Pilgrim's Pride (PPC): Assessing Valuation After a Recent Pullback in the Share Price

Pilgrim's Pride (PPC) has quietly slipped about 17% year to date, even though the business remains profitable and revenue is still growing. That disconnect is exactly what makes the stock interesting.

See our latest analysis for Pilgrim's Pride.

Over the past year, Pilgrim's Pride has seen its share price return sag while the three year total shareholder return of nearly 100% still signals that long term investors have been well rewarded. This suggests recent weakness may reflect shifting sentiment rather than a broken story.

If this kind of cyclical pullback has you scanning for other ideas in consumer staples and beyond, it is a good time to explore fast growing stocks with high insider ownership.

With earnings still healthy and the stock trading below analyst targets, the key question now is whether Pilgrim's Pride is quietly undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 11.6% Undervalued

With Pilgrim's Pride last closing at $39.15 against a narrative fair value near $44, the story points to a moderate valuation gap worth unpacking.

The analysts have a consensus price target of $49.125 for Pilgrim's Pride based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $57.0, and the most bearish reporting a price target of $40.0.

Curious how modest revenue growth, easing margins and a higher future earnings multiple can still point to upside from here? The full narrative breaks down the forecasts, the discount rate and the valuation bridge that connect today's price to that target.

Result: Fair Value of $44.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained chicken demand and higher margin prepared foods could keep earnings more resilient than expected and challenge the idea that margins must compress.Find out about the key risks to this Pilgrim's Pride narrative.

Another Angle on Value

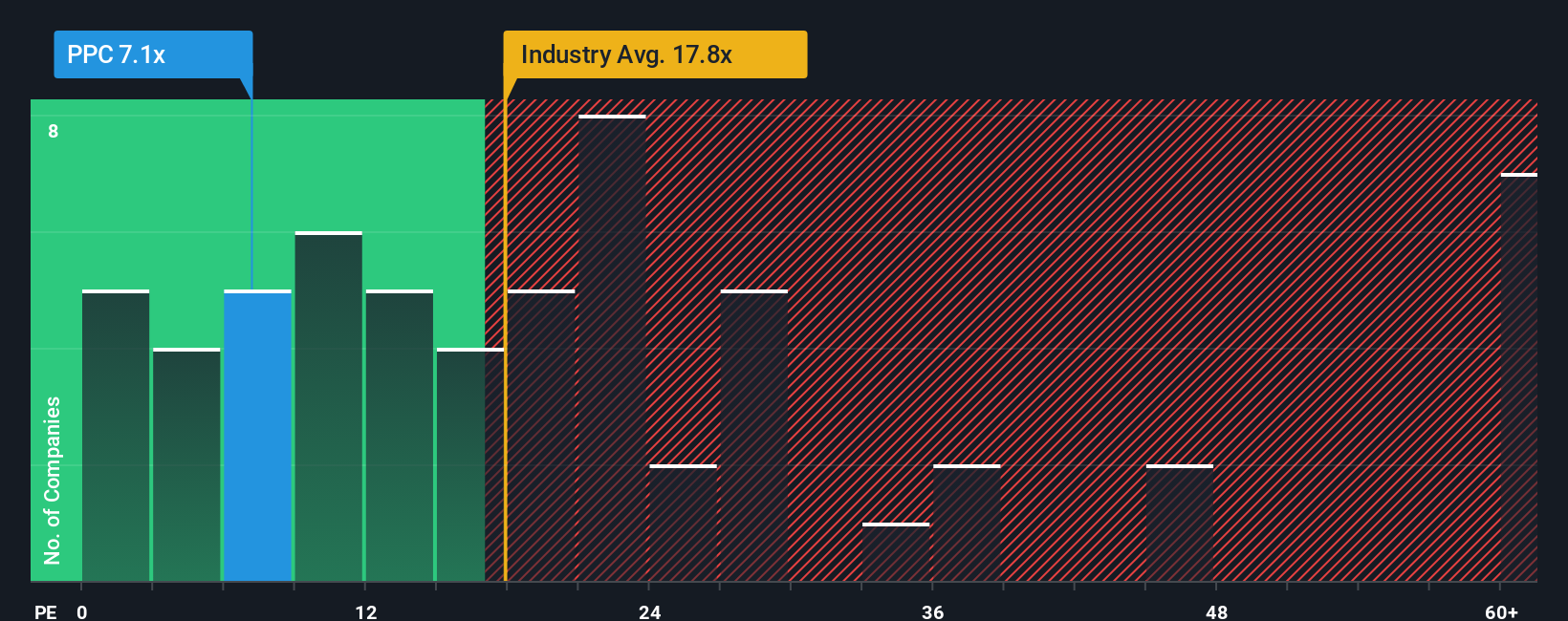

While the narrative fair value suggests upside, PPC’s 7.6x earnings multiple is dramatically cheaper than the US Food industry at 20.2x and peers at 15.8x, and below its 11.4x fair ratio. Is the market overreacting to flat growth or underestimating future cash flows?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pilgrim's Pride for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pilgrim's Pride Narrative

If this take does not quite fit your view, or you would rather dig into the numbers yourself, you can quickly build a tailored perspective in under three minutes: Do it your way.

A great starting point for your Pilgrim's Pride research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with Pilgrim's Pride, you could miss signals elsewhere. Use the Simply Wall Street Screener to line up your next high conviction opportunity.

- Capture early momentum in smaller names by scanning these 3633 penny stocks with strong financials that pair attractive prices with solid underlying businesses.

- Position ahead of the next wave of automation by checking these 25 AI penny stocks targeting companies building real revenue from artificial intelligence.

- Explore potential risk and reward setups with these 915 undervalued stocks based on cash flows that screen for cash flow focused businesses the market may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal