Undiscovered Gems in the US Market This December 2025

As 2025 draws to a close, the U.S. stock market is experiencing turbulence with major indexes closing lower due to pressure on AI stocks and looming economic data releases. In this environment, where concerns about an AI bubble and labor market weaknesses are prevalent, investors may find opportunities in lesser-known small-cap stocks that demonstrate strong fundamentals and resilience amidst broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Fidelity D & D Bancorp (FDBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering a variety of banking, trust, and financial services to individuals, small businesses, and corporate clients with a market cap of $286.75 million.

Operations: Fidelity D & D Bancorp generates revenue primarily from its banking, trust, and financial services segment, totaling $88.60 million. The company's financial performance is influenced by its net profit margin trends over time.

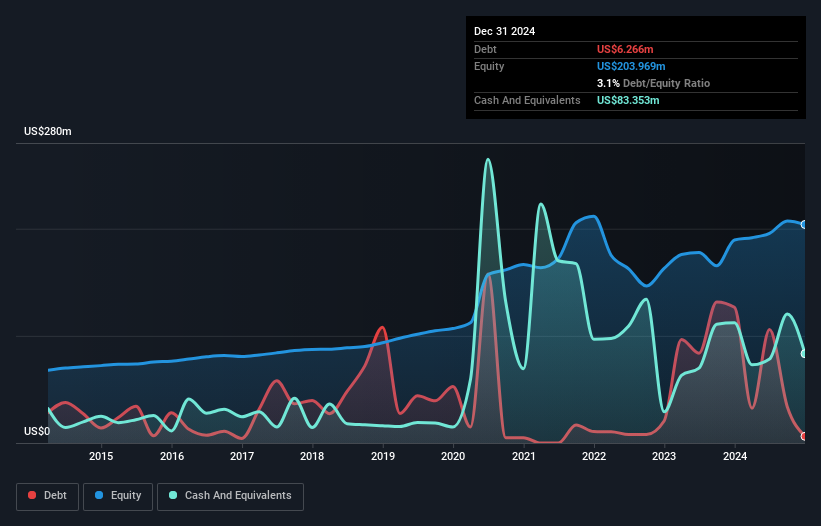

Fidelity D & D Bancorp, with assets totaling US$2.7 billion and equity of US$229.2 million, presents a compelling profile in the banking sector. Their deposits stand at US$2.5 billion against loans of US$1.9 billion, indicating robust financial health supported by a 0.1% bad loan ratio and a net interest margin of 2.7%. Trading at nearly 40% below estimated fair value adds to its investment appeal, alongside impressive earnings growth of 69% over the past year compared to an industry average of 18%. Recent board changes and dividend hikes further underscore its strategic positioning and shareholder focus.

- Take a closer look at Fidelity D & D Bancorp's potential here in our health report.

Evaluate Fidelity D & D Bancorp's historical performance by accessing our past performance report.

Northfield Bancorp (Staten Island NY) (NFBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Northfield Bancorp, Inc. (Staten Island, NY) serves as the bank holding company for Northfield Bank, offering various banking services to individual and corporate clients with a market capitalization of $507.89 million.

Operations: Northfield Bancorp generates revenue primarily through its banking segment, which reported $141.98 million. The company's financial performance can be analyzed by examining its net profit margin trends over recent periods.

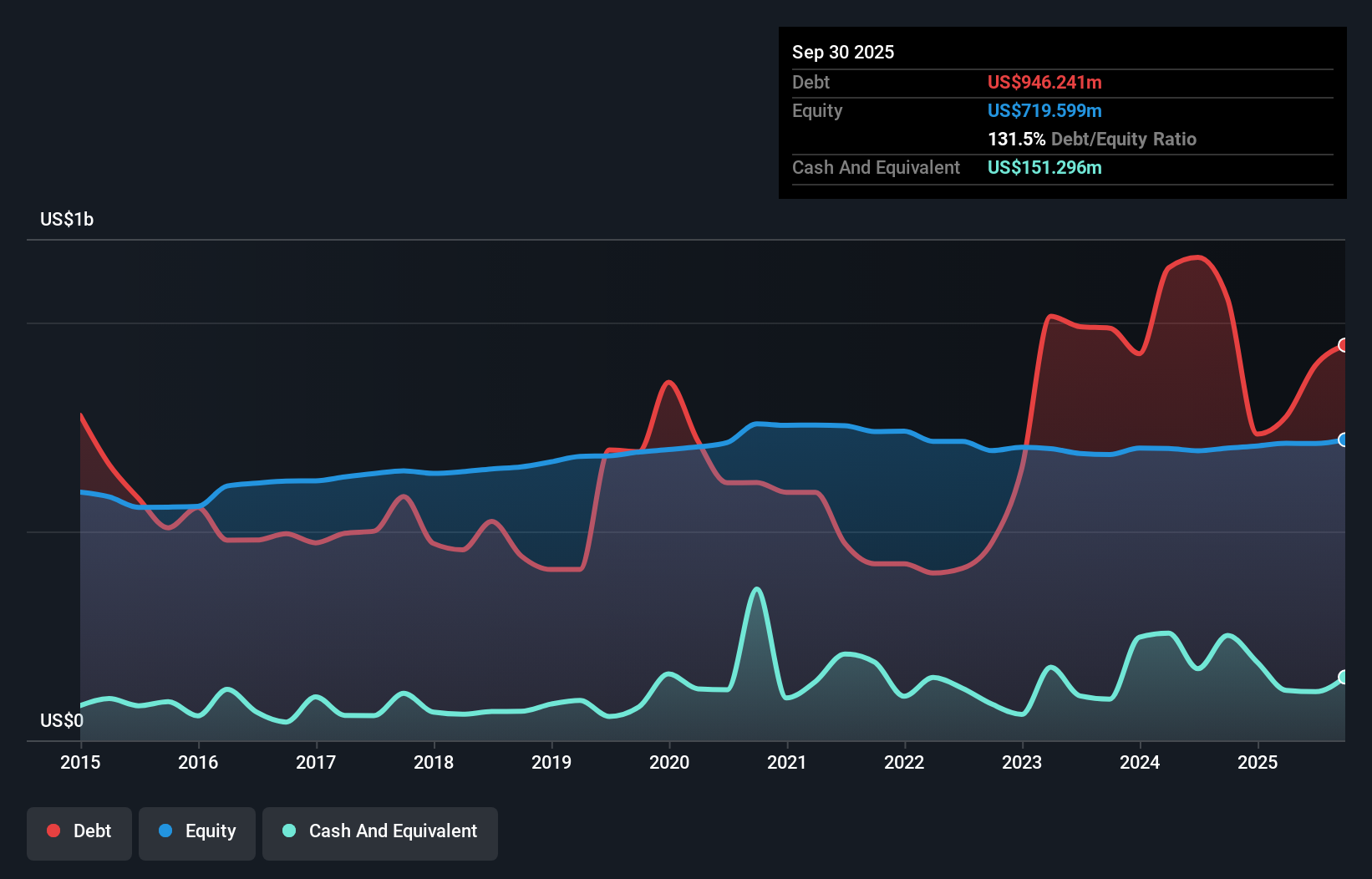

Northfield Bancorp, a financial entity with total assets of US$5.7 billion and equity of US$719.6 million, showcases a robust profile with total deposits at US$4 billion against loans of US$3.9 billion. The bank's net interest margin sits at 2.1%, and it maintains a sufficient allowance for bad loans at 0.5% of total loans, highlighting prudent risk management practices. Earnings surged by 47% over the past year, outpacing the industry average significantly, while its price-to-earnings ratio stands attractively below the market average at 12.9x, indicating potential value for investors seeking growth in this sector.

- Click here to discover the nuances of Northfield Bancorp (Staten Island NY) with our detailed analytical health report.

Learn about Northfield Bancorp (Staten Island NY)'s historical performance.

Oil-Dri Corporation of America (ODC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Oil-Dri Corporation of America, along with its subsidiaries, specializes in the development, manufacturing, and marketing of sorbent products both domestically and internationally, with a market capitalization of approximately $753.33 million.

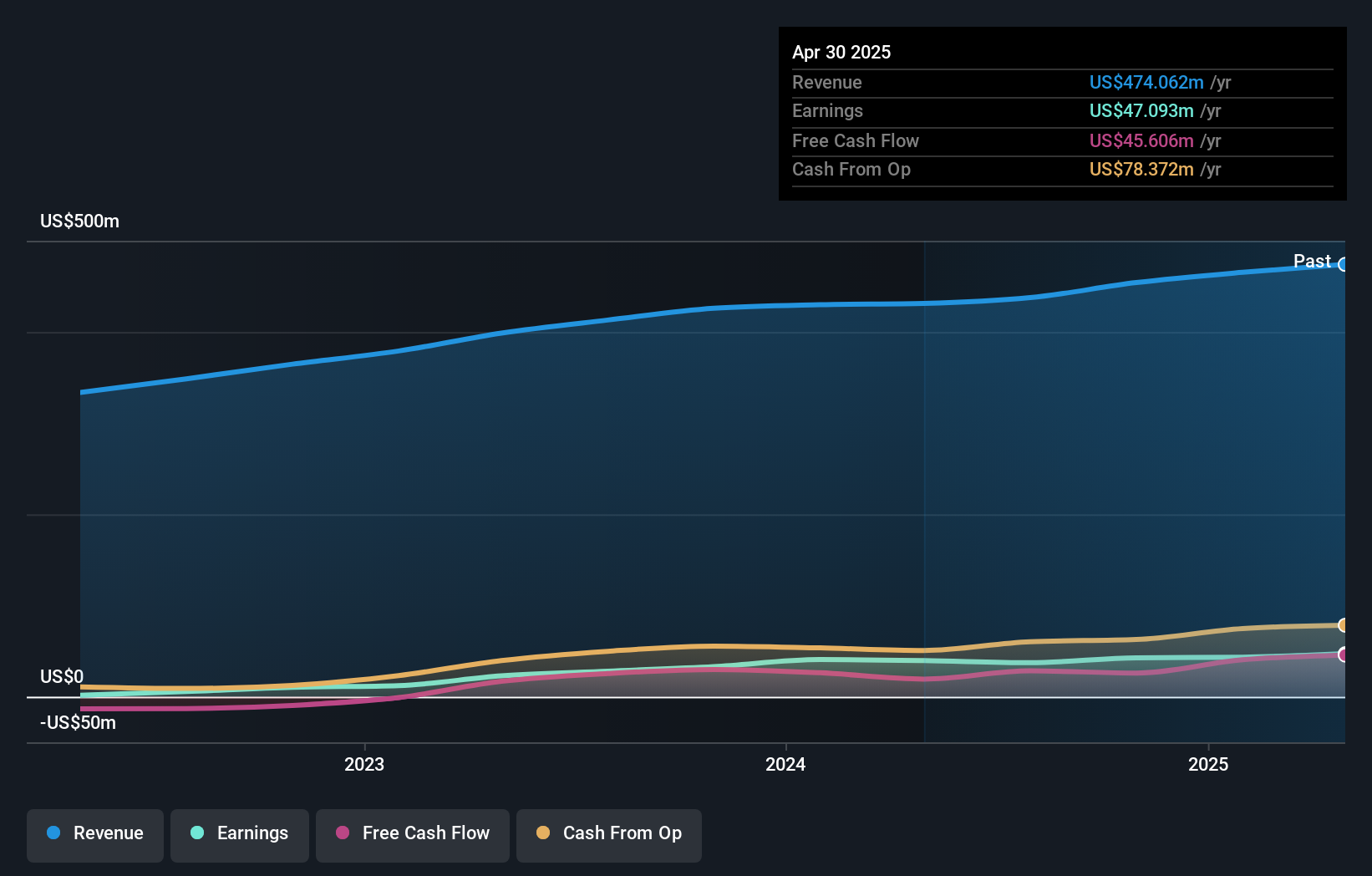

Operations: ODC generates revenue primarily from two segments: Retail and Wholesale Products, contributing $299.65 million, and Business to Business Products, generating $178.47 million. The net profit margin is a key financial metric for the company.

Oil-Dri Corporation of America, a player in the household products sector, has shown robust financial health with earnings growth of 18.6% over the past year, outpacing its industry. Trading at 65.7% below estimated fair value adds to its appeal for potential investors. Despite an increase in debt-to-equity from 6.6% to 14.9% over five years, it holds more cash than total debt and maintains high-quality earnings with EBIT covering interest payments by a factor of nearly 49 times. Recent dividend hikes reflect confidence in sustained profitability, even as Q1 sales dipped to US$120 million from US$128 million last year.

Taking Advantage

- Dive into all 295 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal