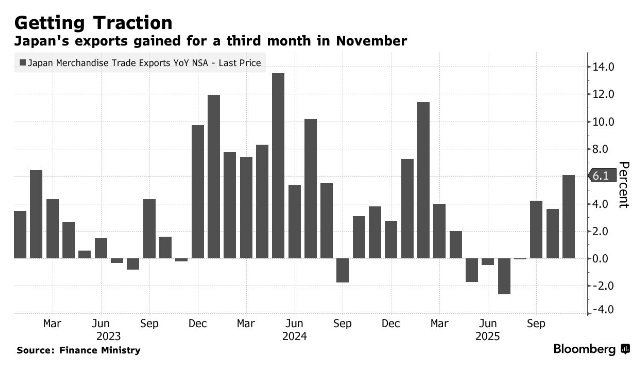

Exports to the US rebounded for the first time in eight months, and Japan's exports increased 6.1% in November, exceeding expectations

The Zhitong Finance App learned that Japan's exports have grown, mainly due to the first recovery in exports to the US in eight months, offsetting the decline in exports to China, which further supported the Bank of Japan's interest rate hike on Friday.

Japan's Ministry of Finance reported on Wednesday that overall exports increased 6.1% year-on-year in November, mainly driven by semiconductor components and medical supplies. This figure exceeded economists' expectations, with exports to the US and the EU rising sharply by 8.8 percent and 19.6 percent, respectively.

For the Bank of Japan, the recovery in exports to the US will send a positive signal. Markets generally expect the Bank of Japan to raise the benchmark interest rate to the highest level since 1995. The uncertainty of the US tariff policy is a factor that the Bank of Japan has not raised interest rates again since January, but previous signals from senior officials mean that market participants have basically absorbed expectations that borrowing costs will rise further.

“I think the impact of US tariffs has largely subsided,” said Yutaro Suzuki, an economist at Daiwa Securities. “As companies resume exports due to the easing of tariff uncertainty, exports to the US have increased in value and quantity.”

In contrast to the improvement in trade with the US, Japan's exports to China fell 2.4%, dragged down by chip-making machinery and non-ferrous metals. Since Japanese Prime Minister Takaichi Sanae's remarks about China's Taiwan Province last month sparked a diplomatic dispute, the prospects for trade with China have become uncertain. Since then, China and Japan have been involved in a dispute, including measures such as China issuing a warning about travel to Japan.

Overall, Japan's unadjusted trade balance showed a surplus of 322.3 billion yen (2.1 billion US dollars). Imports increased by 1.3%, slightly below general expectations.

Among them, Japan's trade surplus with the US was 739.8 billion yen, up 11.3% year over year. The surplus has persisted since US President Trump began his second term in January, which means that despite the Trump administration's attempt to reduce the trade deficit by raising tariffs, trade imbalances still exist.

After the US lowered Japanese automobile and parts tariffs from 27.5% to 15% in mid-September, Japan's automobile and parts exports to the US increased in November. The US has also set tariffs on many other products at the same level.

Automobile exports to the US increased by 1.5%, while export volume jumped 7.7%. This discrepancy persists, indicating that Japanese automakers are sacrificing profits by cutting prices to maintain market share.

However, the unit price of cars exported by Japan to the US last month was about 4.08 million yen, which is roughly the same level as when Trump first announced tariffs in April.

Also, according to people familiar with the matter, the US and Japan will evaluate energy projects as a potential initial investment of the 550 billion US dollar joint fund, which is the core element of the trade agreement between the two sides. In October of this year, during Trump's visit to the region, the two sides announced a list of potential projects.

“The export performance in November was quite strong,” Suzuki said. “External demand in the October-December quarter is expected to be one of the important factors supporting the Japanese economy.”

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal