BIC (ENXTPA:BB) Valuation After Exiting Niche Brands and Cancelling Buyback Shares

Société BIC (ENXTPA:BB) is shaking up its perimeter by shutting down Rocketbook and its Skin Creative tattoo brands while also cancelling nearly 760,000 treasury shares, a combination that directly reshapes both operations and capital structure.

See our latest analysis for Société BIC.

The latest moves come after a choppy year for Société BIC, with a 1 year to date share price return of minus 22.83 percent but a more resilient 5 year total shareholder return of 31.43 percent. This suggests short term sentiment is soft even as the longer term story remains constructive.

If this kind of portfolio refocus has you rethinking your own positioning, it could be a good moment to explore fast growing stocks with high insider ownership as potential next ideas to research.

Given modest growth, a double digit discount to analyst targets and a sizeable gap to some intrinsic value estimates, is Société BIC quietly undervalued here, or is the market already baking in all of its future progress?

Most Popular Narrative Narrative: 15.4% Undervalued

With a fair value pitched at €57.90 against a last close of €49.00, the most followed narrative points to meaningful upside if its assumptions play out.

The company's ongoing focus on supply chain optimization (for example, relocation of production closer to key markets) and realization of Horizon plan efficiencies are leading to lower operating expenses and enhanced supply chain agility, which should help improve net margins and bolster earnings resilience, especially in volatile macro environments.

Curious how modest top line expectations can still justify a materially higher price? The narrative leans heavily on richer margins, fatter earnings and a future multiple that assumes investors will keep paying up. Want to see exactly which long range profit and valuation assumptions push the discounted value above today’s quote?

Result: Fair Value of €57.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating digitalization and sustained cost pressures could undermine stationery demand and margins, challenging the upbeat earnings and valuation assumptions embedded in this narrative.

Find out about the key risks to this Société BIC narrative.

Another Angle On Value

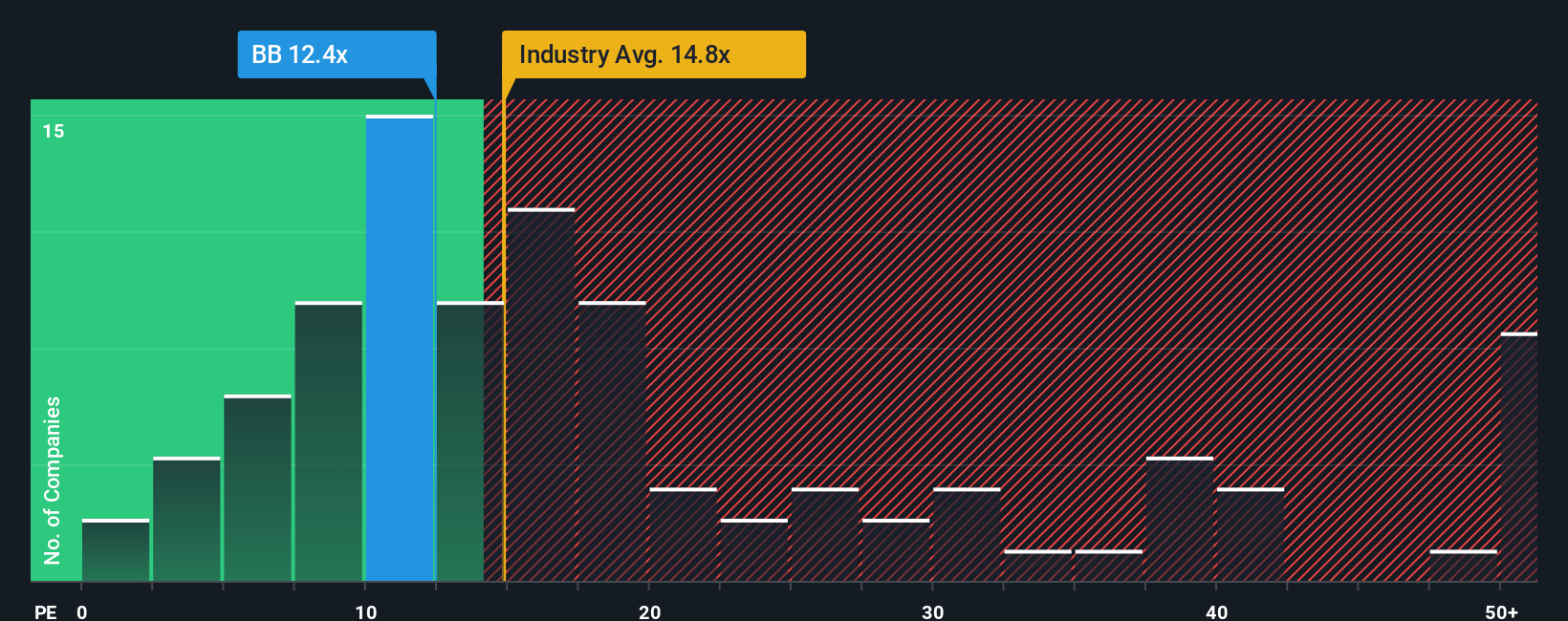

Multiples paint a different picture. At 11.4 times earnings, Société BIC trades just above its peer average of 11.3 times, yet below a fair ratio of 13.8 times and the wider European Commercial Services sector on 14.2 times. Is the market underpricing, or simply cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Société BIC Narrative

If you see the data differently or want to stress test the assumptions yourself, you can build a complete narrative in just minutes: Do it your way.

A great starting point for your Société BIC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener right now to spot opportunities beyond Société BIC, so you are not left watching smarter investors move first.

- Capture potential multi-baggers early by scanning these 3625 penny stocks with strong financials that already show stronger balance sheets and fundamentals than most expect at this price range.

- Ride structural growth trends by targeting these 25 AI penny stocks positioned at the heart of machine learning breakthroughs, automation, and intelligent infrastructure.

- Lock in attractive entry points by focusing on these 911 undervalued stocks based on cash flows where cash flow strength and pricing gaps could offer a compelling margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal