Slide Insurance Holdings (SLDE): Exploring Valuation After a 43% 90-Day Rebound

Slide Insurance Holdings (SLDE) has quietly climbed over the past 3 months, even as its year to date performance still lags. That mix of momentum and recent weakness makes the stock interesting.

See our latest analysis for Slide Insurance Holdings.

That recent 90 day share price return of about 43% suggests sentiment is turning more optimistic, even though the year to date share price return is still negative and the latest close sits at $18.21.

If Slide’s rebound has caught your eye and you want to see what else is gaining traction, now is a good time to explore fast growing stocks with high insider ownership.

With Slide still trading below analyst targets despite improving growth, the key question now is whether the market is overlooking its earnings power or if the current price already reflects its future expansion potential.

Price-to-Earnings of 6.5x: Is it justified?

At a last close of $18.21, Slide Insurance Holdings trades on a price to earnings ratio of 6.5x, which screens as meaningfully undervalued against peers.

The price to earnings multiple compares the current share price to the company’s earnings, making it a simple way to gauge how much investors are paying for each dollar of profit in an insurance business like Slide.

With earnings having grown strongly and net margins improving, such a low multiple suggests the market may be discounting the durability of those profits rather than fully crediting its earnings power, especially when set against an estimated fair price to earnings level that is much higher.

Compared to both direct peers, where the average multiple sits near 12.9x, and the broader US insurance industry at about 13.6x, Slide’s 6.5x looks strikingly compressed, and the fair price to earnings ratio estimate of 13.7x highlights how far sentiment could shift if investors reassess the company’s earnings trajectory.

Explore the SWS fair ratio for Slide Insurance Holdings

Result: Price-to-Earnings of 6.5x (UNDERVALUED).

However, Slide operates in catastrophe exposed coastal markets, and higher than expected claims or tighter reinsurance conditions could quickly erode earnings and compress valuation.

Find out about the key risks to this Slide Insurance Holdings narrative.

Another Take on Value

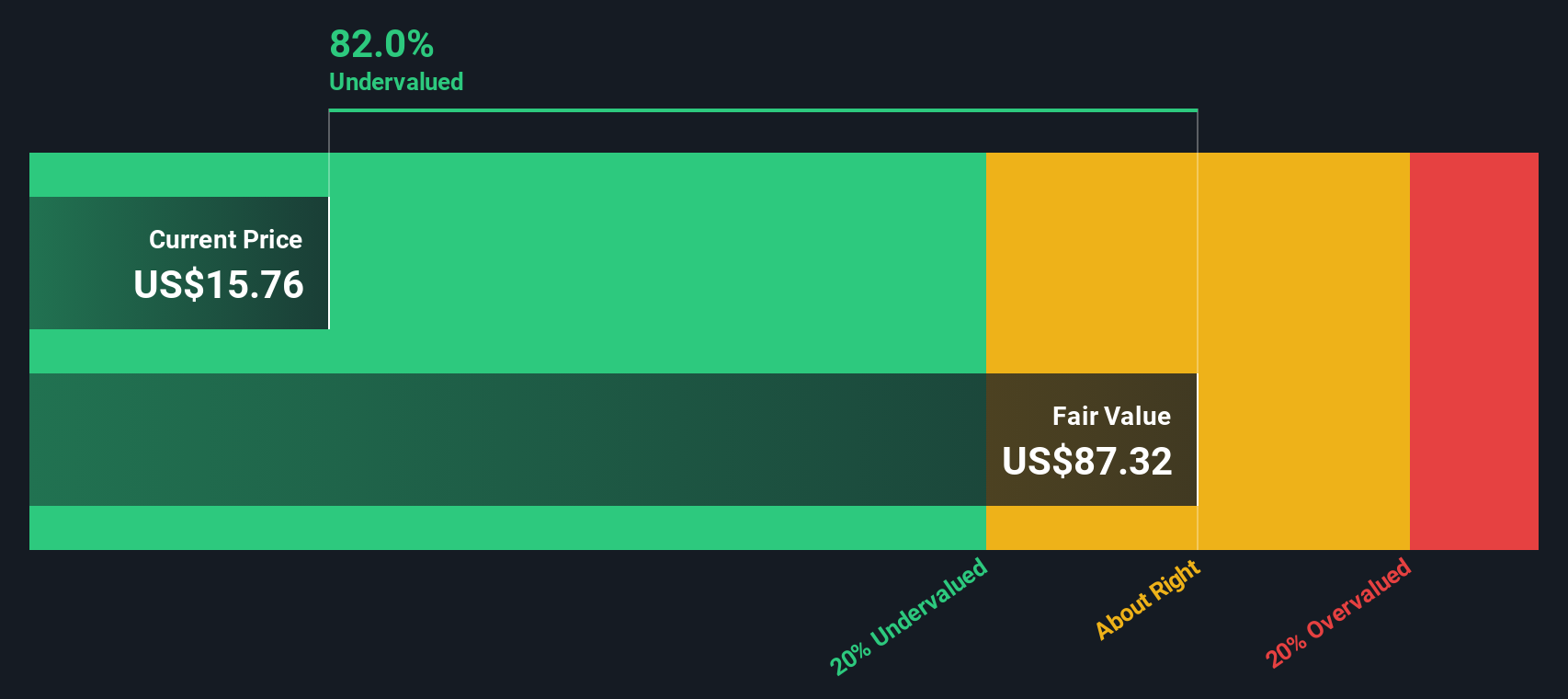

Our DCF model paints an even more dramatic picture, suggesting Slide could be trading about 81.6% below its fair value of roughly $98.82 per share. If that long term cash flow view is closer to reality than today’s earnings multiple, is the market missing something big?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Slide Insurance Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Slide Insurance Holdings Narrative

If our view does not quite match your own, or you prefer digging into the numbers yourself, you can craft a custom take in minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Slide Insurance Holdings.

Looking for more investment ideas?

Before you move on, lock in your next smart move with a few targeted screeners that can uncover opportunities most investors are still overlooking.

- Capture reliable income potential by scanning these 13 dividend stocks with yields > 3% that aim to keep cash flowing into your portfolio while others wait for capital gains.

- Position yourself ahead of the next technological surge by focusing on these 25 AI penny stocks that could reshape entire industries with intelligent automation.

- Strengthen your long term returns by pinpointing these 915 undervalued stocks based on cash flows where market pessimism may have pushed prices well below intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal