3 Asian Stocks Estimated To Trade At Up To 41.9% Below Intrinsic Value

As global markets navigate a period marked by interest rate adjustments and fluctuating economic indicators, Asian stock markets continue to capture investor attention with their unique opportunities. In this environment, identifying stocks trading below their intrinsic value can be a strategic move for investors seeking potential growth, especially when these stocks are supported by strong fundamentals and favorable market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.30 | CN¥161.03 | 48.3% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.96 | CN¥25.25 | 48.7% |

| Wacom (TSE:6727) | ¥788.00 | ¥1535.49 | 48.7% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.11 | HK$16.17 | 49.9% |

| KIYO LearningLtd (TSE:7353) | ¥694.00 | ¥1379.70 | 49.7% |

| IbidenLtd (TSE:4062) | ¥11375.00 | ¥22045.81 | 48.4% |

| Global Security Experts (TSE:4417) | ¥2926.00 | ¥5782.32 | 49.4% |

| Daiichi Sankyo Company (TSE:4568) | ¥3406.00 | ¥6544.37 | 48% |

| Cowell e Holdings (SEHK:1415) | HK$28.02 | HK$55.59 | 49.6% |

| Andes Technology (TWSE:6533) | NT$250.00 | NT$486.30 | 48.6% |

Let's review some notable picks from our screened stocks.

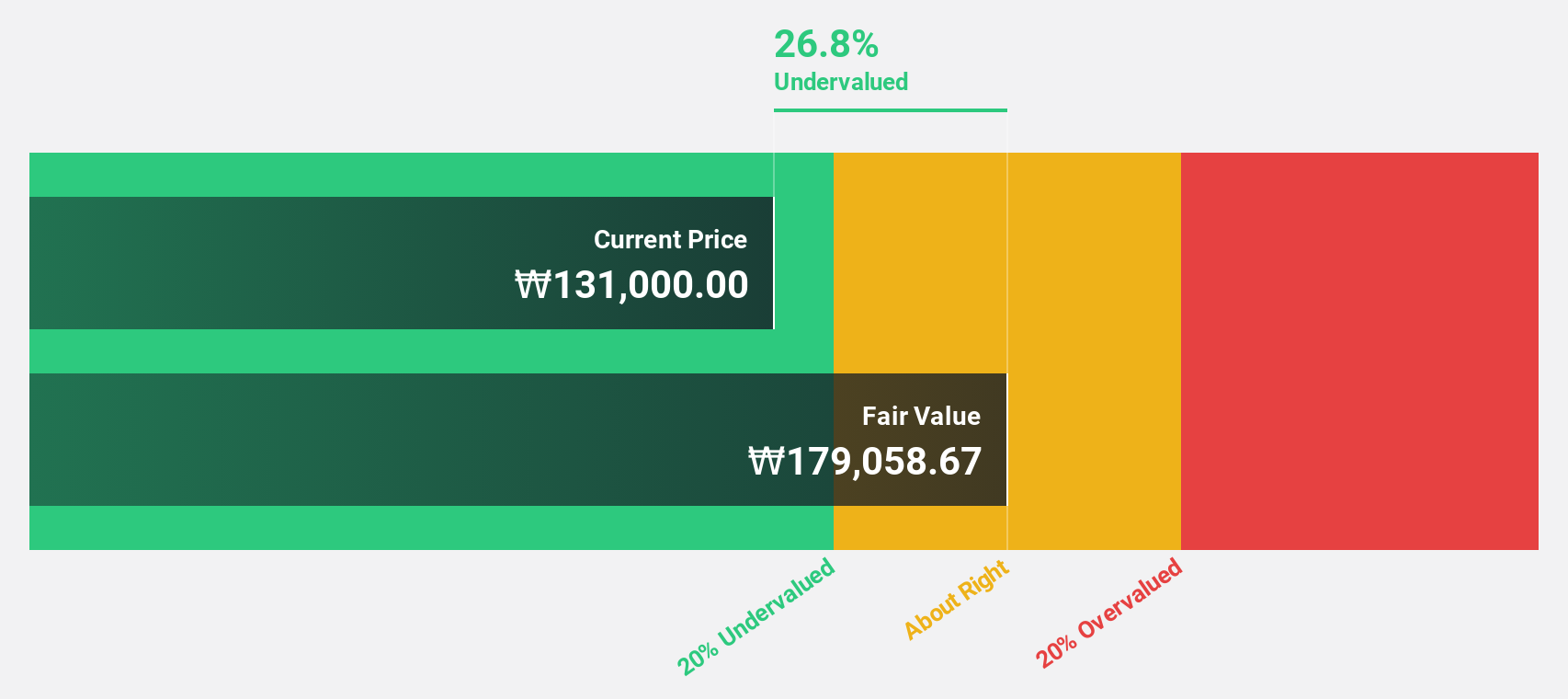

APR (KOSE:A278470)

Overview: APR Co., Ltd. is a company that manufactures and sells cosmetic products for both men and women, with a market cap of ₩9.88 billion.

Operations: The company's revenue is primarily derived from its cosmetics segment, which accounts for ₩1.54 billion, supplemented by its clothing fashion sector contributing ₩38.63 million.

Estimated Discount To Fair Value: 24.6%

APR Corp. is trading at ₩264,000, below its fair value estimate of ₩350,190.13, suggesting undervaluation based on cash flows. Earnings are expected to grow significantly by 31.83% annually over the next three years, with revenue growth forecasted at 29.2%, surpassing the KR market's average of 10.7%. However, its dividend yield of 2.72% isn't well covered by free cash flows despite strong profit growth last year and anticipated revenue exceeding ₩1 trillion in 2025.

- Our expertly prepared growth report on APR implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of APR.

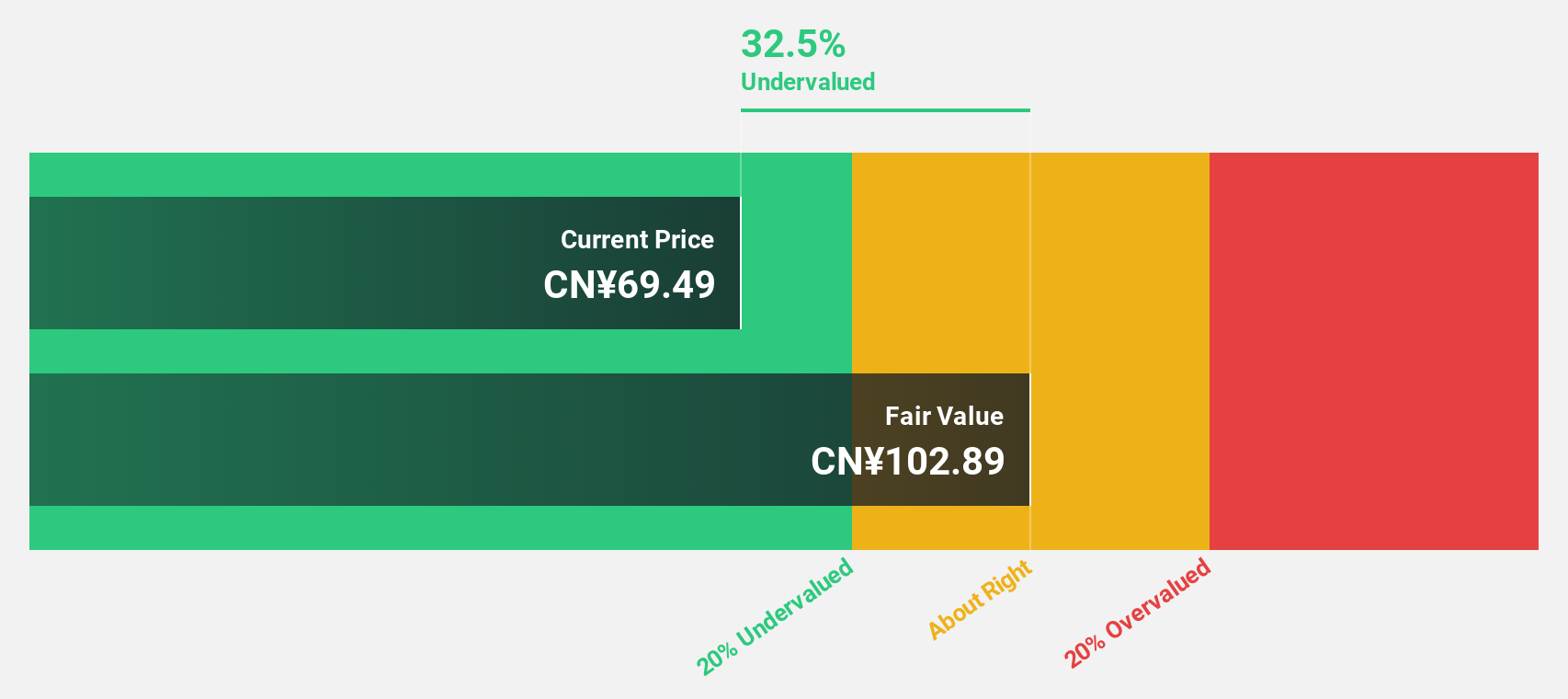

Eyebright Medical Technology (Beijing) (SHSE:688050)

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. operates in the medical technology sector and has a market capitalization of approximately CN¥12 billion.

Operations: The company's revenue is primarily derived from its medical products segment, which generated CN¥1.48 billion.

Estimated Discount To Fair Value: 41.9%

Eyebright Medical Technology (Beijing) is trading at CN¥62.08, well below its estimated fair value of CN¥106.87, indicating significant undervaluation based on cash flows. Despite a decline in net income to CN¥290.16 million for the first nine months of 2025 compared to the previous year, revenue grew to CN¥1.14 billion from CN¥1.08 billion. Earnings are projected to grow annually by 22.4%, with revenue growth outpacing the Chinese market at 20.2%.

- Our growth report here indicates Eyebright Medical Technology (Beijing) may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Eyebright Medical Technology (Beijing).

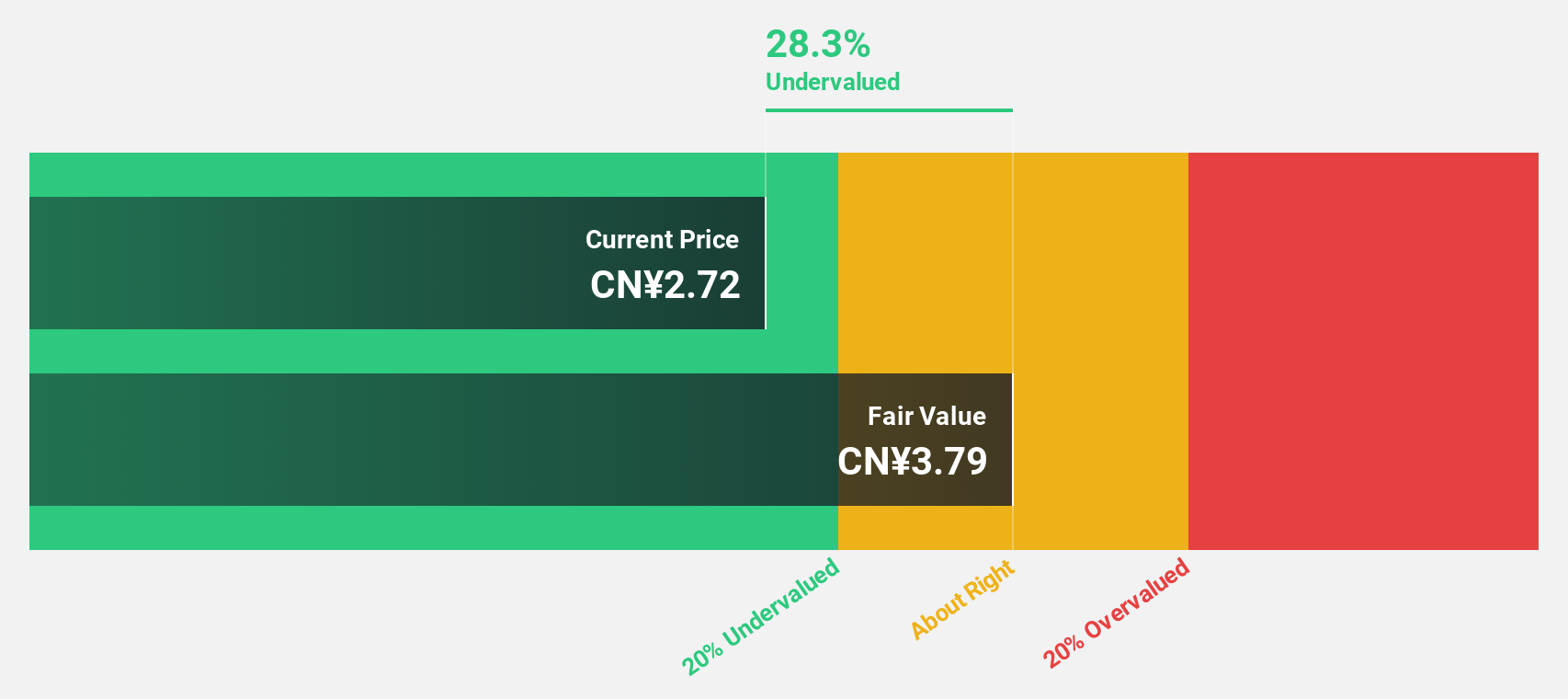

Offcn Education Technology (SZSE:002607)

Overview: Offcn Education Technology Co., Ltd. operates as a multi-category vocational education institution in China with a market cap of CN¥17.08 billion.

Operations: The company generates revenue of CN¥2.12 billion from its Education and Training segment.

Estimated Discount To Fair Value: 27.1%

Offcn Education Technology is trading at CN¥2.77, below its estimated fair value of CN¥3.8, highlighting undervaluation based on cash flows. Despite a drop in net income to CNY 91.97 million for the first nine months of 2025 from the previous year, earnings are forecast to grow significantly by 70% annually over the next three years, outpacing the Chinese market's expected growth rate of 27.1%.

- Insights from our recent growth report point to a promising forecast for Offcn Education Technology's business outlook.

- Unlock comprehensive insights into our analysis of Offcn Education Technology stock in this financial health report.

Taking Advantage

- Investigate our full lineup of 274 Undervalued Asian Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal