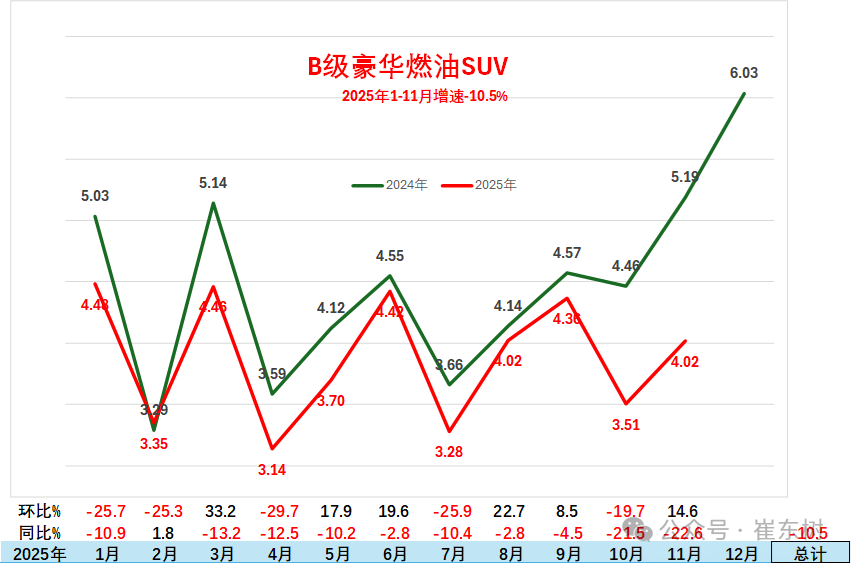

Cui Dongshu: In November, the B-class luxury SUV market fell 22.6% year on year, increased 14.6% month-on-month, and the monthly trend was better than the B-class mainstream fuel SUV market

The Zhitong Finance App learned that Cui Dongshu, Secretary General of the Passenger Federation Branch, published an article stating that in November, the B-class fuel SUV market fell 27% compared to November last year, and increased 6% from October, and the growth pressure was strong. Among them, the B-class luxury SUV market fell 22.6% from November last year, and increased 14.6% from October. The monthly trend is better than the B-class mainstream fuel SUV market. The traditional peak season for the winter market this year was not strong. Sales of homogenized products declined severely, differentiated products performed well, and the trend of high-end consumption upgrading was obvious.

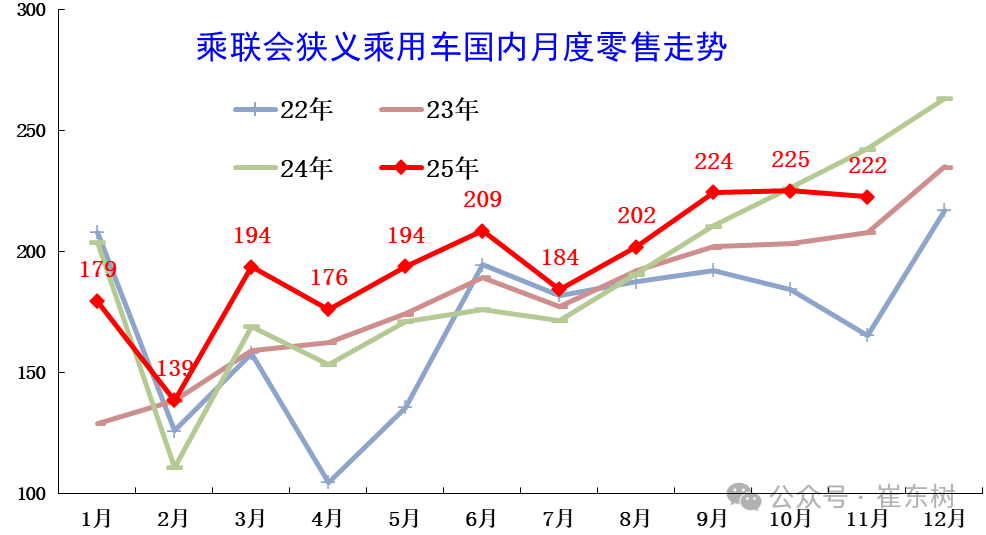

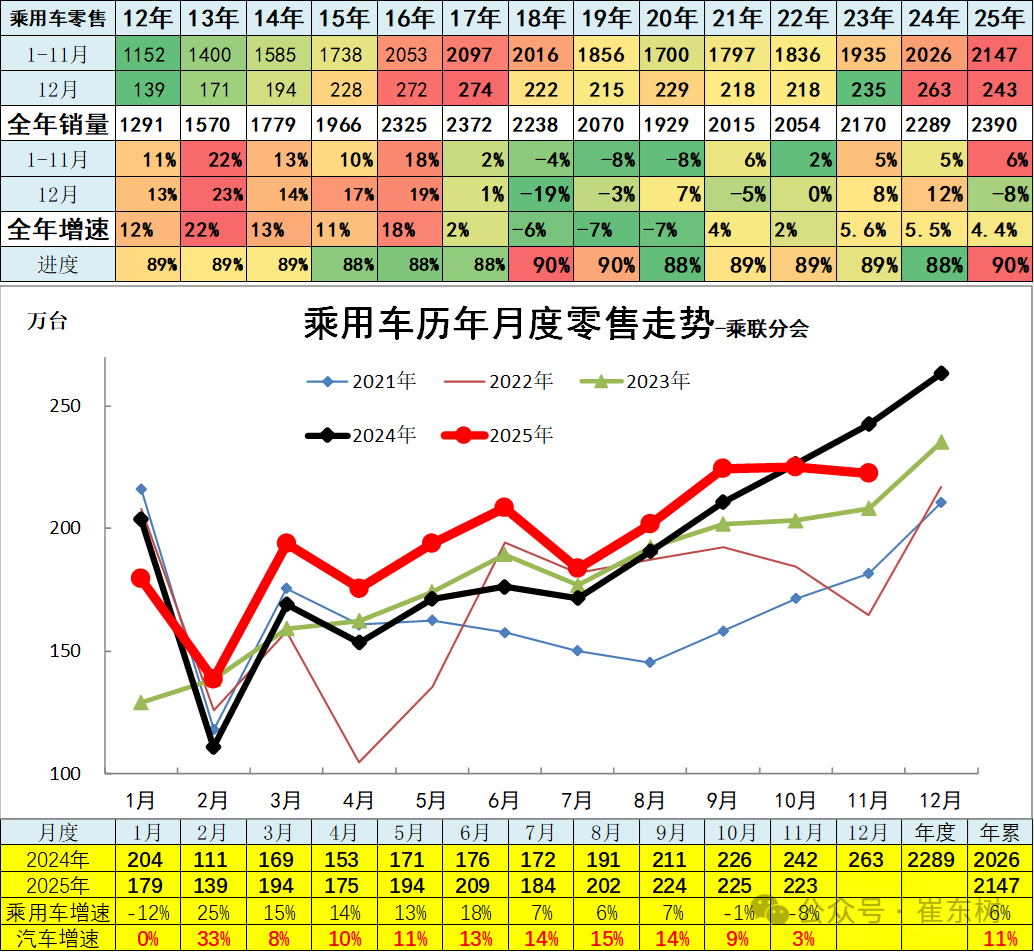

There is a big contrast between the monthly trend of the passenger car market in 2025 and previous years. The cumulative retail growth rate in the domestic car market increased by 1.2% from January-February, increased 15% in March-June, hovered around 6% in July-September, and fell back to 8% in November. Sales in the car market basically leveled off in September-November, which is basically in line with the “low before, middle, high, back flat” trend judged at the beginning of the year.

The traditional peak season since October of this year has not been strong. Sales of homogenized products have declined significantly. The B-class SUV market has declined significantly, and some new high-end models have performed brilliantly, while some models, such as the new Cadillac XT5, have bucked the trend, reflecting the high level of acceptance of new fuel vehicle products by major car companies. Although negative growth pressure was strong in the fourth quarter of this year, the “14th Five-Year Plan” car market growth was already strong. Currently, the market is in a gap period for subsidy adjustments. Looking ahead to the beginning of the “15th Five-Year Plan” in 2026, the car market still has great potential for growth.

1. In 2025, the trend of sales in the car market is high and flat is abnormal

Domestic retail sales of passenger cars were low and high in 2024, and continued to rise in July-December. Early low to medium high characteristics of the car market in 2025. In January, due to weak factors such as before the Spring Festival, the cumulative retail growth rate of the domestic car market continued to rise from negative 12% in January to 11% in January-June. July-November showed a gradual deceleration characteristic of a high base, and the market emerged from a “low to medium high back flat” trend. Retail sales grew steadily year-on-year in July-September of this year, and underperformed in October-November under a high base.

Reasons for the abnormal downturn in the car market in February and November

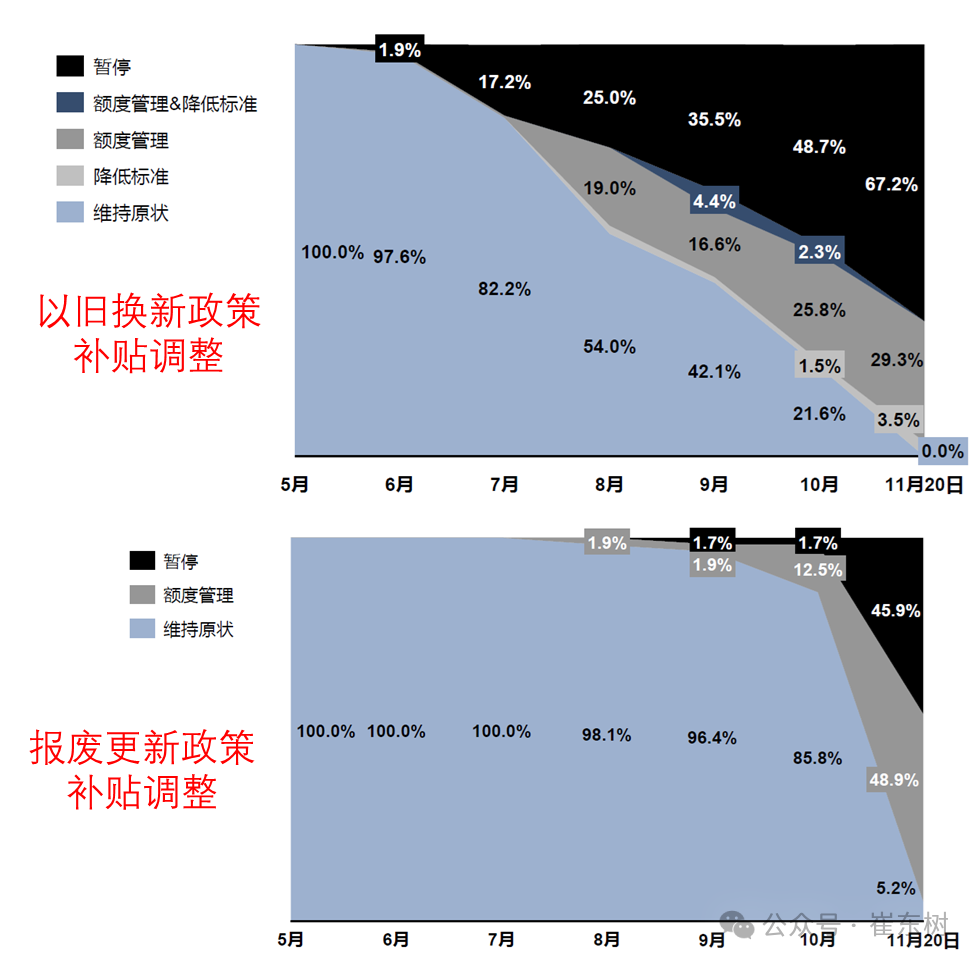

Since June, car replacement subsidy policies have been suspended or adjusted in various regions. The number of places where trade-in subsidies has been suspended since September has increased rapidly. Currently, the vast majority of provinces, regions and key cities have adjusted or suspended subsidies, causing the pace of sales in the market to slow down. Subsidies for end-of-life updates have been heavily adjusted since October. Nearly half of the provinces and regions have suspended subsidies for scrap renewals, and the vast majority of other provinces and regions have implemented quota management for scrap renewals, further affecting the normal seasonal increase in sales. Only some provinces, such as Jiangxi, Guizhou, and Hainan, will still have subsidies for scrapping and renewal progressing normally until the end of November.

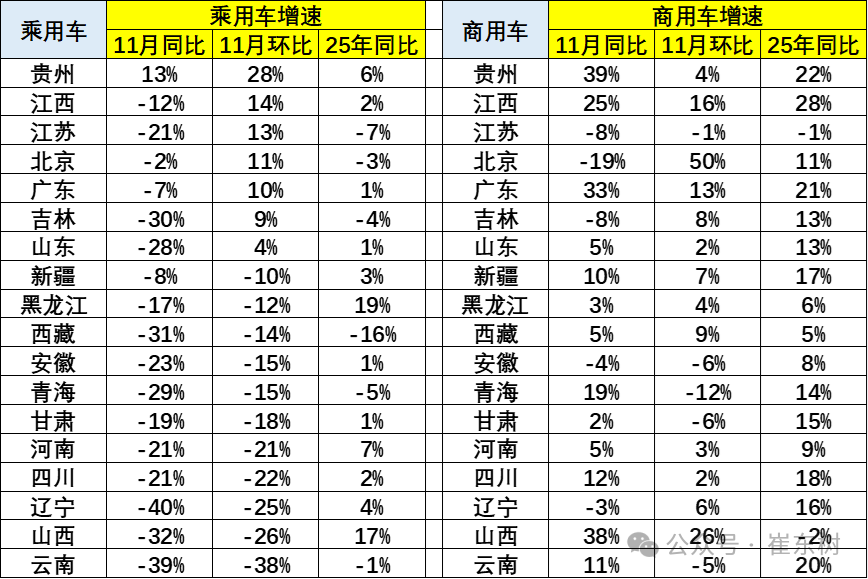

Judging from the growth rate of various provinces and regions, there is a huge difference between passenger cars and commercial vehicles. Passenger car growth was good in some provinces and regions such as Guizhou and Jiangxi, but passenger cars in provinces such as Henan, Sichuan, Shanxi, and Yunnan dropped dramatically from November. The contrast between commercial vehicle growth, which was not affected by passenger car trade-in and scrapping and renewal subsidies, was huge.

Due to severe pressure from the passenger car market to decline month-on-month and negative year-on-year growth in November, there are strong voices calling for a decline in the market. However, I feel that due to rapid growth in the early part of this year, the goal of policy subsidies themselves is to stabilize the overall growth rate, so the phenomenon of steady growth at the end of the year is a reasonable trend. The high base figure for November last year, and the slight negative growth in November of this year ironed out last year's high growth. Compared with November 2022, it is still 5%, so the overall trend is still relatively normal. An important policy to regulate the growth rate this year is trade-in subsidies. As of October 22, the number of automobile trade-in subsidy applications in 2025 exceeded 10 million vehicles, and the number of applications in the previous 11 months had reached 11.2 million vehicles. With the large-scale suspension of subsidies in various regions, the average daily subsidy scale was reduced to 30,000 vehicles in November, and the effect of adjusting the growth rate was obvious.

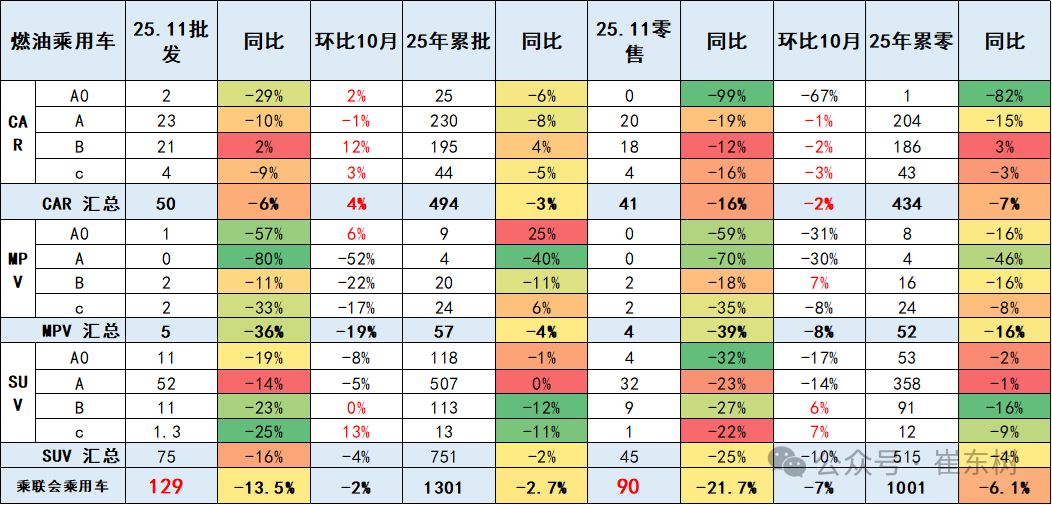

3. The trend of the fuel vehicle market was seriously sluggish in November

Retail sales in the fuel passenger car market fell 22% year on year in November and 7% month on month. The trend is extremely difficult. Among them, new energy is developing rapidly in the B-class high-end SUV market, and the market performance of B-class fuel SUVs is poor.

Driven by the same strategy of oil and electricity, mainstream car companies are rapidly developing new energy SUVs, and the fuel SUV market is facing consumer challenges. How to achieve sustainable development is the car companies' thinking.

In November, the B-class fuel SUV market fell 27% compared to November last year, and increased 6% from October. The growth pressure was strong. Among them, the B-class luxury SUV market fell 22.6% from November last year, and increased 14.6% from October. The monthly trend is better than the B-class mainstream fuel SUV market. The traditional peak season for the winter market this year was not strong. Sales of homogenized products declined severely, differentiated products performed well, and the trend of high-end consumption upgrading was obvious.

4. Analysis of growth opportunities in the downside market

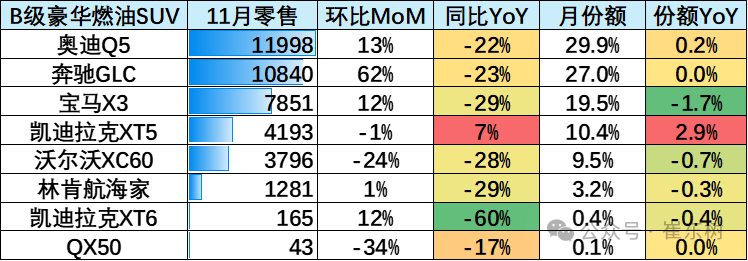

The luxury B-class SUV market declined 22.6% in November, when traditional sales were popular. In the market segment, the BBA top three are still the “basic market,” but the year-on-year performance of these three products collectively showed a sharp decline. Q5 fell 22%, GLC fell 23%, and X3 fell 29%. The decline all broke 20%, which was a significant contraction in sales volume compared to the same period last year. Most of the other luxury brand models also failed to escape the downward impact of the market: the Volvo XC60 fell 28% year on year in November, the Lincoln Navigator fell 29% year on year, and new Volvo brand products also failed to effectively reverse the brand's downward trend in the market segment. The only stable, moderate and positive model in this market is the Cadillac XT5. Its retail sales volume in November reached 4,193 units, up 7% year on year, and the market share increased 2.9 percentage points over the same period last year. The unusual performance of the new XT5 probably explains the opportunity points that exist in this market segment in an environment of overall contraction: in today's rapidly changing market environment, it is even more necessary to respond to the real value pain points of consumers.

First, today's consumers tend to be more rational. Compared to conceptual luxury value, current consumers are beginning to pay attention to the rational value of products. The simple luxury narrative is already discouraging. For example, in the past year, the new Cadillac XT5 has successfully created the two major value anchors of “million-level full-scene luxury” and “full-road hummingbird chassis”. It not only satisfies users' needs for luxury, but also provides differentiated value through products and design in an environment where this level generally creates a “sense of youth”, and has been recognized by users. Second, safety has gradually become a sensitive topic in the automotive industry. Cadillac has transformed safety promises into empirical evidence and underpinning by creating a “Benevolent Shield” and launching a “Golden Body Equity”, further strengthening users' perception of value and expanding differentiated competitive advantages.

It is worth noting that in recent years, after following the freshness of extreme technology from new power brands, they will eventually return to a relatively rational level of consideration. The core demand in the luxury fuel vehicle market is also extending from “immediate travel needs” and “emotional value.” However, for luxury brands, they will still face certain pressures and challenges next year. The market competition will be more intense, and the pattern of sharing and reserving differences will become more obvious. Adhering to good brand characteristics and not following the trend, and making differentiated products may be a key factor in winning in this market.

5. Analysis of future car market growth potential

The slowdown in retail sales in the fourth quarter of this year is conducive to creating good room for growth in the “15th Five-Year Plan”. The domestic passenger car market trend was strong during the “14th Five-Year Plan”. From 19.29 million units in 2020 to 23.9 million units in 2025, sales increased by 4.4 million units, exports increased by 5 million units, and the total increase in the “14th Five-Year Plan” was nearly 10 million units. However, retail sales in the “13th Five-Year Plan” car market had a negative increase of 370,000 units from 19.29 million units in 2020. Among these, there were special factors in 2020, but passenger car retail sales in the “13th Five-Year Plan” basically had zero growth. However, for luxury brands, they will still face certain pressures and challenges next year. Regardless of whether the market segment grows in size, market competition will become more intense, and the pattern of sharing common ground while reserving differences will become more obvious. Adhering to good brand characteristics and not following the trend, and making differentiated products may be a key factor in winning in this market.

The Central Economic Work Conference was successfully held in Beijing from the 10th to the 11th of this month. The conference focused on deploying economic work in 2026, and clearly proposed optimizing the implementation of the “two new” policies in terms of “adhering to domestic demand leadership and building a strong domestic market”. From January to November 2025, the consumer goods trade-in policy has driven sales of related products above the 2.5 trillion yuan mark, benefiting more than 360 million people, of which more than 11.2 million cars were traded in. The conference made it clear that the national supplement policy will continue to be implemented in 2026, but the specific implementation methods will be optimized. Therefore, the factors that plagued the automobile market slump in the fourth quarter of this year will change in early 2026, and car trade-in work will continue after optimization, which will contribute greatly to unlocking the potential of automobile consumption.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal