Capital One (COF) Valuation Revisited After Upbeat Analyst Calls and Fresh Credit Quality Update

Capital One Financial (COF) is back in the spotlight after a wave of upbeat analyst commentary arrived alongside its latest charge-off and delinquency update, giving investors fresh data to gauge credit trends and growth potential.

See our latest analysis for Capital One Financial.

The upbeat analyst calls and fresh credit quality data are landing against a powerful backdrop, with Capital One’s share price up a solid 35.2 percent year to date and a standout 187.9 percent three year total shareholder return, suggesting momentum is still firmly building rather than fading.

If this kind of move has you wondering what else might be setting up for strong multi year runs, now is a good time to explore fast growing stocks with high insider ownership.

Yet with the stock already up sharply and trading only modestly below analyst targets, is Capital One still flying under the radar on valuation, or are investors now paying up for years of future growth, limiting today’s upside?

Most Popular Narrative Narrative: 7.2% Undervalued

With Capital One Financial last closing at $241.61 versus a most popular narrative fair value near $260, the story suggests a potential valuation gap supported by expectations of rapid expansion.

The analysts have a consensus price target of $236.758 for Capital One Financial based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $265.0, and the most bearish reporting a price target of just $160.0.

Want to see what powers that valuation gap? The narrative focuses on expectations of strong revenue growth, improved earnings, and a future profit multiple that could differ from what some traditional bank investors might anticipate.

Result: Fair Value of $260.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy integration costs from the Discover deal and tougher premium card competition could erode margins and challenge the upbeat long term growth narrative.

Find out about the key risks to this Capital One Financial narrative.

Another Angle on Valuation

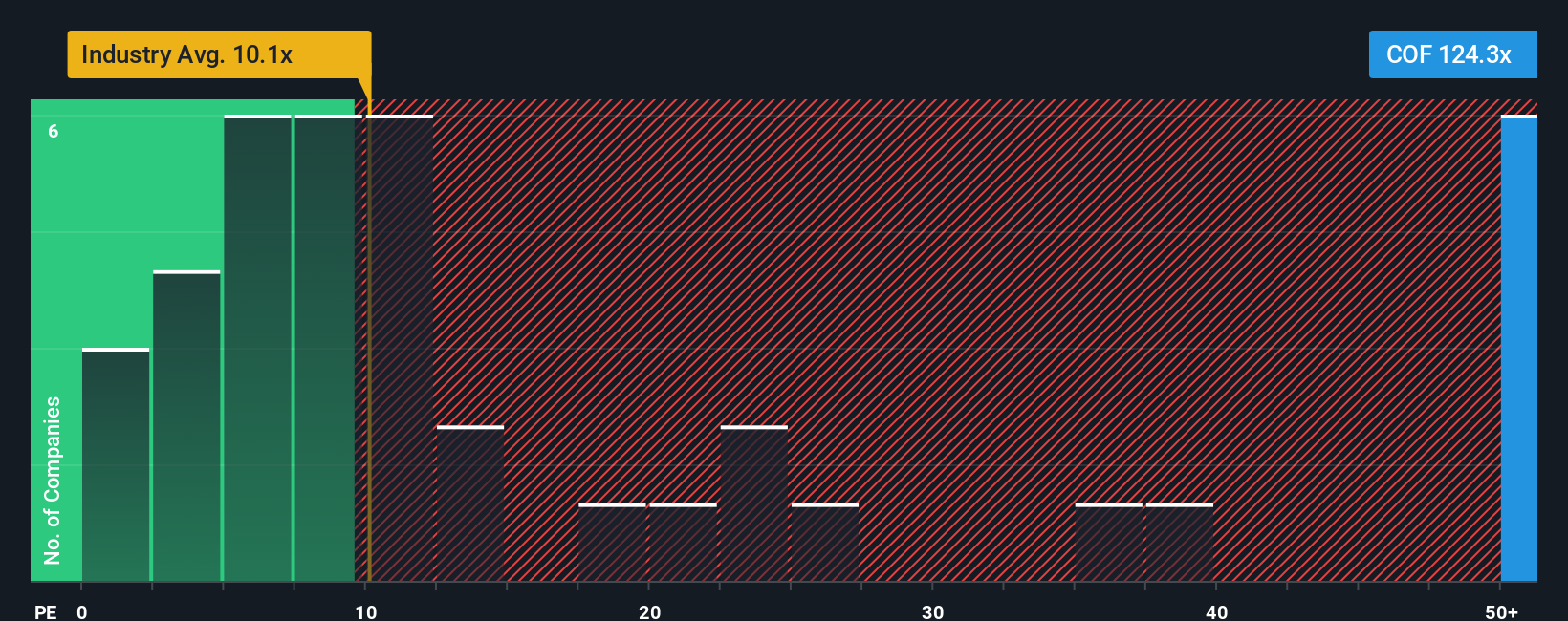

On raw earnings, the picture flips. Capital One trades at about 133 times earnings, far richer than both the US Consumer Finance industry at 9.7 times and peers at 28 times, and even well above a fair ratio of 30.9 times. This raises the risk that expectations are already stretched.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital One Financial Narrative

If this view does not quite match your own, or you would rather dig into the numbers yourself, you can build a full narrative from scratch in just a few minutes. All you need to do is Do it your way.

A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one opportunity when smarter, data driven ideas are a click away. Use the Simply Wall St Screener now so you do not miss what is next.

- Capture income potential by targeting companies in these 13 dividend stocks with yields > 3% that combine attractive yields with balance sheet strength and room to keep raising payouts.

- Capitalize on transformative innovation through these 25 AI penny stocks, where businesses harness artificial intelligence to reshape industries and earnings power.

- Position yourself early in groundbreaking technology by scanning these 28 quantum computing stocks poised to benefit from advances in computation, security, and sensing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal