Discovering Undiscovered Gems in Global Markets December 2025

As global markets navigate the complexities of fluctuating interest rates and mixed economic signals, small-cap stocks have captured attention with the Russell 2000 Index leading gains amid a broader market rally. In this dynamic environment, identifying promising yet overlooked companies requires a keen eye for those that can leverage favorable conditions such as lower borrowing costs and resilient sector-specific trends to drive growth.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Thai Steel Cable | NA | 3.35% | 17.89% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Sing Investments & Finance | 0.21% | 8.60% | 11.10% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| JB Foods | 113.93% | 31.03% | 41.46% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Changbai Mountain Tourism (SHSE:603099)

Simply Wall St Value Rating: ★★★★★★

Overview: Changbai Mountain Tourism Co., Ltd. operates in the tourism industry in China with a market capitalization of CN¥12.88 billion.

Operations: Changbai Mountain Tourism generates revenue through its operations in the tourism sector in China. The company has a market capitalization of CN¥12.88 billion.

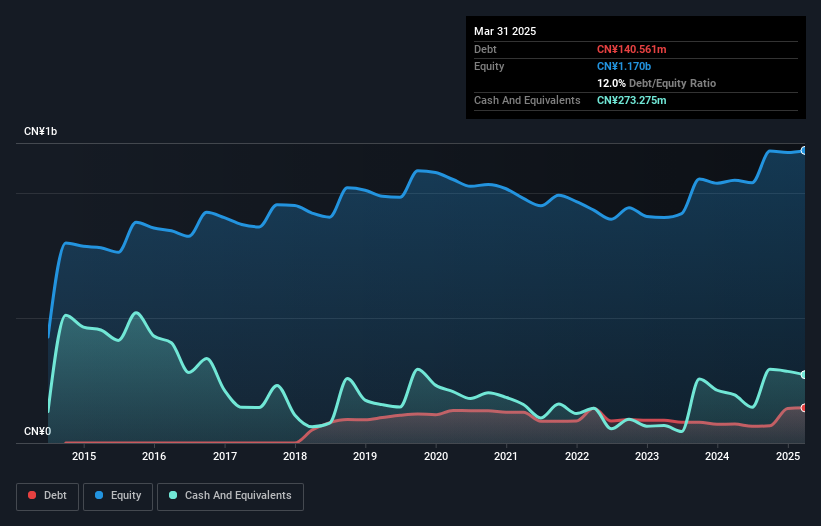

Changbai Mountain Tourism is showing promising signs of growth, with a recent earnings increase of 8.6% over the past year, outpacing the hospitality sector's -5.4%. The company's debt-to-equity ratio has improved from 12.5% to 10.1% over five years, indicating prudent financial management. Recent private placements raised approximately CNY 235 million at CNY 41 per share, suggesting strong investor confidence despite a volatile share price in recent months. With net income rising slightly to CNY 149 million for the first nine months of this year and high-quality earnings reported, future prospects appear encouraging for this small-cap entity in China's tourism industry.

- Dive into the specifics of Changbai Mountain Tourism here with our thorough health report.

Learn about Changbai Mountain Tourism's historical performance.

Sichuan Zigong Conveying Machine Group (SZSE:001288)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sichuan Zigong Conveying Machine Group Co., Ltd. operates in the manufacturing sector, focusing on the production of conveying machinery, with a market capitalization of CN¥7.36 billion.

Operations: The company generates revenue primarily from the manufacturing and sale of conveying machinery. With a market capitalization of CN¥7.36 billion, it focuses on optimizing its production processes to enhance profitability.

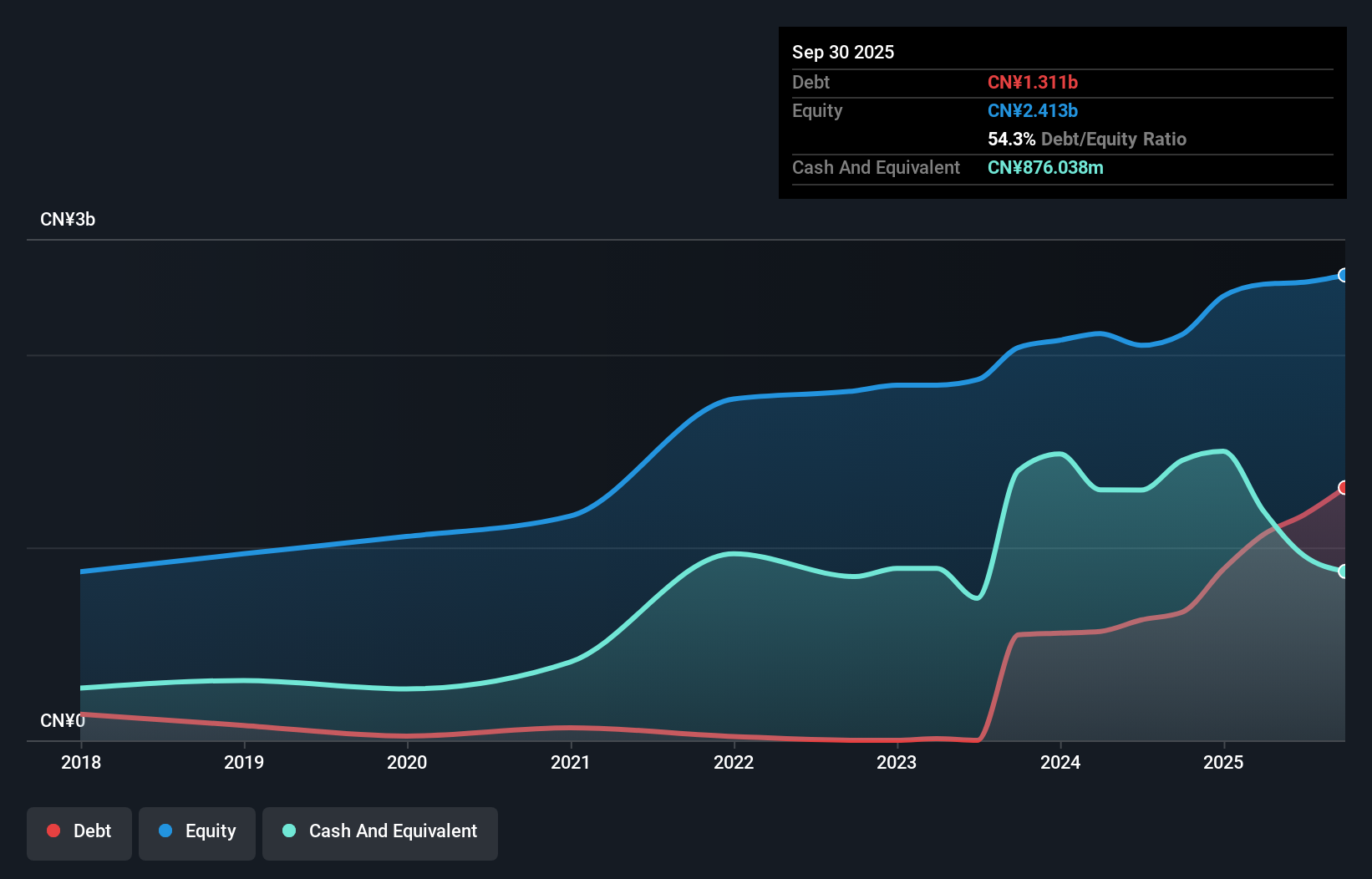

Sichuan Zigong, a nimble player in the machinery sector, has seen its earnings surge by 54.6% over the past year, outpacing the industry average of 6.1%. Its price-to-earnings ratio stands at 43.5x, slightly below the industry's 45.9x benchmark, indicating potential value for investors. Despite a satisfactory net debt to equity ratio of 18%, its debt level has risen from 4.8% to 54.3% over five years, which could be a point of concern amidst robust earnings growth and high non-cash earnings quality. Recent changes in company bylaws suggest strategic shifts that might influence future performance positively or negatively depending on execution and market conditions.

Nanfang Ventilator (SZSE:300004)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanfang Ventilator Co., Ltd. specializes in designing and manufacturing HVAC products in China, with a market cap of CN¥5.37 billion.

Operations: With a market cap of CN¥5.37 billion, Nanfang Ventilator generates revenue primarily through the design and manufacturing of HVAC products in China. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its net profit margin.

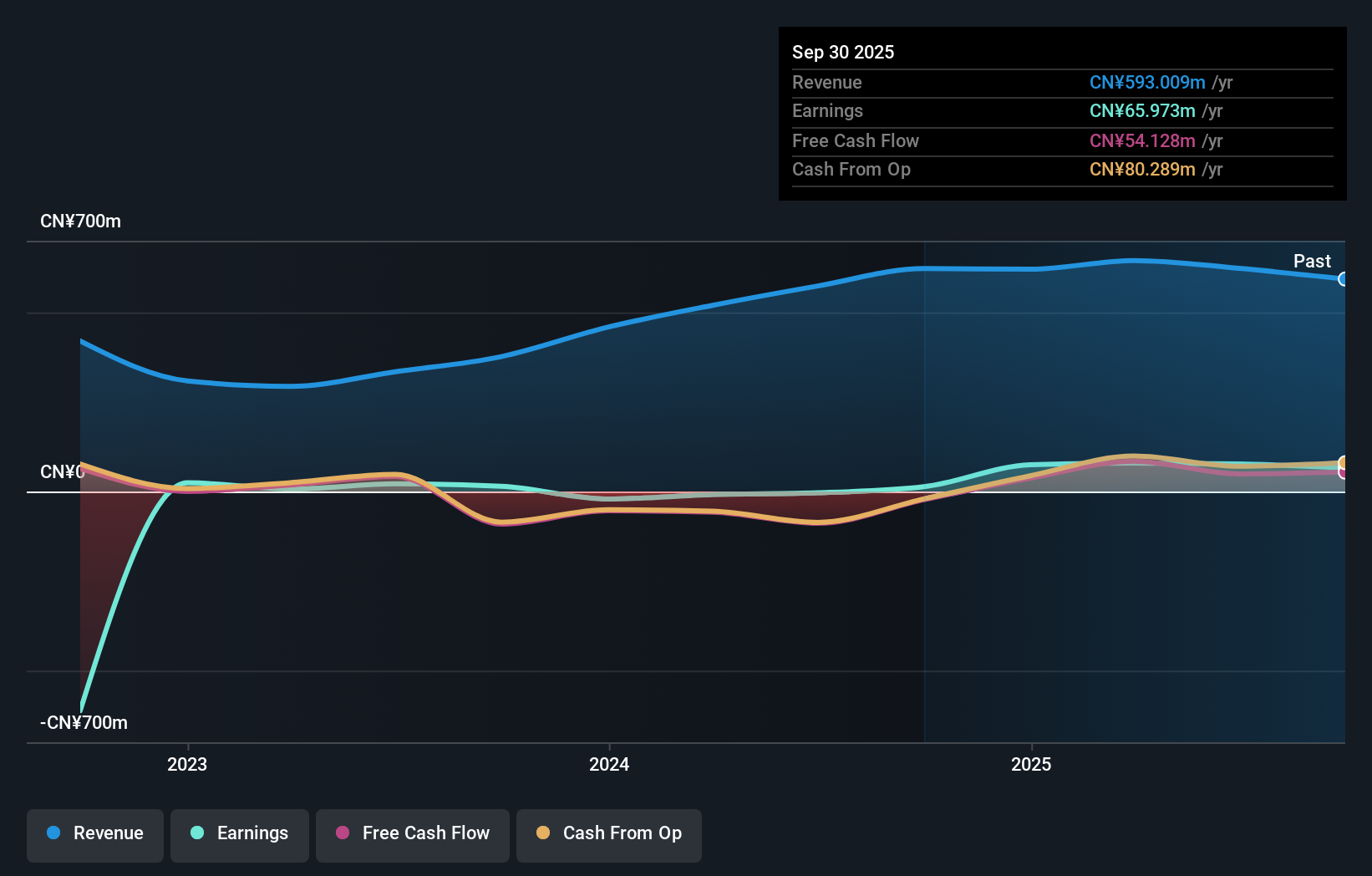

Nanfang Ventilator is navigating the market with a notable earnings growth of 395.6% over the past year, significantly outpacing its industry peers. The company operates debt-free, having eliminated an 18.3% debt-to-equity ratio from five years ago, which enhances its financial stability. Despite these positives, recent reports show a dip in sales to CNY 393.29 million from CNY 420.7 million and net income at CNY 33.45 million compared to last year's CNY 41.97 million for the same period, reflecting some challenges in maintaining revenue momentum amidst broader industry trends and economic conditions.

Make It Happen

- Click through to start exploring the rest of the 3009 Global Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal