Why Hilton Grand Vacations (HGV) Is Up 7.0% After $400 Million Timeshare Loan Securitization And What's Next

- Hilton Grand Vacations recently completed a US$400 million securitization of timeshare loans via Hilton Grand Vacations Trust 2025-3EXT, issuing four tranches of notes with a weighted average coupon of 5.07% and an advance rate of 96% to institutional investors in a private placement.

- The deal both recycles capital back onto the balance sheet and signals institutional confidence in the quality of HGV’s timeshare receivables, as the company plans to use proceeds to pay down debt and support broader corporate needs.

- We’ll now explore how this latest US$400 million securitization, and its impact on leverage and funding flexibility, reshapes Hilton Grand Vacations’ investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Hilton Grand Vacations Investment Narrative Recap

To own Hilton Grand Vacations, you need to believe that its timeshare model, growing member base and financing engine can translate into stronger, more efficient earnings over time. The latest US$400 million securitization helps liquidity and slightly eases balance sheet pressure, but it does not change the near term focus on improving receivables performance and stabilizing earnings after a weaker Q3.

Among recent announcements, Fitch’s final ratings on the 2025-3EXT notes stand out as directly relevant. While Fitch cited weakening asset performance and borrower risk, it also judged the credit enhancement on these securitized loans as adequate under stressed scenarios. That balance between higher credit risk and continued access to funding is central to how this securitization affects HGV’s catalysts around cost of capital and financing flexibility.

Yet while funding access looks solid, investors should be aware that rising delinquencies and a 27% allowance for bad debt could...

Read the full narrative on Hilton Grand Vacations (it's free!)

Hilton Grand Vacations’ narrative projects $6.4 billion revenue and $785.5 million earnings by 2028. This requires 12.6% yearly revenue growth and a $728.5 million earnings increase from $57.0 million today.

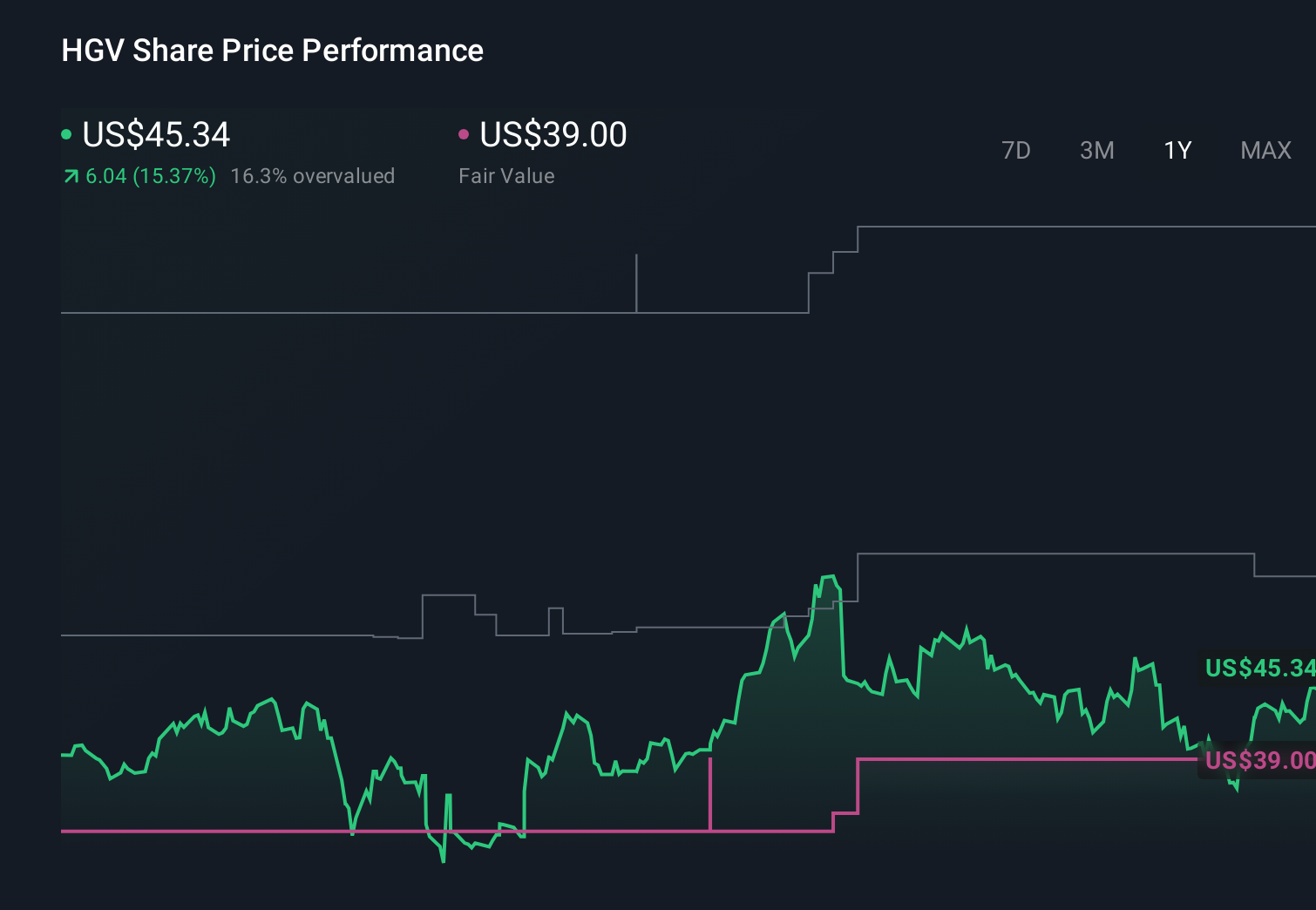

Uncover how Hilton Grand Vacations' forecasts yield a $51.70 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for HGV span from about US$51.70 to over US$54,000, reflecting very different expectations. Against that backdrop, HGV’s heavy reliance on securitizing timeshare receivables puts asset quality and bad debt trends at the center of its future performance, so it is worth comparing several viewpoints before forming a view.

Explore 4 other fair value estimates on Hilton Grand Vacations - why the stock might be worth just $51.70!

Build Your Own Hilton Grand Vacations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hilton Grand Vacations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Grand Vacations' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal