Taking Stock of Nordson (NDSN) Valuation After Strong Q4 Beat and Upgraded 2026 Guidance

Nordson (NDSN) just wrapped up fiscal 2025 with Q4 and full year numbers that cleared Wall Street’s bar, and its 2026 guidance is what really has investors leaning in right now.

See our latest analysis for Nordson.

The upbeat 2026 outlook seems to be nudging sentiment in Nordson’s favor, with a roughly mid teens year to date share price return and a solid multi year total shareholder return suggesting steady, not explosive, momentum.

If Nordson’s measured grind higher has you thinking about other industrial names with steady cash flows, it could be a good moment to explore aerospace and defense stocks as a next hunting ground.

With earnings guidance implying steady double digit EPS and the stock still trading at a small discount to analyst targets, is Nordson quietly undervalued here, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 10.5% Undervalued

With Nordson closing at $236.37 against a most popular narrative fair value of $264.10, the story points to upside that the latest guidance appears to reinforce.

Strategic focus on recurring revenue streams, including aftermarket and consumable products, coupled with targeted cost restructurings and portfolio optimization (divestiture of lower margin contract manufacturing), are expected to lift net margins and earnings resilience through a higher value business mix.

Want to see what kind of revenue runway and margin lift would justify this richer valuation multiple, even as the assumed discount rate edges higher? The narrative unpacks a detailed earnings bridge, a stepped change in profitability, and a future multiple more often seen in faster growing industrial tech names. Curious how those moving parts combine to support that higher fair value estimate?

Result: Fair Value of $264.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged weakness in key end markets or disappointing returns on elevated R&D and M&A spending could quickly challenge today’s upbeat margin narrative.

Find out about the key risks to this Nordson narrative.

Another View, Multiples Signal a Richer Price

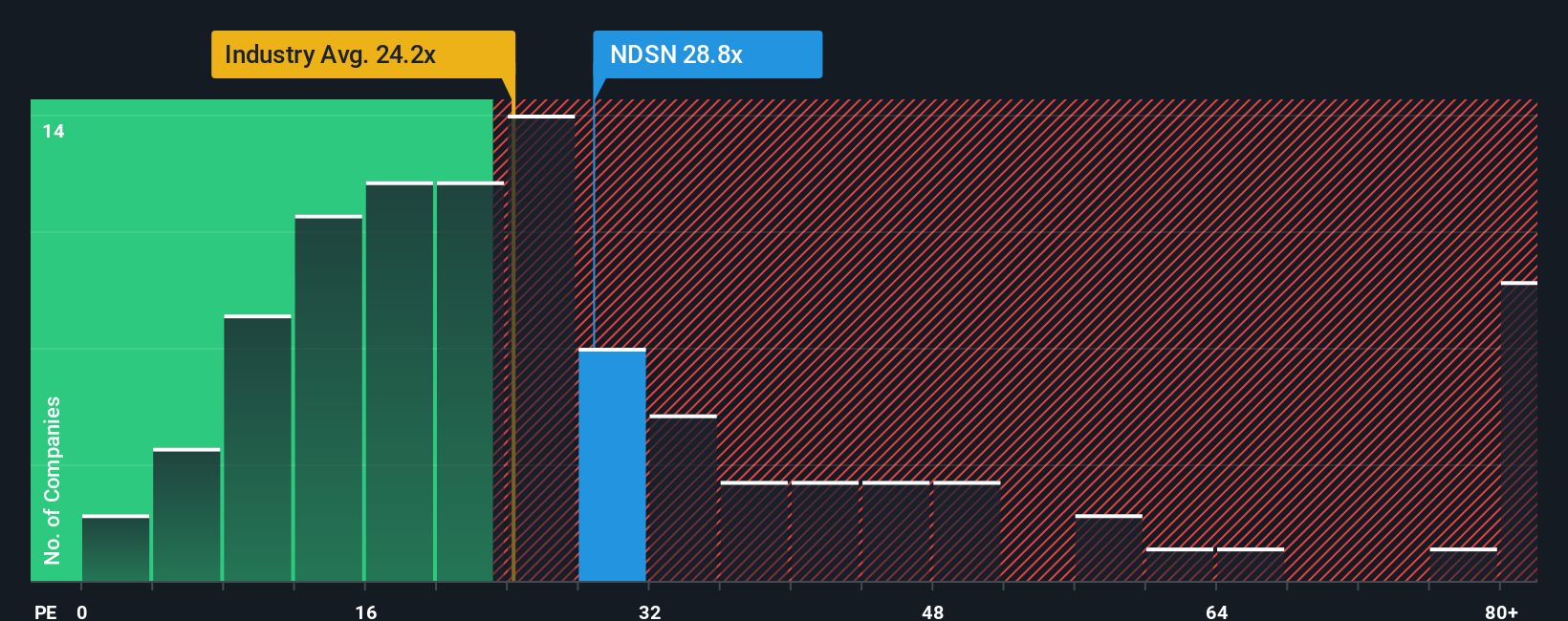

On valuation ratios, Nordson looks anything but cheap. It trades at 27.4 times earnings versus 26.2 times for the US Machinery group and a fair ratio of 23.7 times, which suggests investors are already paying up. This raises the question of how much upside is really left.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nordson Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your Nordson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop your research with one stock; use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy before others react.

- Capture potential market mispricings by targeting companies flagged as underappreciated through these 911 undervalued stocks based on cash flows, tailored to long term cash flow strength.

- Position ahead of transformative technology shifts by scanning these 28 quantum computing stocks, where breakthroughs could reshape entire industries.

- Turn income goals into a structured plan by focusing on dependable payers within these 13 dividend stocks with yields > 3% that offer attractive yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal