Dai Nippon Printing (TSE:7912) Valuation After New 10nm NIL Breakthrough for Next‑Gen Logic Semiconductors

Dai Nippon Printing (TSE:7912) just unveiled a new nanoimprint lithography template capable of 10nm circuit lines, effectively targeting 1.4nm generation logic chips while trimming reliance on costly, power hungry EUV tools.

See our latest analysis for Dai Nippon Printing.

That backdrop helps explain why the latest NIL breakthrough has landed on an already upbeat share price. Dai Nippon Printing has posted a robust year to date share price return alongside a triple digit multi year total shareholder return that signals sustained, compounding confidence in the story rather than a short term spike in sentiment.

If you are excited by how manufacturing tech can reshape returns, it is also worth scouting other innovation driven names via high growth tech and AI stocks to spot your next idea.

Yet with shares already up strongly and trading only slightly below analyst targets, the key question now is whether Dai Nippon Printing still trades at a meaningful discount or if the market has fully priced in its semiconductor upside.

Price to Earnings of 14.7x: Is it justified?

On a price to earnings ratio of 14.7 times and a last close of ¥2,726.5, Dai Nippon Printing screens modestly valued versus its own fundamentals.

The price to earnings multiple compares the current share price to per share earnings, making it a direct read on how much investors are paying for each unit of profit. For a diversified commercial and electronics group with steady but not explosive growth, it is a central yardstick for how the market is weighing its current profit base against future cash generation.

Relative to peers, the picture is nuanced. Dai Nippon Printing looks a touch expensive versus the broader JP Commercial Services industry average multiple of 14.2 times, yet it trades at a noticeable discount to a peer set average of 19.9 times. It also sits below our estimate of a fair price to earnings ratio of 21.7 times, a level the market could move toward if its semiconductor and electronics earnings deliver as expected.

Explore the SWS fair ratio for Dai Nippon Printing

Result: Price-to-Earnings of 14.7x (UNDERVALUED)

However, downside risks linger, including weaker semiconductor equipment demand and execution missteps that delay the ramp-up of high margin electronics projects into meaningful earnings contributions.

Find out about the key risks to this Dai Nippon Printing narrative.

Another View on Value

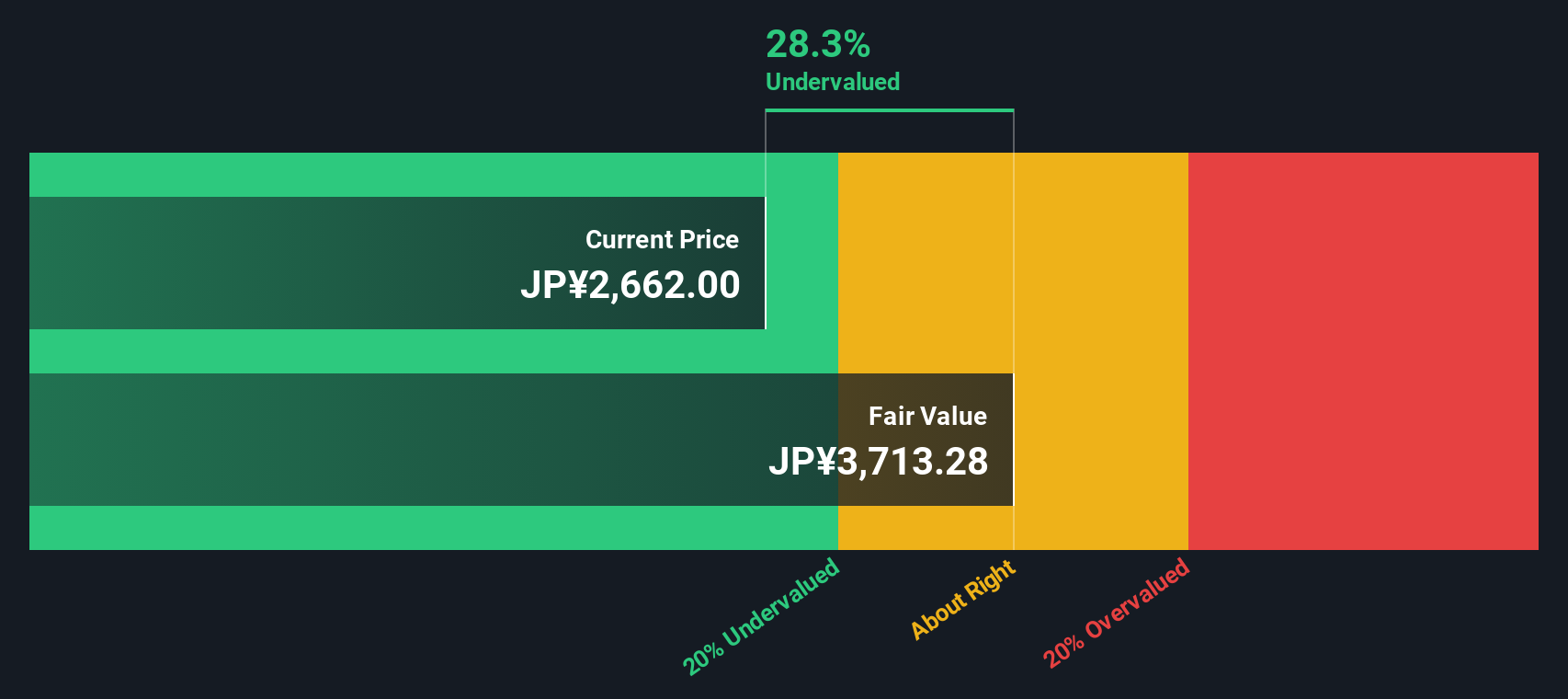

Our DCF model paints an even stronger case for upside, with Dai Nippon Printing trading about 28% below its estimated fair value of ¥3,801.26. If the cash flow story proves right, could today’s price simply reflect lingering doubt rather than true worth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dai Nippon Printing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dai Nippon Printing Narrative

If you are not fully aligned with this view or would rather scrutinize the numbers yourself, you can quickly build a personalized thesis in under three minutes: Do it your way.

A great starting point for your Dai Nippon Printing research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential opportunities by scanning three focused stock sets on Simply Wall St that many investors may overlook.

- Consider capturing momentum early by reviewing high potential names using these 3625 penny stocks with strong financials that already show financial strength beneath their small market caps.

- Explore ways to position your portfolio in the automation wave with these 30 healthcare AI stocks shaping developments in diagnostics, treatment, and medical efficiency.

- Review these 13 dividend stocks with yields > 3% to research companies offering yields above 3 percent while still maintaining balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal