Helios Technologies (HLIO) Valuation Check After Sun Hydraulics’ New 0‑Series Counterbalance Valve Launch

How the new 0 Series launch ties into Helios Technologies stock

Helios Technologies, Inc. (HLIO) just expanded its Sun Hydraulics lineup with the new 0 Series counterbalance valves, targeting cramped, demanding hydraulic applications and subtly reinforcing the company’s edge in precision motion control.

For shareholders, this kind of focused product development can matter over time, especially when it supports higher margin, engineering driven niches rather than chasing pure volume.

See our latest analysis for Helios Technologies.

At a share price of $55.86, Helios has given investors a robust year to date share price return of roughly 26 percent, while the 1 year total shareholder return of about 13 percent suggests momentum is positive but not explosive.

If this kind of targeted product launch catches your eye, it could be worth widening the lens and exploring fast growing stocks with high insider ownership for other under the radar growth stories with skin in the game.

With earnings growing faster than revenue and the stock still trading at a double digit discount to analyst targets and intrinsic value estimates, is Helios quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 14.3% Undervalued

With Helios Technologies last closing at $55.86 against a narrative fair value of $65.20, the valuation case leans toward a meaningful upside if assumptions hold.

The analysts have a consensus price target of $60.6 for Helios Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $73.0, and the most bearish reporting a price target of just $55.0.

Want to see what kind of earnings surge, margin rebuild, and premium multiple are built into this story? The full narrative breaks down the entire playbook.

Result: Fair Value of $65.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, end market cyclicality and slower adoption of Helios's more advanced, IoT enabled solutions could easily derail the upbeat growth and margin narrative.

Find out about the key risks to this Helios Technologies narrative.

Another Lens on Value

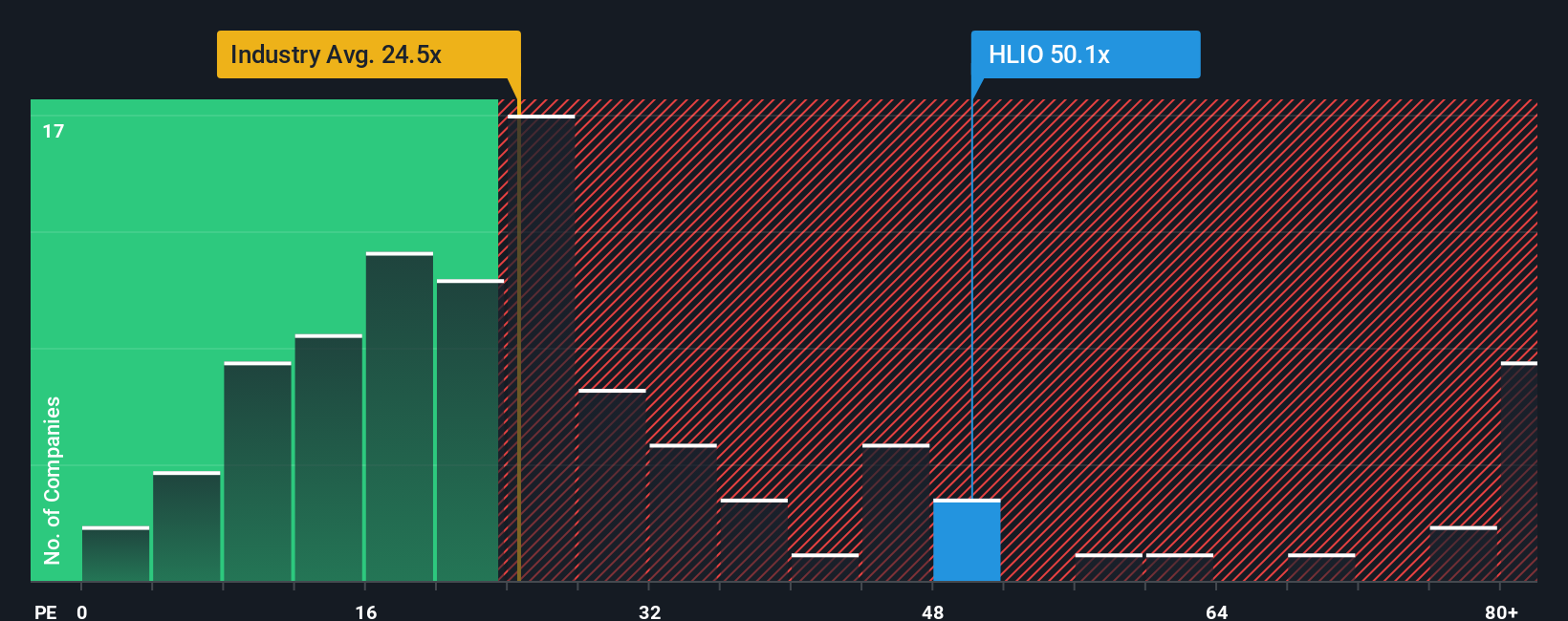

Step away from narratives and Helios suddenly looks expensive on a simple earnings lens. Its price to earnings ratio of 54.9 times compares with a fair ratio of 47.5 times, the Machinery industry at 26.2 times, and peers at 36.3 times. Is the market overpaying for the turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helios Technologies Narrative

If you see the numbers differently or want to stress test the assumptions yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Helios Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Helios might only be the beginning, and if you stop here you could miss some of the market’s most compelling, overlooked, and income boosting opportunities.

- Capitalize on mispriced quality by targeting companies trading below their cash flow potential using these 915 undervalued stocks based on cash flows before the crowd catches on.

- Ride the next secular shift in medicine and technology by focusing on innovators powered by these 30 healthcare AI stocks that could reshape patient outcomes.

- Lock in reliable cash returns while markets stay uncertain by filtering for these 13 dividend stocks with yields > 3% offering attractive income with room for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal