Mirum Pharmaceuticals (MIRM): Assessing Valuation After Strong Multi‑Year Shareholder Returns

Mirum Pharmaceuticals (MIRM) has quietly turned into one of those stocks that reward patience, with shares up roughly 57% over the past year even after some recent month level volatility.

See our latest analysis for Mirum Pharmaceuticals.

The latest moves fit into a broader uptrend, with Mirum’s 1 day share price return of 4.6 percent and strong year to date share price gains. These build on an impressive multi year total shareholder return profile.

If Mirum’s run has you thinking about what else is working in healthcare, this could be a good moment to explore healthcare stocks for more ideas.

With revenues climbing, losses narrowing and the stock still trading at a steep discount to consensus targets, is Mirum a rare value in a hot biotech niche, or is the market already baking in years of future growth?

Most Popular Narrative: 29.6% Undervalued

Mirum Pharmaceuticals most followed narrative pegs fair value well above the recent 67.05 dollar close, framing the stock as meaningfully discounted before key catalysts.

Multiple late stage pipeline catalysts, including three pivotal study readouts (VISTAS, VANTAGE, EXPAND) over the next 24 months and the initiation of the Phase II Fragile X study, set the stage for further product label expansions and new indication launches, underpinning future revenue diversification and potential earnings acceleration.

Want to see what kind of growth trajectory justifies that upside case? The narrative leans on aggressive revenue expansion, margin lift and a rich future earnings multiple. Curious how those moving parts add up to its fair value call?

Result: Fair Value of $95.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if volixibat stumbles in pivotal trials, or Livmarli underdelivers as competition, pricing and reimbursement pressures intensify.

Find out about the key risks to this Mirum Pharmaceuticals narrative.

Another View: Price To Sales Tells A Different Story

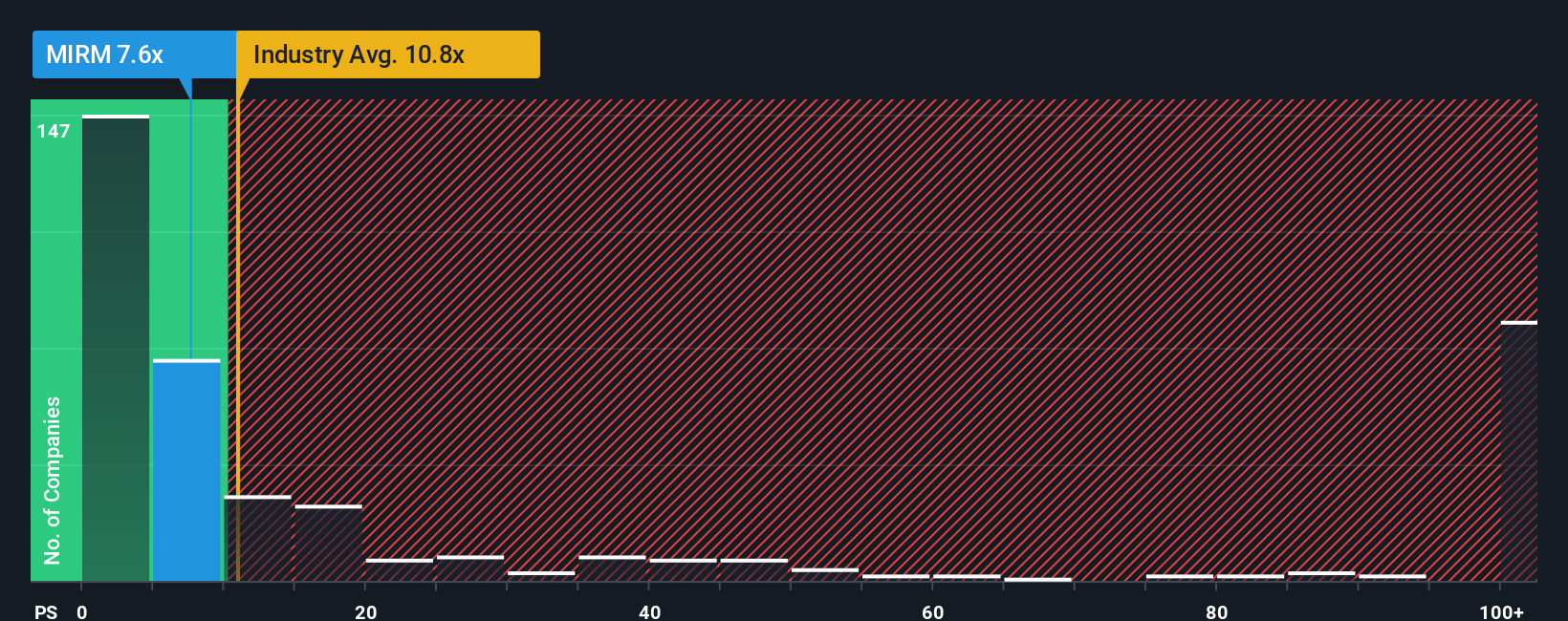

Mirum screens as cheap against our fair ratio on a price to sales of 7.3 times versus a fair ratio of 7.9 times, yet it looks expensive versus peers at 5 times and an industry average of 12 times. Is that gap a margin of safety or a warning that expectations are already high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mirum Pharmaceuticals Narrative

If you see the story differently and want to dig into the numbers yourself, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mirum Pharmaceuticals.

Ready For Your Next Investment Move?

Before the market’s next big swing leaves you watching from the sidelines, put Simply Wall St’s powerful screener to work and line up your next opportunities now.

- Capitalize on mispriced prospects by targeting these 909 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride powerful innovation trends by zeroing in on these 25 AI penny stocks at the forefront of artificial intelligence breakthroughs.

- Secure dependable income potential by focusing on these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal