Should Edenred’s Deeper Role in Daimler Truck’s EV Charging Rollout Require Action From Edenred (ENXTPA:EDEN) Investors?

- Edenred recently announced a partnership with Daimler Truck to power the TruckCharge semi-public electric charging network across Europe, using its Spirii e-mobility software and extending Mercedes Benz electric trucks’ access to the UTA Edenred public charging network of roughly 420 truck-compatible stations in 23 countries.

- This move positions Edenred’s Spirii platform at the core of a large-scale heavy-vehicle charging ecosystem, reinforcing its role in the road transport energy transition and deepening its relationships with major fleet operators.

- We’ll now examine how Edenred’s deeper role in Daimler Truck’s European EV charging rollout could influence its existing investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

Edenred Investment Narrative Recap

Edenred’s investment case leans on steady digital payments growth, underpenetrated benefits and mobility markets, and operating leverage from its platform model. The Daimler Truck partnership reinforces the EV mobility catalyst but does not materially change the near term earnings picture, nor does it remove key risks such as margin pressure from sustained tech spending and regulatory uncertainty in core markets.

The October 2025 Visa partnership looks especially relevant here, as both moves deepen Edenred’s role as an infrastructure provider for payments and mobility. Together, they highlight how Edenred is trying to build higher value, recurring transaction flows on top of its existing client base, even as it continues to face headwinds from slower growth in mature European markets and FX and cash flow volatility in Latin America.

Yet beneath the appeal of Edenred’s growing EV and payments reach, investors should be aware of the pressure that sustained technology and compliance spending could place on...

Read the full narrative on Edenred (it's free!)

Edenred's narrative projects €3.5 billion revenue and €706.1 million earnings by 2028.

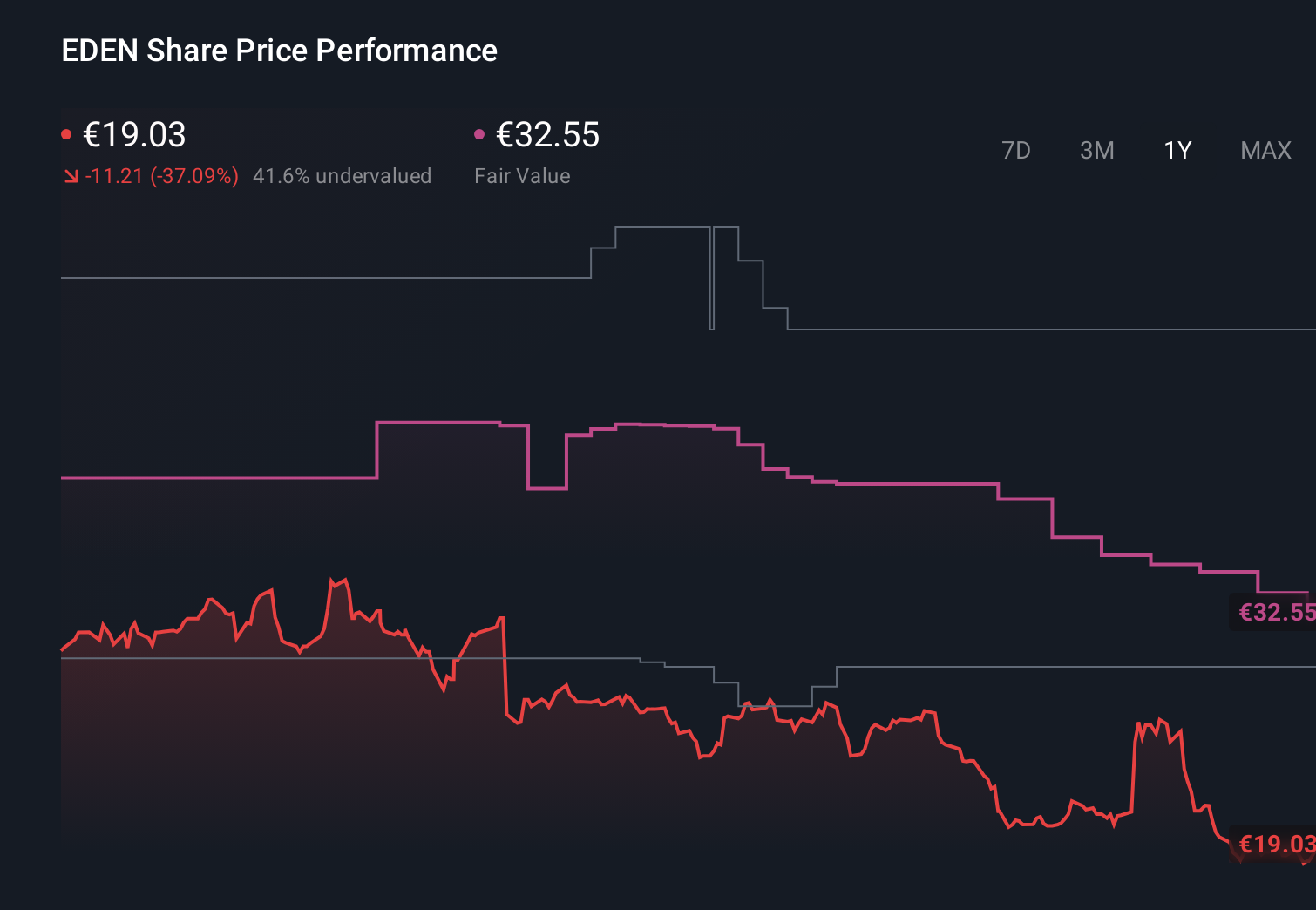

Uncover how Edenred's forecasts yield a €32.55 fair value, a 75% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span about €25.56 to €58.58 per share, showing how far apart individual views can be. Against this backdrop, the TruckCharge partnership may matter most for investors focused on Edenred’s longer term role in EV infrastructure and how that could offset slower growth in mature European benefits markets.

Explore 7 other fair value estimates on Edenred - why the stock might be worth just €25.56!

Build Your Own Edenred Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edenred research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Edenred research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edenred's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal