Cincinnati Financial (CINF): Reassessing Valuation After Strong Q3 2025 Earnings and Cautious Market Sentiment

Cincinnati Financial (CINF) surprised the market with stronger than expected Q3 2025 adjusted earnings, as higher equity portfolio gains and fewer catastrophe losses lifted net income. However, the share price still slipped after the release.

See our latest analysis for Cincinnati Financial.

That muted reaction sits against a much stronger backdrop, with Cincinnati Financial’s share price return of 16.1% year to date and a five year total shareholder return of 121.78% suggesting momentum is still firmly on its side.

If this earnings reaction has you reassessing the sector, it could be a good moment to explore fast growing stocks with high insider ownership as potential next wave opportunities beyond the big insurers.

With the stock trading just below analyst targets after a strong multi year run, the key question now is whether Cincinnati Financial is still undervalued or if the market is already pricing in its future growth.

Most Popular Narrative Narrative: 4.2% Undervalued

With Cincinnati Financial last closing at $165.42 against a narrative fair value near $173, the story leans modestly positive and sets up a key earnings debate.

Ongoing premium growth, particularly double-digit net written premium growth in multiple years (with four out of the last five years), supported by expanding relationships with independent agents and entry into new specialty products and markets, is poised to drive long-term revenue expansion.

Want to see what kind of revenue glide path and margin reset could still justify that higher valuation? The narrative leans on surprisingly rich earnings power assumptions. Curious how much profit compression it is willing to tolerate and still call the stock undervalued? The full breakdown reveals the exact growth, margin, and multiple combination doing the heavy lifting.

Result: Fair Value of $172.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if catastrophe losses normalize or if competition and pricing pressure squeeze margins faster than analysts currently anticipate.

Find out about the key risks to this Cincinnati Financial narrative.

Another Way to Look at Value

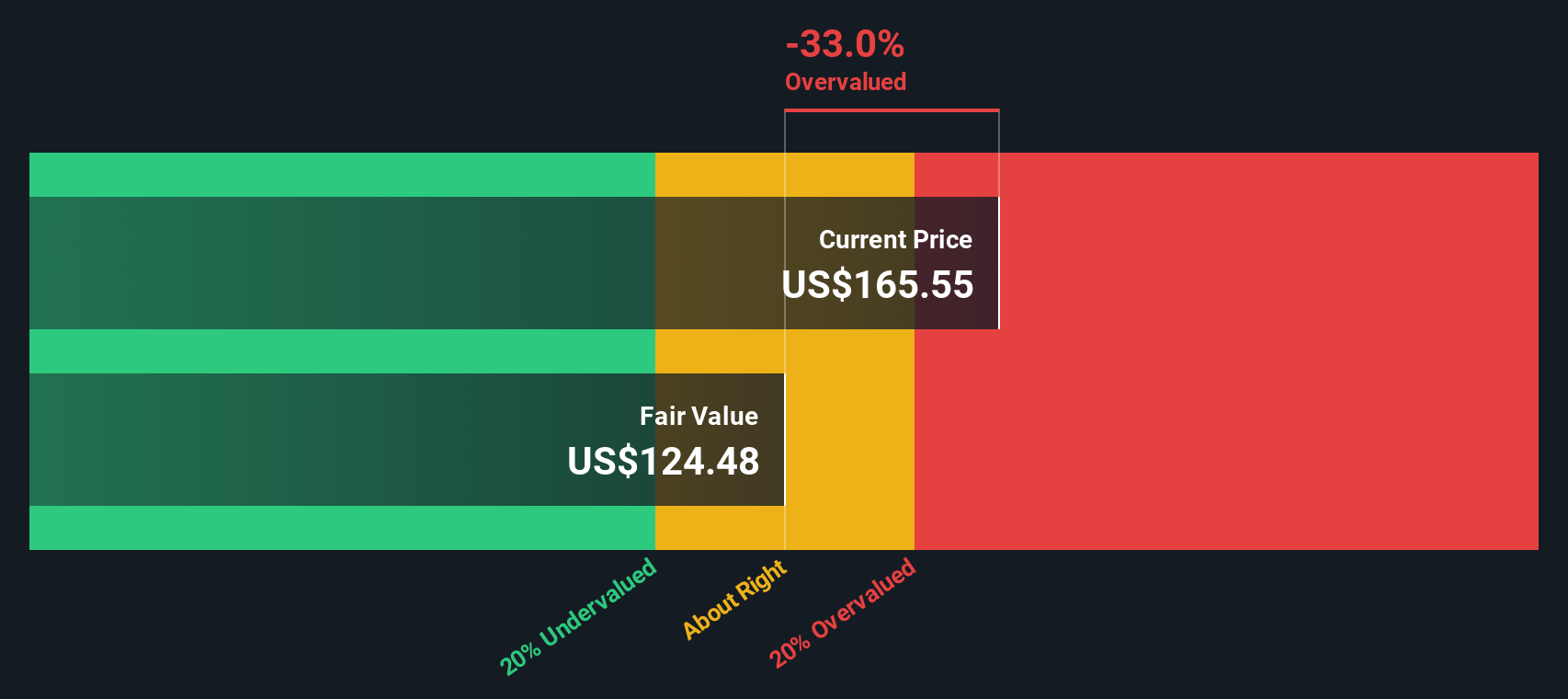

Our DCF model paints a more cautious picture, suggesting Cincinnati Financial is trading above an intrinsic value near $139, so screens as overvalued rather than modestly cheap. If growth slows or margins compress as forecast, will today’s price still feel comfortable in a year or two?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cincinnati Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cincinnati Financial Narrative

If you see the story differently or want to test your own assumptions directly in the model, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Cincinnati Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to quickly spot fresh ideas that match your conviction before the crowd catches on.

- Capture potential mispricings early by targeting these 911 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Position ahead of the next wave of innovation by zeroing in on these 25 AI penny stocks that could reshape entire industries.

- Lock in reliable income potential by focusing on these 13 dividend stocks with yields > 3% that can bolster returns even when prices move sideways.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal