European Penny Stocks To Watch In December 2025

As the European markets navigate a mixed landscape, with Germany's DAX seeing gains while the UK's FTSE 100 slips slightly, investors are keenly observing potential shifts in economic policy and market dynamics. For those interested in exploring opportunities beyond established giants, penny stocks—despite their somewhat outdated name—remain an intriguing area of investment. These smaller or newer companies can offer unique value propositions when backed by strong financials, providing a blend of growth potential and stability that might be overlooked by larger firms.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.64 | €82.4M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.00 | €14.86M | ✅ 4 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.10 | €41.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.285 | €378.73M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.86 | €75.28M | ✅ 1 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.788 | €26.39M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 287 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Libertas 7 (BME:LIB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Libertas 7, S.A. operates in Spain's real estate and investment sectors with a market cap of €65.75 million.

Operations: The company's revenue is derived from three main segments: Investments (€2.07 million), Touristic Area (€2.10 million), and Real Estate Area (€8.58 million).

Market Cap: €65.75M

Libertas 7, S.A., operating in Spain's real estate and investment sectors, reported significant earnings growth with sales reaching €12.59 million for the nine months ended September 30, 2025. The company's net income improved to €1.86 million from €0.472 million a year ago, demonstrating strong performance despite high share price volatility. Libertas maintains a robust balance sheet with short-term assets exceeding liabilities and more cash than total debt, though its operating cash flow coverage of debt is limited at 10.4%. Trading well below estimated fair value and supported by seasoned board members, it presents potential for investors seeking undervalued opportunities in the sector.

- Get an in-depth perspective on Libertas 7's performance by reading our balance sheet health report here.

- Evaluate Libertas 7's prospects by accessing our earnings growth report.

Alpcot Holding (OM:ALPCOT B)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alpcot Holding AB (publ) operates a digital platform for personal finance in Sweden's financial industry, with a market cap of approximately SEK 199.79 million.

Operations: The company's revenue is primarily generated from its Asset Management segment, amounting to SEK 128.05 million.

Market Cap: SEK199.79M

Alpcot Holding AB, with a market cap of approximately SEK 199.79 million, operates in Sweden's financial industry and is currently unprofitable, reporting a net loss of SEK 4.75 million for the third quarter of 2025. Despite its negative return on equity and high share price volatility, the company has managed to reduce losses significantly over the past five years at a rate of 62% annually. Alpcot is debt-free and trades at a substantial discount to its estimated fair value. While management and board experience are limited, short-term assets comfortably cover liabilities, offering some financial stability amid growth challenges.

- Jump into the full analysis health report here for a deeper understanding of Alpcot Holding.

- Explore Alpcot Holding's analyst forecasts in our growth report.

4MASS Spólka Akcyjna (WSE:4MS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 4Mass Spólka Akcyjna is involved in the manufacture and distribution of make-up products, with a market capitalization of PLN106.61 million.

Operations: There are no reported revenue segments for this company.

Market Cap: PLN106.61M

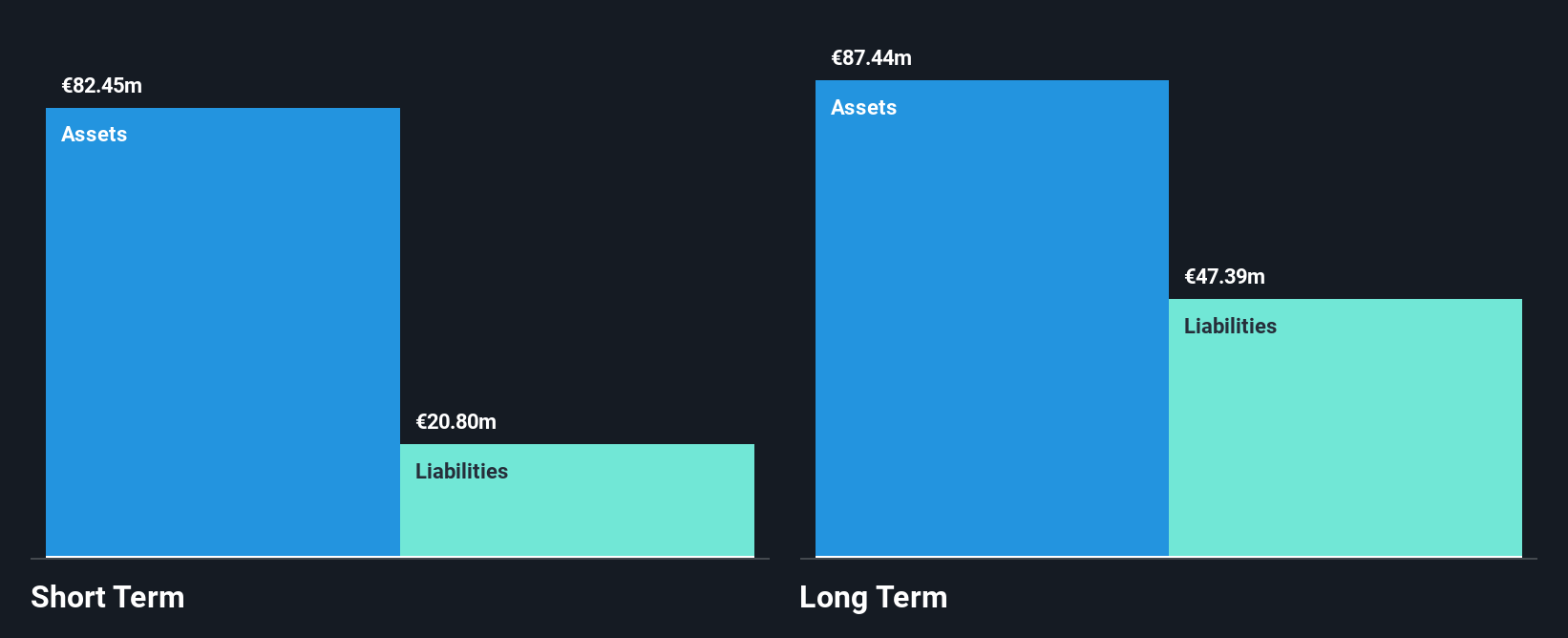

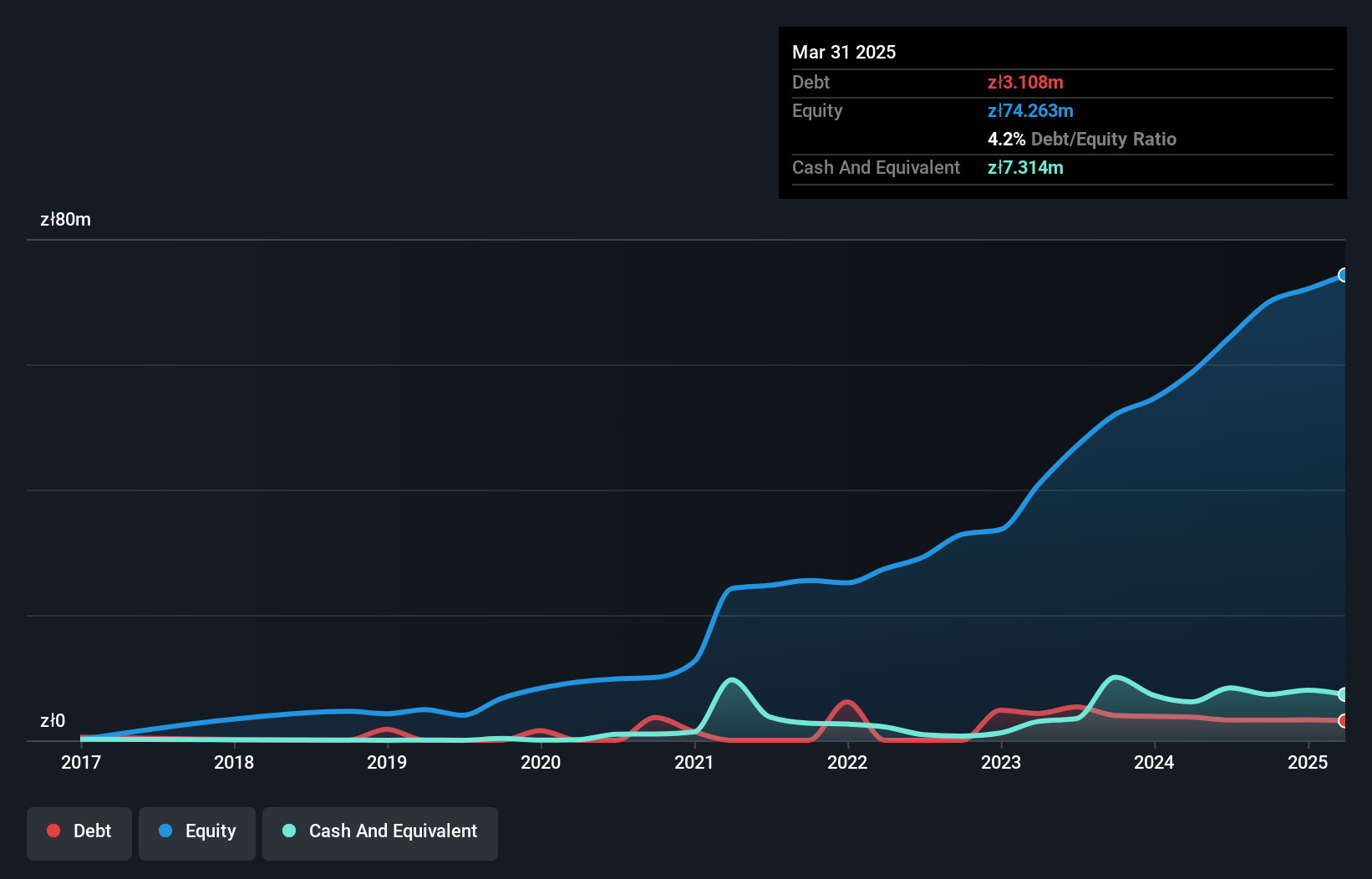

4MASS Spólka Akcyjna, with a market cap of PLN106.61 million, reported declining revenues and net income for the third quarter of 2025 compared to the previous year. Despite this, the company maintains high-quality earnings and has significantly reduced its debt-to-equity ratio over five years. Short-term assets exceed both short- and long-term liabilities, while cash surpasses total debt. The board is experienced with an average tenure of three years. Although profit margins have fallen from last year, operating cash flow robustly covers debt obligations. Trading well below estimated fair value suggests potential undervaluation despite recent earnings challenges.

- Take a closer look at 4MASS Spólka Akcyjna's potential here in our financial health report.

- Examine 4MASS Spólka Akcyjna's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Unlock more gems! Our European Penny Stocks screener has unearthed 284 more companies for you to explore.Click here to unveil our expertly curated list of 287 European Penny Stocks.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal