Assessing Madison Square Garden Sports (MSGS) Valuation After Earnings Beat and Credit Facility Updates

Madison Square Garden Sports (MSGS) just pushed to a fresh all time high after a stronger than expected Q1 earnings print, even though revenue lagged. Investors appear to be prioritizing profitability.

See our latest analysis for Madison Square Garden Sports.

The latest Q1 beat and credit facility updates have helped extend a steady uptrend, with the stock now near $235.21 and momentum firming after a roughly high single digit 3 month share price return, backed by a strong multi year total shareholder return.

If this kind of earnings driven momentum has your attention, it might be a good time to scan the wider market using fast growing stocks with high insider ownership as a starting shortlist.

With MSGS outpacing the market and trading not far below analyst targets, despite negative trailing earnings but strong multi year returns, is this a rare chance to buy into iconic sports assets, or is the market already pricing in future growth?

Most Popular Narrative: 11.1% Undervalued

With Madison Square Garden Sports closing at $235.21 against a narrative fair value near $264.50, the story hinges on future earnings power, not current losses.

The upcoming ramp up in high value national media rights fees for the NBA (beginning in fiscal '26) will offset the recent step down in local media rights, positioning MSG Sports for an overall increase in recurring media revenue and supporting both revenue growth and higher net margins over the next several years. Expanded international partnerships and marketing deals such as with Abu Dhabi's Department of Culture and Tourism signal rising global interest in the Knicks and Rangers franchises, enhancing sponsorship income and merchandise opportunities, which are likely to boost top line revenue.

Curious how modest headline growth can still justify a rich future earnings multiple, powered by margin expansion and franchise scarcity value? Want to see the exact roadmap behind that projection and how it turns current losses into sizable future profits? The full narrative breaks down the assumptions line by line.

Result: Fair Value of $264.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case still depends on volatile local media economics and a concentrated reliance on just two flagship teams sustaining fan and sponsor demand.

Find out about the key risks to this Madison Square Garden Sports narrative.

Another View: Market Ratios Flash Caution

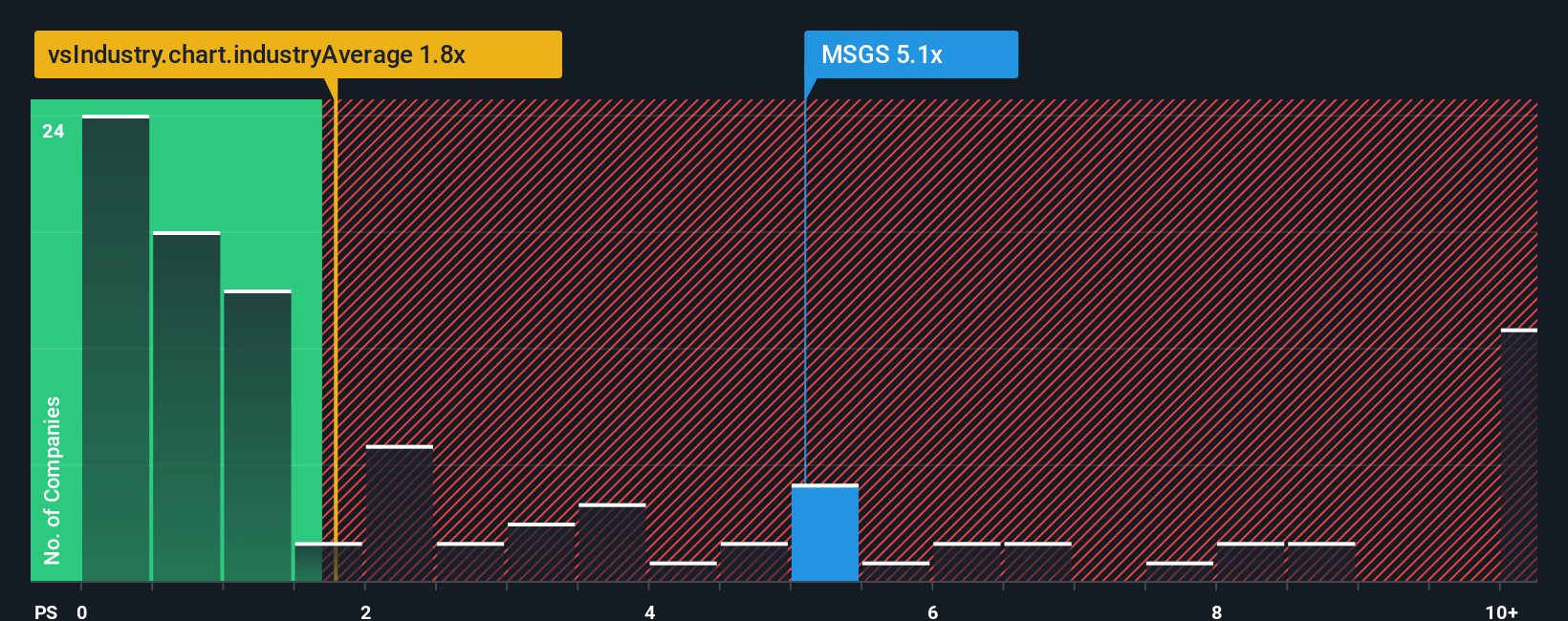

While the narrative points to upside, the numbers tell a tougher story. On sales, Madison Square Garden Sports trades at about 5.5 times revenue, far richer than the US Entertainment sector at 1.4 times and its own fair ratio of 1.1 times, which suggests meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Madison Square Garden Sports Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Madison Square Garden Sports research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research at one stock. A world of opportunity is waiting in plain sight on the Simply Wall Street Screener.

- Capture early stage potential by tracking these 3625 penny stocks with strong financials that already show real financial strength instead of just hype.

- Position ahead of the next tech wave by scanning these 25 AI penny stocks powering automation, data intelligence, and transformative software platforms.

- Lock in quality at a discount by reviewing these 911 undervalued stocks based on cash flows where cash flows suggest the market is still asleep.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal