Reassessing United Overseas Bank (SGX:U11) Valuation After S$3b Capital Return, Covered Bonds and Q3 Profit Drop

United Overseas Bank (SGX:U11) is back in focus after unveiling a S$3 billion capital return package and fresh covered bond issuances, even as Q3 2025 profit dropped sharply on higher precautionary credit allowances.

See our latest analysis for United Overseas Bank.

Those capital returns and covered bond deals come after a volatile stretch, with the latest S$34.75 share price sitting below its peak but supported by a resilient 5 year total shareholder return near 100 percent. This suggests that longer term momentum remains intact.

If UOB's mix of capital returns and risk management has you reassessing your bank exposure, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings under short term pressure, but a hefty capital return plan and a share price still below intrinsic estimates, is UOB quietly undervalued today, or are investors already paying up for its next leg of growth?

Most Popular Narrative Narrative: 3% Undervalued

With the narrative fair value sitting just above the S$34.75 last close, the story hinges on how UOB converts disciplined growth into durable earnings power.

The sustained digital transformation including investments in AI partnerships (e.g., with Accenture) and expansion of digital banking offerings is expected to accelerate customer acquisition and lower cost to serve, leading to higher fee income, improved cost to income ratios, and potentially higher margins as digital scale efficiencies are realized.

Curious how steady revenue expansion, shifting profit margins and a richer earnings multiple are expected to work together here. Want to see the exact growth runway this narrative is banking on and how it justifies paying more for future profits.

Result: Fair Value of $35.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and rising credit costs could quickly undermine the growth narrative if economic conditions soften more than expected.

Find out about the key risks to this United Overseas Bank narrative.

Another Angle On Value

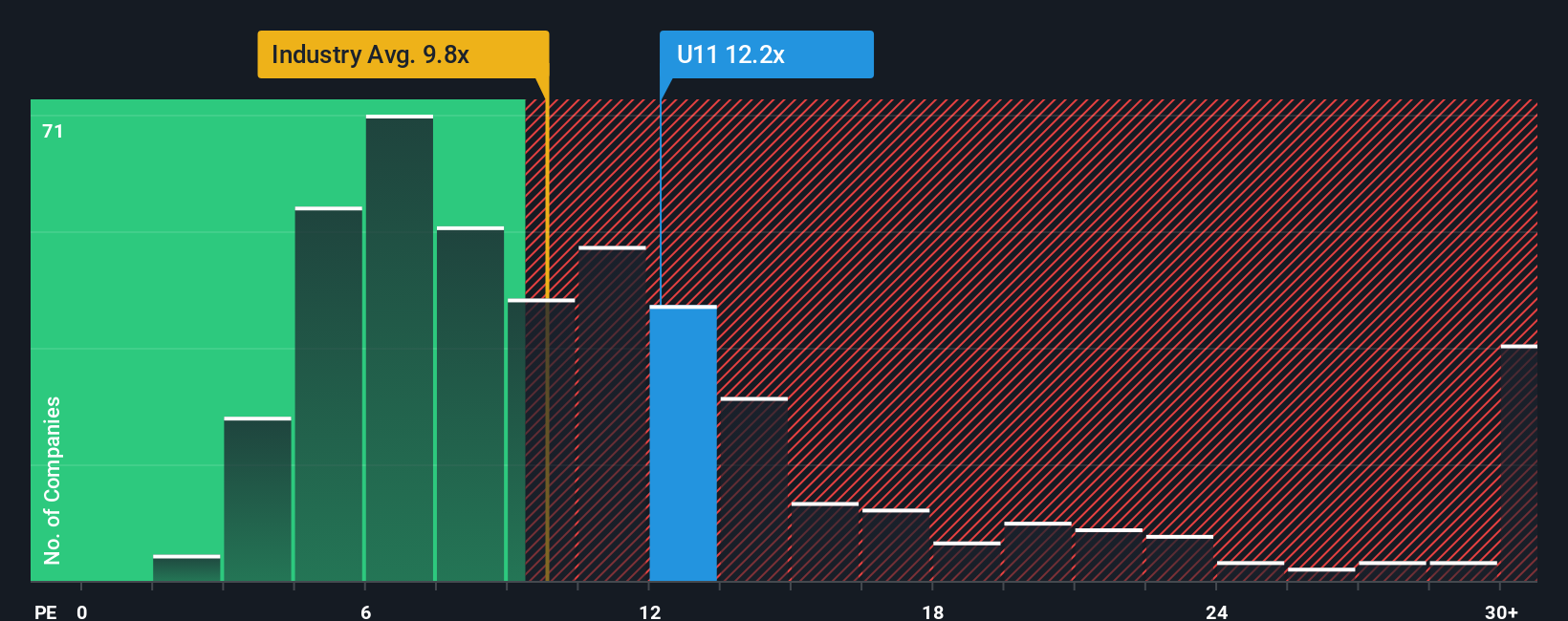

On earnings, the picture looks less generous. UOB trades on about 12.2 times earnings, richer than the Asian banks average near 9.8 times and not far below its fair ratio of 13 times. That smaller gap implies less clear upside, so the risk reward is less obvious here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Overseas Bank Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in minutes: Do it your way.

A great starting point for your United Overseas Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning focused stock ideas tailored to different strategies, so you stay ahead of the crowd.

- Target potential value wins by screening for companies trading below intrinsic estimates with these 915 undervalued stocks based on cash flows.

- Ride innovation trends by zeroing in on fast growing automation and machine learning plays through these 25 AI penny stocks.

- Strengthen your income stream by uncovering reliable payers with yields above 3 percent using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal