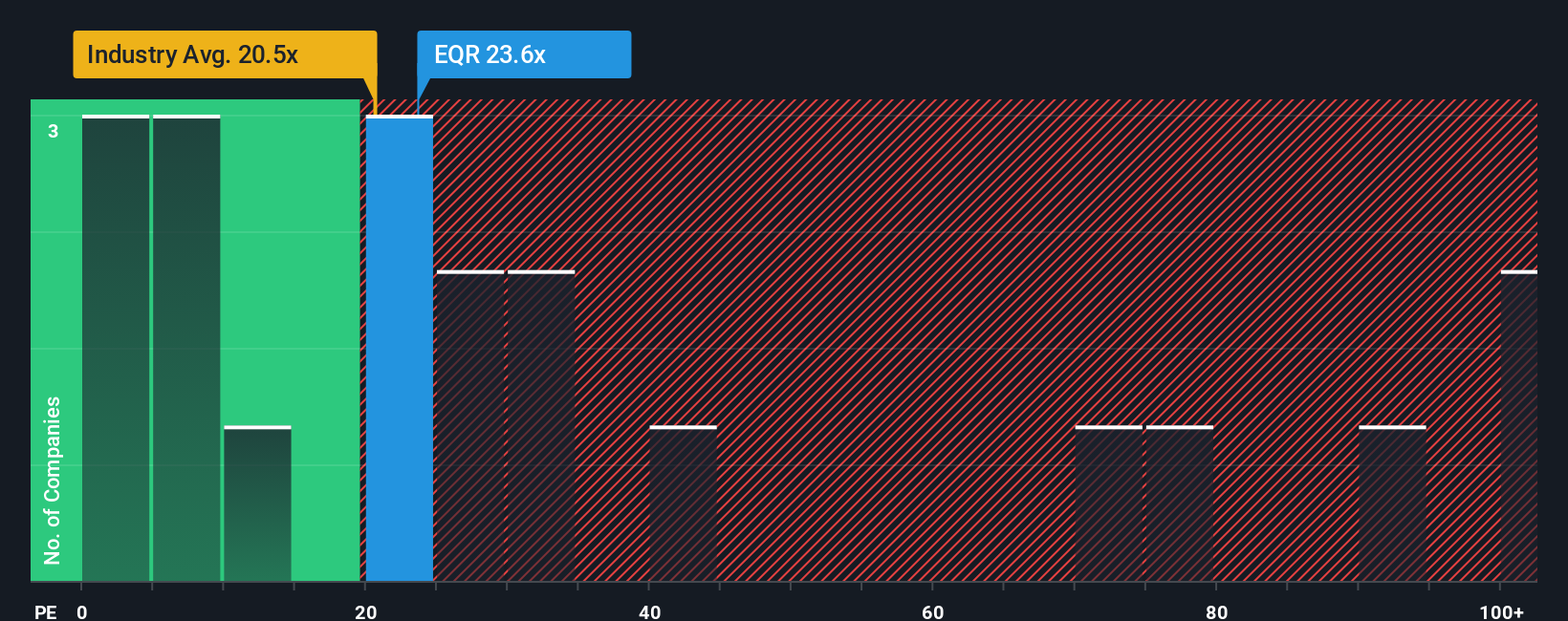

Equity Residential currently trades at about 20x earnings, which is roughly in line with the Residential REITs industry average of around 20x but well below the broader peer group average close to 37x. To move beyond simple comparisons, Simply Wall St calculates a proprietary Fair Ratio for each company. This Fair Ratio represents the PE multiple that would be reasonable given its earnings growth outlook, industry, profit margins, market value and specific risk profile.

Because the Fair Ratio for Equity Residential is estimated at about 25.8x, noticeably above the current 20x multiple, the shares appear undervalued using this lens, assuming the underlying earnings and risk assumptions hold.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equity Residential Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply the stories investors tell about a company, backed up by their own assumptions for future revenue, earnings, margins and fair value. A Narrative connects three pieces: what you believe about the business, how that belief translates into a financial forecast, and what fair value that forecast implies for the stock today. On Simply Wall St, millions of investors build and share these Narratives on the Community page, making it an easy, accessible tool rather than a complex spreadsheet exercise. Once you have a Narrative, you can compare your Fair Value to the current Price to decide whether Equity Residential looks like a buy, a hold, or a sell, and the platform automatically updates the Narrative when new news or earnings arrive. For example, some investors might lean into a bullish Equity Residential Narrative with stronger rent growth, resilient margins and a fair value in the low 80 dollar range, while more cautious investors might assume softer demand, margin pressure and a fair value closer to the mid 60s.

Do you think there's more to the story for Equity Residential? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal