Blackstone Mortgage Trust (BXMT): Assessing Valuation After Recent Share Price Momentum

Blackstone Mortgage Trust (BXMT) has quietly delivered a solid run lately, gaining about 9 % over the past month and nearly 20 % in the past year, catching income-focused investors attention.

See our latest analysis for Blackstone Mortgage Trust.

That 9.0 % 1 month share price return, supported by a 13.5 % year to date share price gain and a 19.6 % 1 year total shareholder return, suggests momentum is quietly rebuilding as investors reassess income and credit risk around the current 20.17 dollars share price.

If BXMT has you thinking about where else steady momentum might be forming, this is a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With shares now trading close to analyst targets, backed by improving earnings but modest growth, the key question is whether BXMT is still trading below its fundamentals or if the market is already pricing in future gains.

Most Popular Narrative Narrative: 1.6% Undervalued

With Blackstone Mortgage Trust last closing at 20.17 dollars against a narrative fair value of 20.5 dollars, the story hinges on aggressive earnings repair and redeployment.

The resolution of impaired loans is expected to be a catalyst for future growth by reducing the non performing assets and allowing the company to recapture earnings potential, thereby potentially increasing net margins as capital is redeployed into more productive investments.

Curious how a capital heavy lender aims to flip past losses into near perfect margins and rapid earnings growth, all under a single discount rate playbook? Tap through and see how this narrative builds that case step by step.

Result: Fair Value of $20.5 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unresolved impaired loans and timing gaps between repayments and redeployment could still derail the earnings rebound that this optimistic narrative depends on.

Find out about the key risks to this Blackstone Mortgage Trust narrative.

Another View: Multiples Flash a Caution Signal

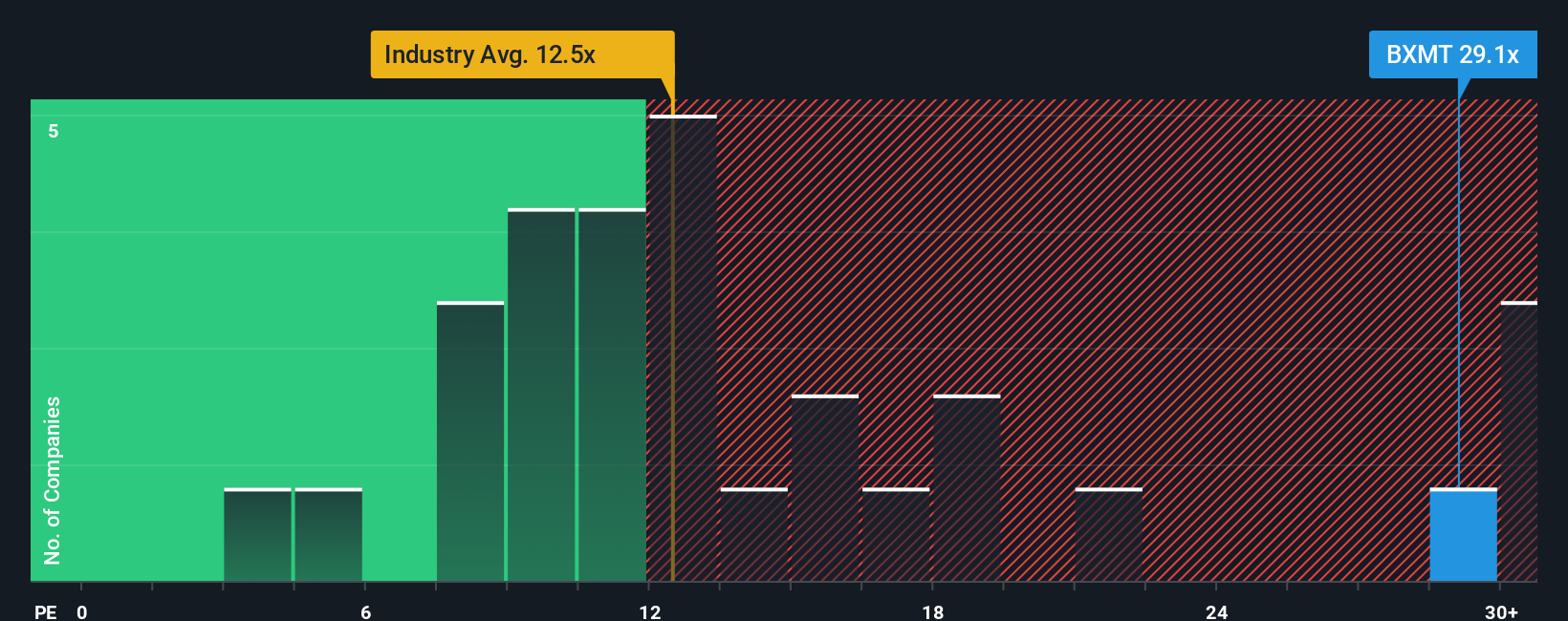

While the narrative fair value paints BXMT as roughly fairly priced, the earnings multiple tells a tenser story. At about 31.9 times earnings versus a 13.2 times industry average and a 17.7 times fair ratio, investors are paying a rich premium that could unwind if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Mortgage Trust Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you call it a day, lock in an edge by scanning fresh opportunities with the Simply Wall St screener so potential winners do not slip past you.

- Capture mispriced potential by targeting companies trading below intrinsic value through these 908 undervalued stocks based on cash flows and position yourself ahead of a possible rerating.

- Capitalize on powerful themes reshaping markets by zeroing in on innovators listed in these 25 AI penny stocks that could reshape industries and long term returns.

- Boost your income strategy by filtering for reliable payers via these 13 dividend stocks with yields > 3% and build a portfolio where cash flow works as hard as you do.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal