European Growth Companies With High Insider Ownership To Watch

As the European market navigates mixed performances with Germany's DAX gaining and France's CAC 40 Index slipping, investors are keenly watching for signals from the European Central Bank regarding potential rate hikes. In this environment, growth companies with high insider ownership can be particularly appealing, as such ownership often indicates strong confidence in a company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| CD Projekt (WSE:CDR) | 29.7% | 51.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Peab (OM:PEAB B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Peab AB (publ) is a construction and civil engineering company operating in Sweden, Norway, Finland, Denmark, and internationally with a market cap of SEK22.97 billion.

Operations: Peab AB's revenue segments include SEK20.49 billion from Industry, SEK23.05 billion from Construction, SEK17.24 billion from Civil Engineering, SEK3.59 billion from Project Development - Housing Development, and SEK777 million from Project Development - Property Development.

Insider Ownership: 13.3%

Earnings Growth Forecast: 21.6% p.a.

Peab is experiencing significant earnings growth, forecasted at 21.6% annually over the next three years, outpacing the Swedish market. Despite trading at a good value compared to peers and industry, its revenue growth of 4.4% per year lags behind higher benchmarks. Recent contracts totaling billions in SEK reflect robust project acquisition, including sustainable initiatives like Stockholm's Meatpacking District development. However, Peab faces challenges with interest coverage and an unstable dividend track record amidst substantial insider ownership.

- Click here and access our complete growth analysis report to understand the dynamics of Peab.

- Upon reviewing our latest valuation report, Peab's share price might be too pessimistic.

Sonova Holding (SWX:SOON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sonova Holding AG is a global provider of hearing care solutions for children and adults, with operations spanning Switzerland, the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific; it has a market cap of CHF12.34 billion.

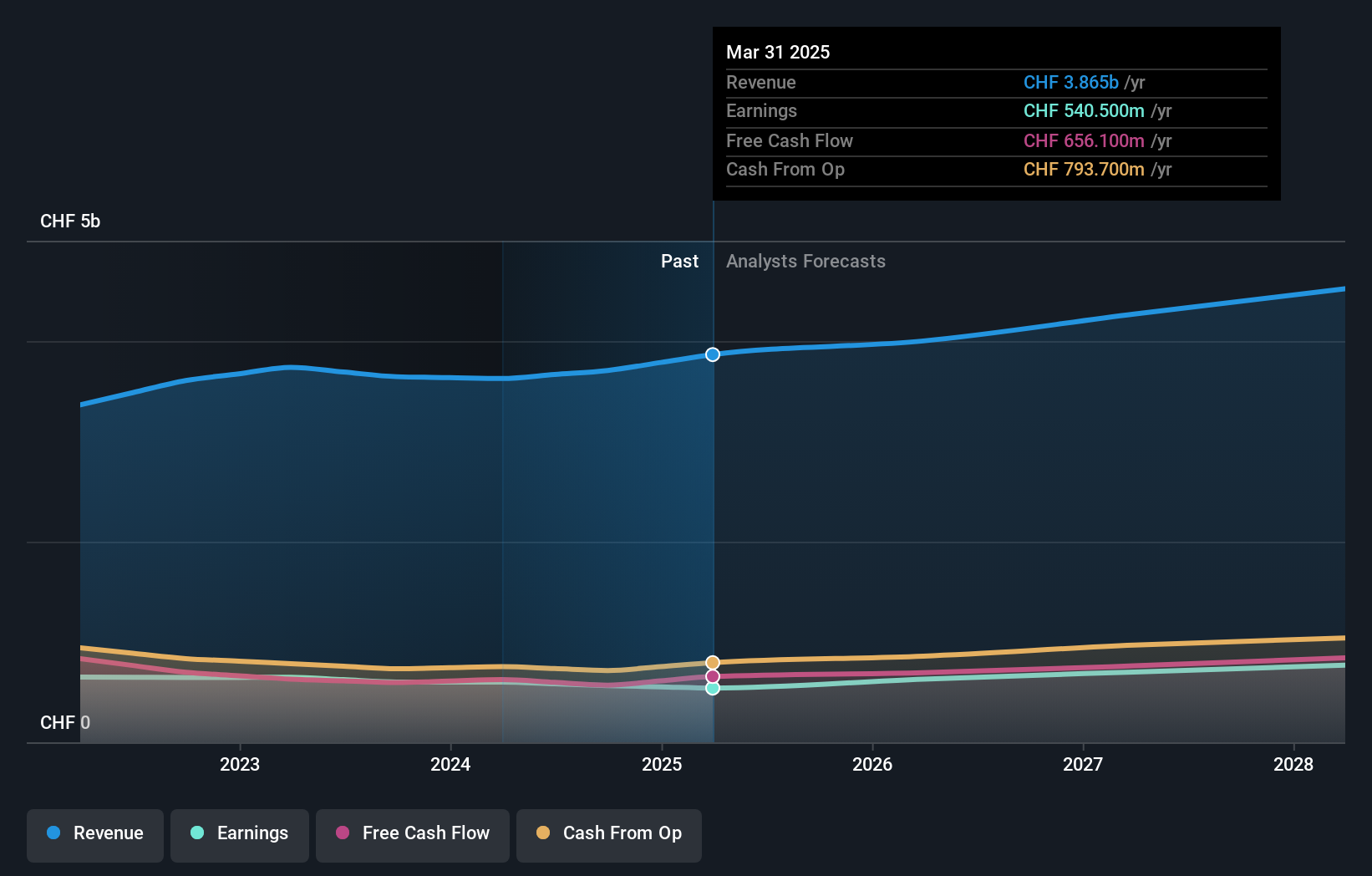

Operations: Sonova's revenue is primarily derived from its Hearing Instruments segment, which generated CHF3.57 billion, and its Cochlear Implants segment, contributing CHF290.80 million.

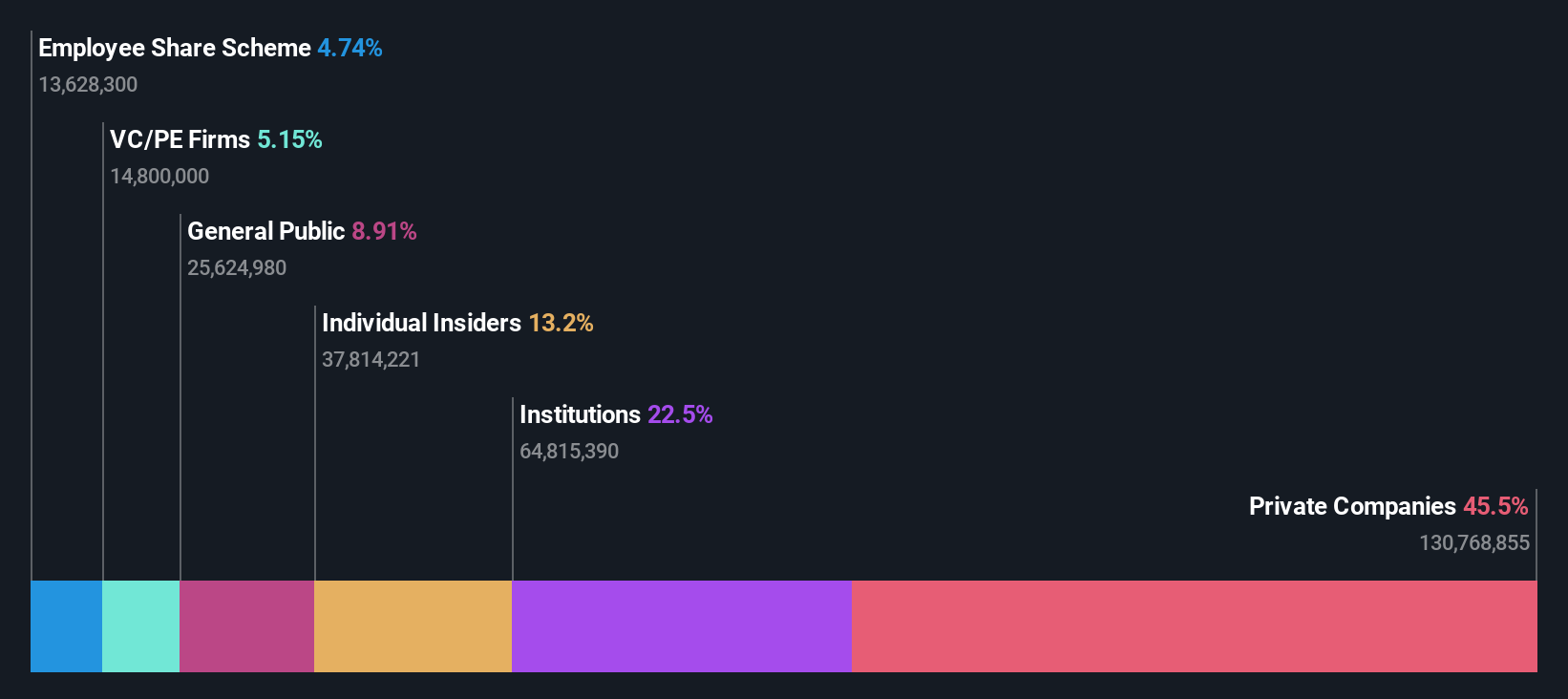

Insider Ownership: 17.7%

Earnings Growth Forecast: 11.3% p.a.

Sonova Holding, with high insider ownership, is undergoing a strategic reorganization to enhance regional agility and customer focus. Despite being dropped from the Swiss SMI Index, it maintains robust innovation with its AI-driven DEEPSONIC chip and Infinio Ultra products. The company forecasts 11.3% annual earnings growth, outpacing the Swiss market's 10.5%, though revenue growth is slower at 5.5%. Sonova trades at a substantial discount to its estimated fair value, offering potential upside for investors seeking value in innovative hearing technology solutions.

- Dive into the specifics of Sonova Holding here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Sonova Holding's current price could be quite moderate.

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stadler Rail AG, with a market cap of CHF2 billion, manufactures and sells trains across Switzerland, Germany, Austria, Europe, the Americas, and CIS countries.

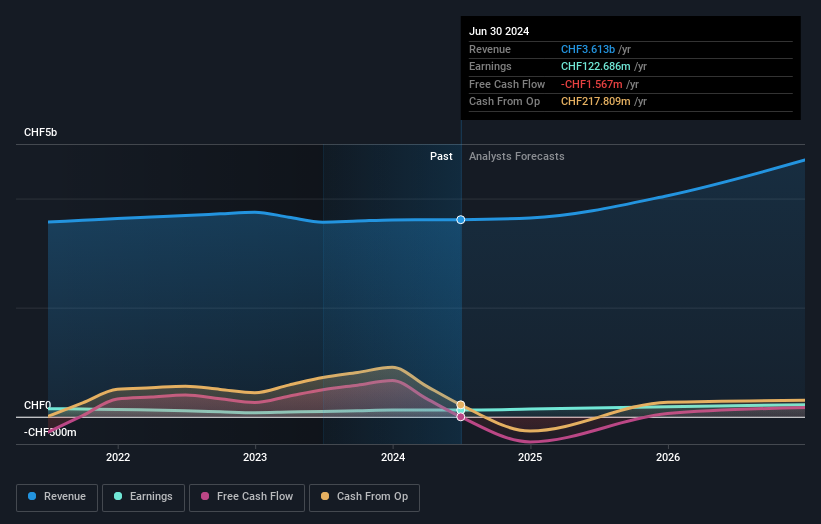

Operations: Stadler Rail's revenue is primarily derived from its Rolling Stock segment at CHF2.83 billion, followed by Service & Components at CHF949.78 million, and Signalling at CHF87.31 million.

Insider Ownership: 14.9%

Earnings Growth Forecast: 52.6% p.a.

Stadler Rail, with significant insider ownership, is positioned for growth with its earnings expected to increase substantially at 52.6% annually over the next three years, outpacing both Swiss market averages and its own revenue growth forecast of 13.9%. Despite trading significantly below estimated fair value, challenges include lower profit margins compared to last year and debt not well covered by operating cash flow. However, the high forecasted return on equity of 21.8% suggests potential for strong financial performance ahead.

- Unlock comprehensive insights into our analysis of Stadler Rail stock in this growth report.

- In light of our recent valuation report, it seems possible that Stadler Rail is trading beyond its estimated value.

Next Steps

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 211 companies by clicking here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal