Middle Eastern Penny Stocks To Consider In December 2025

As the Middle Eastern markets experience a downturn, driven by falling oil prices and global market uncertainties, investors are turning their attention to alternative opportunities. Penny stocks, often misunderstood as relics of past trading eras, continue to offer potential for growth through smaller or newer companies with strong financial fundamentals. This article highlights several promising penny stocks in the region that combine affordability with robust financial health, presenting an underappreciated opportunity for investors seeking value.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.23 | SAR1.28B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.384 | ₪170.92M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.1B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.24 | AED670.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.87 | SAR974M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.22 | AED371.91M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.75 | AED15.9B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.84 | AED506.68M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.578 | ₪202.37M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 81 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

United Fidelity Insurance Company (P.S.C.) (ADX:FIDELITYUNITED)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: United Fidelity Insurance Company (P.S.C.) operates in the United Arab Emirates, providing a range of general and life insurance services, with a market capitalization of AED 241.60 million.

Operations: The company's revenue is primarily derived from three segments: Consumer insurance at AED 255.43 million, Commercial insurance at AED 127.84 million, and Employee Benefits at AED 226.32 million.

Market Cap: AED241.6M

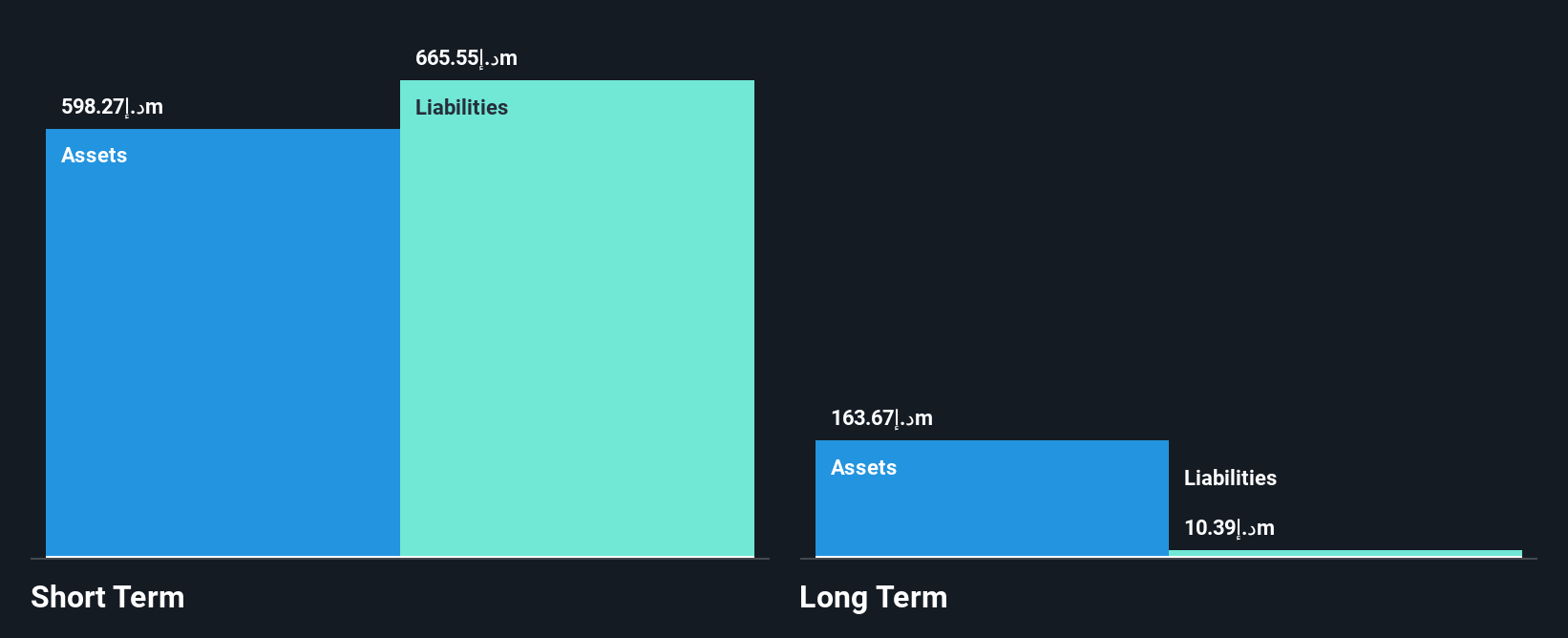

United Fidelity Insurance Company (P.S.C.) has shown improvement in its financial performance, reporting a net income of AED 9.88 million for Q3 2025 compared to a net loss the previous year. Despite being unprofitable over recent years, this marks a positive shift. The company maintains more cash than debt and holds short-term assets of AED 555.9 million, though these do not fully cover short-term liabilities of AED 613.1 million. Recent amendments to their Articles of Association signal strategic capital restructuring efforts through share issuance programs, potentially impacting future financial stability and shareholder value.

- Take a closer look at United Fidelity Insurance Company (P.S.C.)'s potential here in our financial health report.

- Learn about United Fidelity Insurance Company (P.S.C.)'s historical performance here.

Ras Al Khaimah for White Cement & Construction Materials P.S.C (ADX:RAKWCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ras Al Khaimah Co. for White Cement & Construction Materials P.S.C., along with its subsidiaries, produces and distributes lime and cement products both in the United Arab Emirates and globally, with a market capitalization of AED520.16 million.

Operations: The company's revenue is derived from two main segments: AED158.98 million from international markets and AED125.82 million within the United Arab Emirates.

Market Cap: AED520.16M

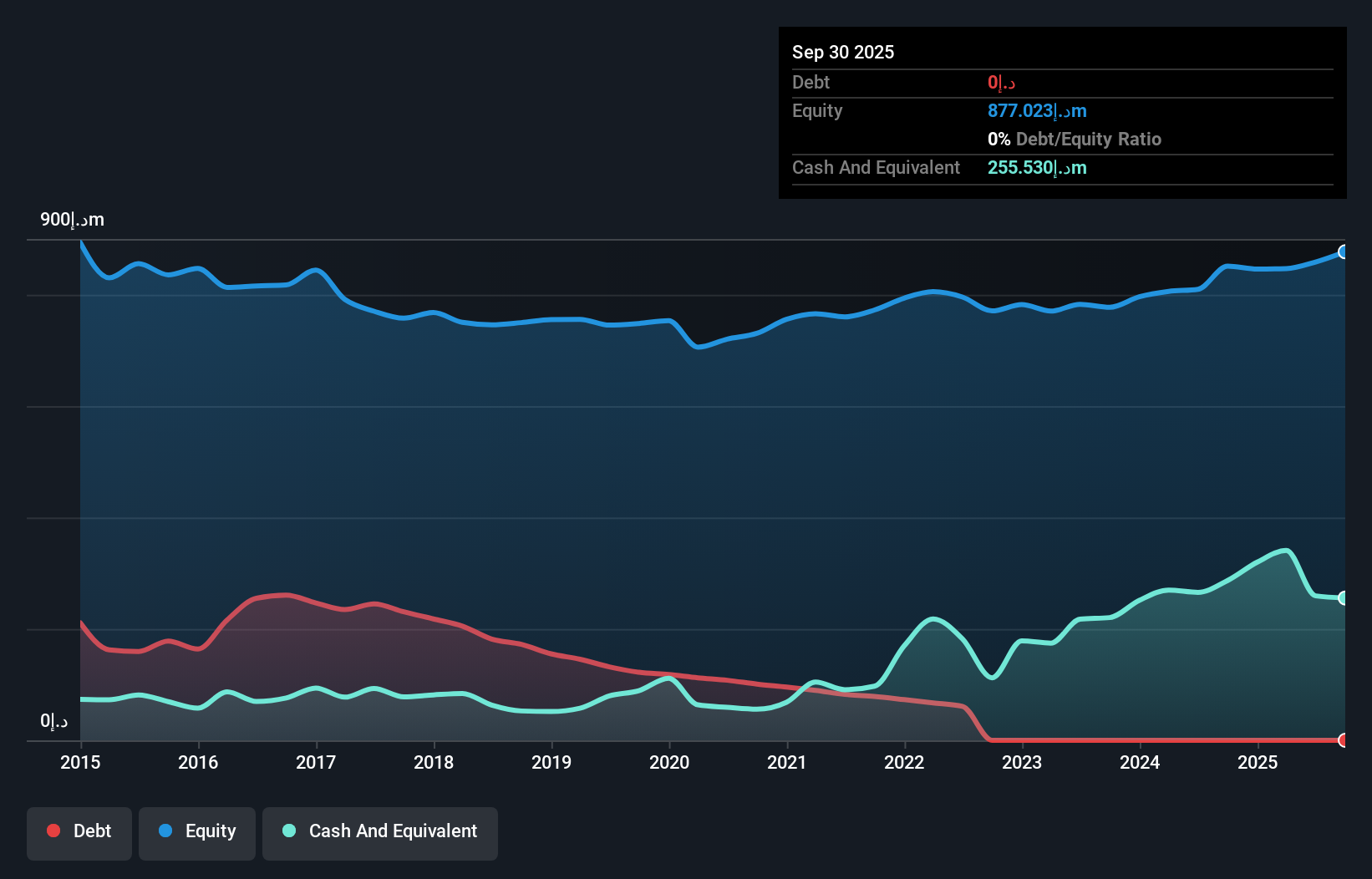

Ras Al Khaimah Co. for White Cement & Construction Materials P.S.C. has demonstrated stable financial performance, with recent earnings results indicating a slight increase in net income to AED 10.49 million for Q2 2025, up from AED 9.11 million the previous year. The company benefits from being debt-free and has robust short-term assets of AED384.2 million that comfortably exceed its liabilities, highlighting strong liquidity management. Despite low return on equity at 4.6%, the company's earnings have grown by an average of 13.2% per year over the past five years, though recent growth lags behind industry averages significantly.

- Dive into the specifics of Ras Al Khaimah for White Cement & Construction Materials P.S.C here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Ras Al Khaimah for White Cement & Construction Materials P.S.C's track record.

Fonet Bilgi Teknolojileri (IBSE:FONET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fonet Bilgi Teknolojileri A.S. offers information technology services primarily in the healthcare sector both within Turkey and internationally, with a market cap of TRY2.67 billion.

Operations: The company generates revenue of TRY526.48 million from its healthcare software segment.

Market Cap: TRY2.67B

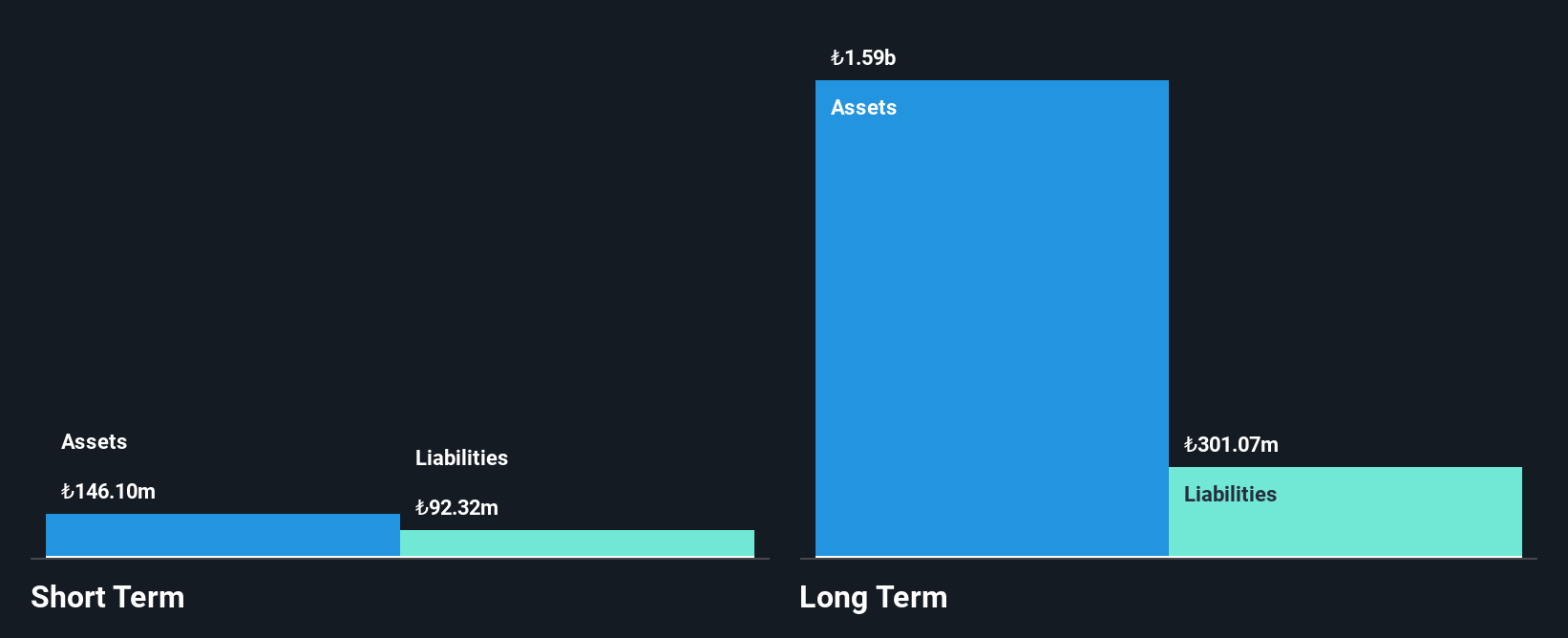

Fonet Bilgi Teknolojileri A.S. has shown mixed financial performance, with strong liquidity as short-term assets of TRY171.2 million exceed liabilities, and cash surpasses total debt. However, its return on equity is low at 9.2%, and recent earnings growth has been negative at -57.8%. Despite this, the company reported a significant rise in third-quarter sales to TRY209.61 million from TRY131.53 million last year, with net income increasing to TRY68.78 million from TRY15.02 million previously, indicating improved profitability in the short term despite challenges in profit margins and long-term liability coverage concerns.

- Navigate through the intricacies of Fonet Bilgi Teknolojileri with our comprehensive balance sheet health report here.

- Assess Fonet Bilgi Teknolojileri's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Dive into all 81 of the Middle Eastern Penny Stocks we have identified here.

- Seeking Other Investments? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal