Does Flutter’s New Governance Hire Amid UK Tax Pressures Change The Bull Case For Flutter (FLUT)?

- Flutter Entertainment PLC has announced that Sally Susman, currently Executive Vice President and Chief Corporate Affairs Officer at Pfizer, will join its board as a non-executive director following the company’s Annual General Meeting on May 29, 2026.

- Her appointment brings extensive global corporate affairs and governance experience from Pfizer, Estée Lauder, American Express, and multiple public and nonprofit boards at a time when Flutter is addressing rising UK gaming taxes and regulatory complexity.

- We’ll now examine how Flutter’s response to sharply higher UK gaming taxes could influence its existing investment narrative and long-term outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Flutter Entertainment Investment Narrative Recap

To own Flutter today, you need to believe its scale in online betting and iGaming can offset rising regulation and the company’s current losses, with U.S. and Brazil growth supporting that view. The UK tax hikes remain the key near term earnings headwind, while the Sally Susman board appointment is unlikely to materially change that risk, but it may strengthen Flutter’s governance as regulatory pressure builds.

The recent UK Budget decision to lift online gaming tax to 40% and sports betting duty to 25% has become central to Flutter’s story, given management’s two phase plan of near term cost cuts and longer term operational savings and market share ambitions. How effectively this plan is executed will likely matter more to the investment case than any individual board change.

Yet investors should be aware that higher and more volatile gaming taxes could...

Read the full narrative on Flutter Entertainment (it's free!)

Flutter Entertainment's narrative projects $23.5 billion revenue and $2.5 billion earnings by 2028.

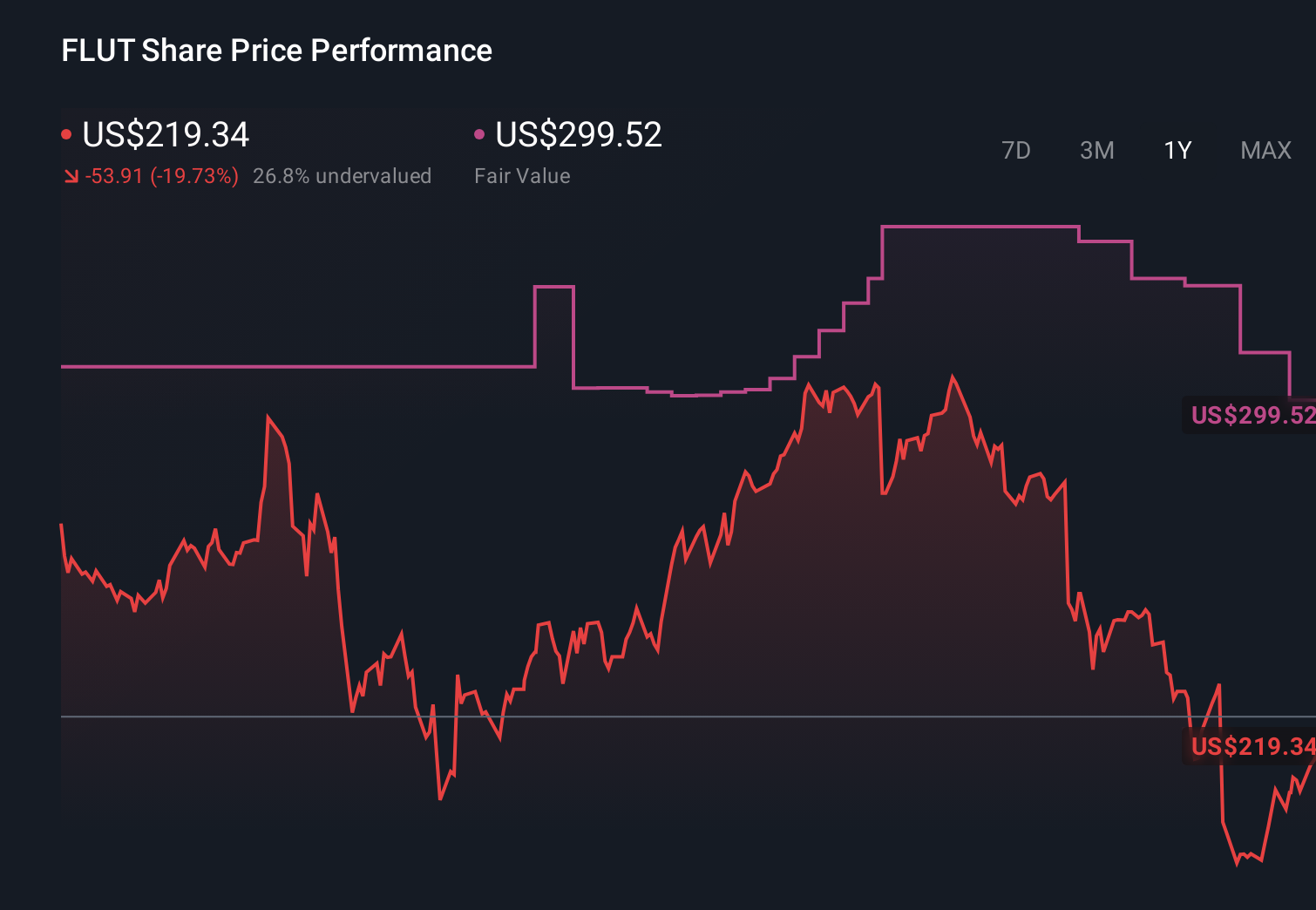

Uncover how Flutter Entertainment's forecasts yield a $299.52 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community fair value estimates for Flutter span from US$162.65 to US$1,000, showing how far apart individual views can be. As you weigh those opinions, the sharp UK tax increases and Flutter’s cost response underline why it is worth comparing several different expectations for future profitability before forming your own view.

Explore 7 other fair value estimates on Flutter Entertainment - why the stock might be worth 26% less than the current price!

Build Your Own Flutter Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flutter Entertainment research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Flutter Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flutter Entertainment's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal