IPO News | Banu Maotou Hot Pot was listed for the second time, and the total number of stores directly managed by the Hong Kong Stock Exchange increased to 162

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 17, Banu International Holdings Limited (abbreviation: Banu Mao Hot Pot) submitted a listing application to the main board of the Hong Kong Stock Exchange, with CICC and CMB International as co-sponsors. The company submitted a listing application to the Hong Kong Stock Exchange on June 16 this year.

According to the prospectus, Banu Maodu Hot Pot is the largest quality hot pot brand in China. It adheres to a productist business philosophy and pursues differentiated market positioning. According to Frost & Sullivan's data, in terms of revenue, Banu is the largest brand in the Chinese quality hot pot market in 2024, with a market share of about 3.1%. In terms of revenue, Banu is the third largest brand in the Chinese hot pot market in 2024, with a market share of about 0.4%.

According to Frost & Sullivan, China's hot pot industry is expected to maintain steady growth between 2024 and 2029, with a compound annual growth rate of around 6.5%. Among them, the quality hot pot industry is growing more significantly, and the compound annual growth rate is expected to reach 7.8%. With the company's established brand advantages and organizational capabilities, Banu will continue to benefit from this trend and further consolidate its leading position on the quality hot pot circuit.

Banu Mao Dao Hot Pot is famous for its Mao Dao Fu and mushroom soup. During the track record period, the total number of directly managed Banu restaurants of Banu Maotou Hot Pot grew from 86 as of December 31, 2022 to 111 as of December 31, 2023, and further increased to 144 as of December 31, 2024 and 156 as of September 30, 2025. The total number of directly-managed Banu stores increased from 83 as of January 1, 2022 to 162 as of December 7, 2025, with a growth rate of 95.2%. The increase in the number of stores reflects Banu's ability to continue to expand on the quality hot pot circuit.

As of December 7, 2025, Banu operated 52 stores in Henan and 110 stores in other provinces of China, which confirmed that Banu was able to successfully replicate the “Henan Model” in other provinces and cities. As of December 7, 2025, according to city level, in addition to the 32 stores opened in first-tier cities, Banu had a total of 130 stores in second-tier cities and below, accounting for 80.2% of the total number of Banu stores as of the same day.

As of the same day, Banu had 5 comprehensive central kitchens integrating production and logistics, and 1 specialized base processing plant. The business covered 14 provinces and municipalities directly under the Central Government in China. Banu's quality hot pot positioning and pricing strategy is not only recognized in the first-tier market, but can also meet the needs of customers in second-tier cities and below for high-quality products, and has broad market adaptability and replicability.

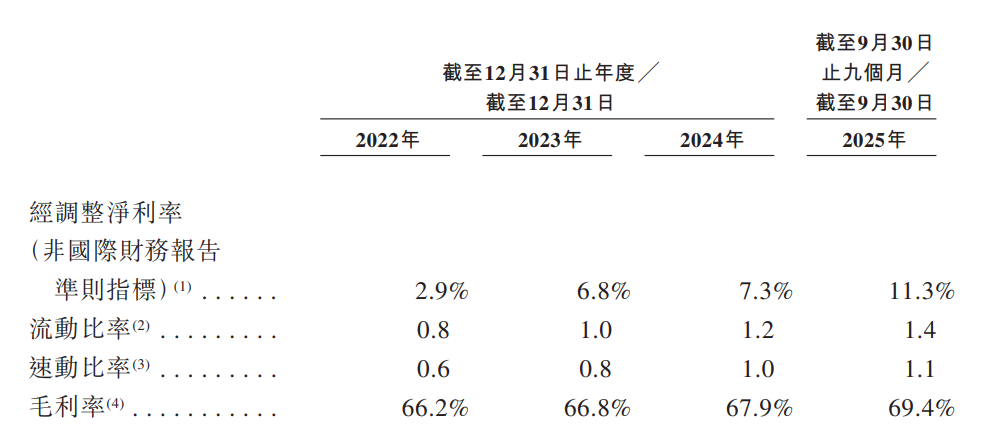

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded revenue of 1,433 billion yuan, 2,112 billion yuan, 2,307 billion yuan and 2,077 billion yuan respectively.

profit

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded annual profits of 5.19 million yuan, 102 million yuan, 123 million yuan, and 156 million yuan respectively.

gross profit margin

For the nine months ended September 30 in 2022, 2023, 2024, and 2025, the company's corresponding gross profit margins were 66.2%, 66.8%, 67.9%, and 69.4%.

Industry Overview

The market size of the hot pot industry grew from RMB 518.8 billion in 2019 to RMB 619.9 billion in 2024, with a CAGR of 3.6%. The market size of the hot pot industry has maintained a rapid growth and healthy development trend. Hot pot is loved by consumers due to its high degree of standardization, mature management system, and broad base of the public. In the future, the market size of the hot pot industry is expected to grow rapidly, reaching approximately RMB 849.8 billion in 2029, with a CAGR of 6.5%.

Due to consumer demand for high-quality ingredients, differentiated experiences, and health and safety standards, quality hot pot is now more competitive. The market size rapidly grew from RMB 60.2 billion in 2019 to RMB 74.1 billion in 2024, with a compound annual growth rate of about 4.2%. In the future, the quality hot pot market is expected to grow rapidly and reach approximately RMB 107.8 billion in 2029, with a CAGR of 7.8%.

The hot pot market in first-tier cities increased from RMB 44 billion in 2019 to RMB 51.2 billion in 2024, with a compound annual growth rate of 3.1%, and is expected to reach RMB 67 billion in 2029, with a compound annual growth rate of 6.5% from 2024 to 2029. In 2024, the hot pot market in China's second-tier cities accounted for 32.9% of the overall hot pot market, and is expected to increase to RMB 269.2 billion by 2029, with a compound annual growth rate of 5.7% since 2024.

As income increases and the pace of life accelerates, people in third-tier cities and below are increasingly looking for restaurants that provide quality food and a good atmosphere. It is expected that this will continue to drive the development of the hot pot market in third-tier cities and below. The size of the hot pot market in third-tier cities and below is expected to increase to RMB 513.5 billion by 2029, with a compound annual growth rate of 7.1% since 2024.

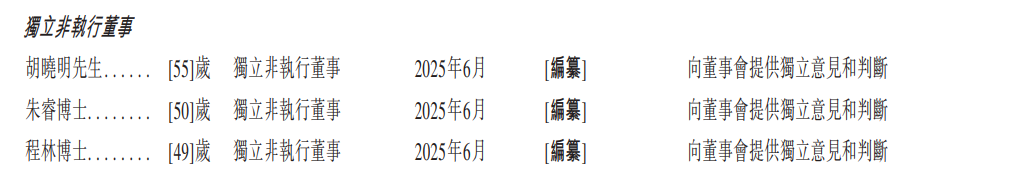

Board Information

The board of directors will be composed of nine directors, including five executive directors, one non-executive director, and three independent non-executive directors.

Shareholding structure

Mr. Du and Ms. Han (mutual spouses) control a total of about 83.38% of the company's voting rights through (i) D&H (BVI) LTD, which holds 75.26% of the company's issued share capital; and (ii) BANU UNITED LTD, which holds 8.11% of the company's issued share capital. D&H (BVI) LTD is owned by (a) DU HAN LTD (wholly owned by Mr. Du and Ms. Han) 10%; and (b) AYCF Concentric LTD. (A wholly-owned subsidiary of AYCF LTD, and ultimately wholly controlled by the trust with Mr. Du as the founder and family members as beneficiaries) holds 90% of the rights.

Furthermore, as the sole director of BANU UNITED LTD, Mr. Doo manages the affairs of BANU UNITED LTD and controls the voting rights of its shares. BANU UNITED LTD is wholly owned by Hangzhou Pasco, and the general partner of Hangzhou Pasco is Zhengzhou Xingshenghe (a company with 80% and 20% owned by Mr. Du and Ms. Han respectively). Therefore, Mr. Du, Ms. Han, D&H (BVI) LTD, DU HAN LTD, AYCF Concentric LTD. , AYCF LTD, BANU UNITED LTD, Hangzhou Pasco, and Zhengzhou Xingsheng together form the company's controlling shareholder group.

Intermediary team

Co-sponsor and sponsor and overall coordinator: China International Finance Hong Kong Securities Limited and CMB International Capital Limited.

Overall Coordinators: China International Finance Hong Kong Securities Co., Ltd., CITIC Construction Investment (International) Finance Co., Ltd., CITIC Lyon Securities Limited.

Company Legal Advisers: On Hong Kong and US law: Davis Polk & Wardwell; on Chinese law: Jingtian Gongcheng Law Firm; on Cayman Islands law: Harney Westwood & Riegels.

Co-sponsor legal advisors: Hong Kong and US law: Gao Weishen & Co.; relating to Chinese law: Haiwen Law Firm.

Auditor and reporting accountant: KPMG.

Industry consultant: Frost & Sullivan (Beijing) Consulting Co., Ltd.

Compliance Advisor: Zibo Capital Co., Ltd.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal