Annaly Capital Management (NLY): Assessing Valuation After Announcing Its Q4 2025 Cash Dividend

Annaly Capital Management (NLY) just declared a fourth quarter 2025 cash dividend of $0.70 per share, payable on January 30, 2026, with both the record date and ex dividend date set for December 31, 2025.

See our latest analysis for Annaly Capital Management.

At a share price of $22.12, Annaly’s roughly 20 percent year to date share price return and 30 percent one year total shareholder return suggest momentum is still positive as investors continue to reward its income profile despite periodic rate related volatility.

If this kind of income story has you thinking more broadly about your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership for fresh ideas beyond mortgage REITs.

Yet with shares now hovering around analyst targets despite a hefty intrinsic value discount score, investors have to ask whether Annaly still trades below its true worth or if the market is already factoring in future growth.

Most Popular Narrative Narrative: 0.1% Overvalued

With Annaly Capital Management closing at $22.12 against a narrative fair value of $22.10, the story hinges on aggressive growth and margin expansion assumptions.

The analysts have a consensus price target of $21.023 for Annaly Capital Management based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $3.4 billion, earnings will be $3.2 billion, and it would be trading on a PE ratio of 7.0x, assuming you use a discount rate of 11.0%.

Curious how a mature mortgage REIT can support this kind of earnings leap and a much lower future multiple without breaking the story? The full narrative unpacks bold revenue scaling, margin expansion and share count assumptions that quietly rewire what long term returns could look like.

Result: Fair Value of $22.10 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising rate volatility and intensified competition across non agency mortgage markets could quickly pressure Annaly’s spreads, earnings trajectory and valuation assumptions.

Find out about the key risks to this Annaly Capital Management narrative.

Another Look At Value

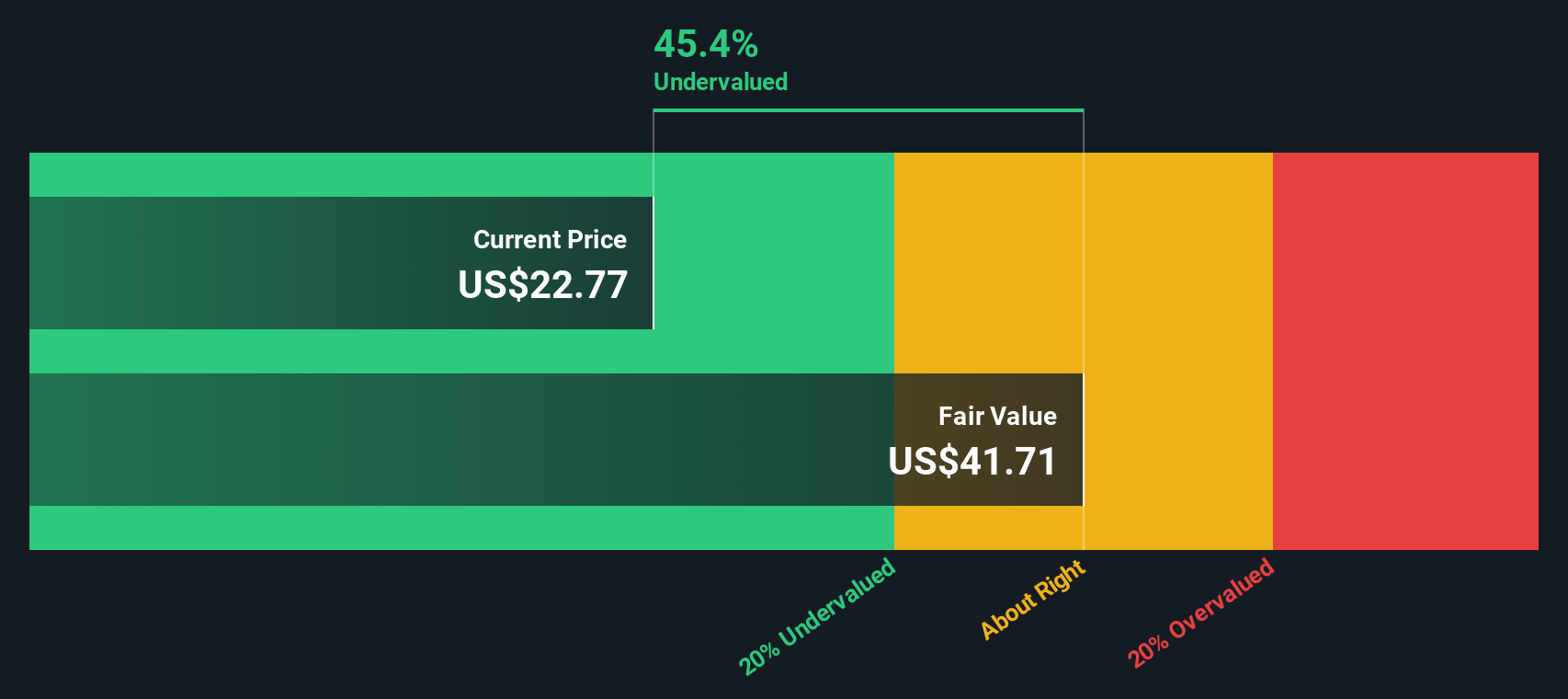

Our SWS DCF model paints a very different picture, suggesting Annaly could be trading about 47 percent below its estimated fair value of roughly $41.94, even as the narrative based view calls it about fairly priced. Which story do you think the market eventually believes?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Annaly Capital Management Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Annaly Capital Management research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If you stop with just one story, you could miss some of the most compelling opportunities on the market, so put the Simply Wall Street Screener to work now.

- Capture potential high income opportunities by scanning these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow without stretching your risk profile.

- Capitalize on powerful structural trends by targeting these 30 healthcare AI stocks that blend innovation, resilience and long term demand in a single theme.

- Position yourself early in emerging digital infrastructure by tracking these 80 cryptocurrency and blockchain stocks reshaping payments, security and data ownership worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal