UDR (UDR) Valuation Check After a 17% Share Price Decline Despite Growing Earnings

UDR (UDR) has quietly slipped about 17 % over the past year, even as its revenue and net income kept growing. That disconnect between fundamentals and share performance is what makes the stock interesting now.

See our latest analysis for UDR.

UDR’s 1 year share price return of about negative 17% contrasts with its positive 3 year and 5 year total shareholder returns, suggesting long term momentum has cooled as investors reassess interest rate and real estate risks.

If UDR’s mixed momentum has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership as potential next wave opportunities.

With earnings still growing, a sizeable intrinsic value discount and analysts seeing upside from here, investors face a key question: is UDR now an overlooked opportunity, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 12.3% Undervalued

With UDR last closing at $35.46 against a narrative fair value near $40.43, the valuation story hinges on how its earnings and margins evolve.

Analysts expect earnings to reach $227.8 million (and earnings per share of $0.72) by about September 2028, up from $127.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $296.4 million in earnings, and the most bearish expecting $148.0 million.

Want to see what kind of revenue lift and margin expansion has to materialize to back this call, and why the projected earnings multiple looks more like a growth stock than a traditional REIT, even as expectations stretch years into the future?

Result: Fair Value of $40.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent new supply in key Sunbelt markets and tighter rent regulations in coastal cities could undermine revenue growth and compress margins more quickly than expected.

Find out about the key risks to this UDR narrative.

Another View: Rich On Earnings Metrics

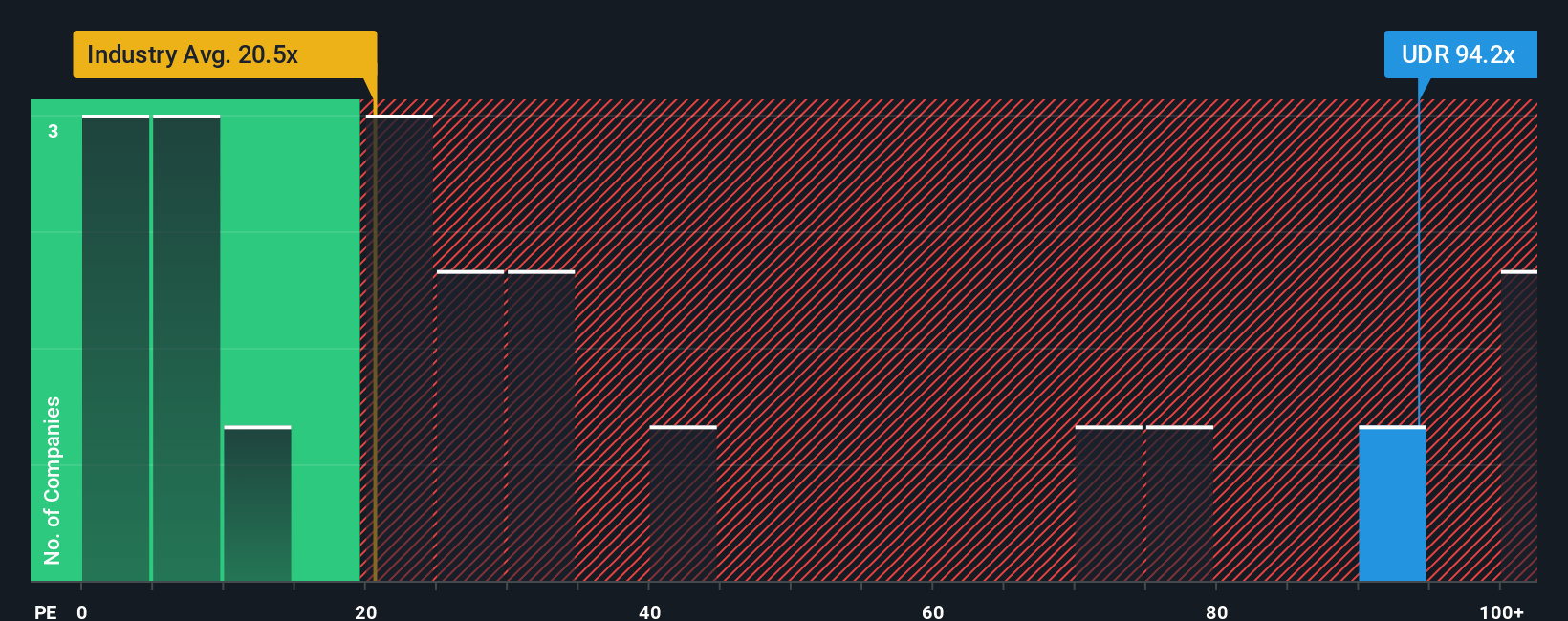

While the narrative fair value suggests upside, UDR trades on a steep price to earnings ratio of about 80.9 times, compared with 25.1 times for the North American Residential REITs industry and a fair ratio near 32.9 times. This implies meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UDR Narrative

If you see the story differently, or just want to test your own assumptions against the numbers, you can build a complete narrative in minutes: Do it your way.

A great starting point for your UDR research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more smart ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover stocks that match your strategy and timeframe.

- Capture potential mispricings by scanning these 908 undervalued stocks based on cash flows that may be trading well below their long term cash flow potential.

- Capitalize on technological shifts by targeting these 25 AI penny stocks positioned at the forefront of artificial intelligence innovation and adoption.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that aim to deliver payouts above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal