LTC Properties (LTC): Assessing Valuation After Recent Share Price Pullback and Strong Earnings Growth

LTC Properties (LTC) has quietly pulled back about 5% over the past month even as its annual revenue and net income each climbed roughly 35%, raising questions about whether investors are overlooking this healthcare REIT.

See our latest analysis for LTC Properties.

The recent pullback leaves LTC’s share price only modestly higher year to date, while a steadier three and five year total shareholder return suggests long term holders have still been rewarded even as near term momentum cools.

If this healthcare REIT has you rethinking the sector, it could be worth scanning other specialised opportunities across healthcare stocks to see what else fits your portfolio.

With revenue and profits growing far faster than its share price and the stock still trading at a notable discount to analyst targets, is LTC quietly offering value, or are markets simply pricing in all the growth ahead?

Most Popular Narrative: 9% Undervalued

With the most followed narrative placing LTC’s fair value modestly above the last close, the story hinges on how aggressively cash flows can scale.

The company's ability to recycle capital out of older skilled nursing assets (via portfolio sales and potential loan prepayments) and redeploy proceeds into higher-yielding, modern properties enhances rent growth potential and operating efficiency. This, in turn, supports higher net margins and long-term NAV growth.

Curious how rapid top line expansion, shifting margins, and a specific future earnings multiple combine into that fair value? The narrative lays out every assumption.

Result: Fair Value of $37.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive acquisition pricing and higher debt costs could compress yields and margins and undermine the assumed growth in earnings and fair value.

Find out about the key risks to this LTC Properties narrative.

Another View: Rich On Earnings

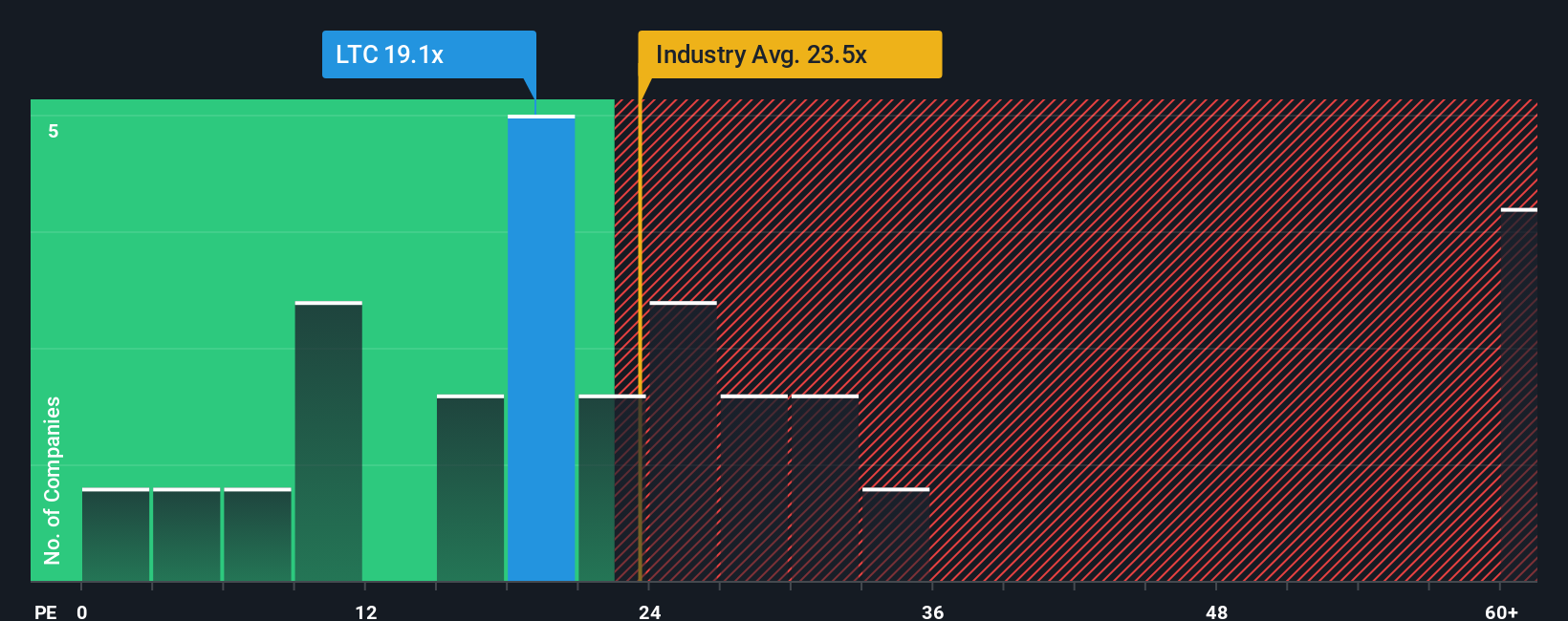

While the narrative pegs LTC as about 9% undervalued, the price tag looks steeper when you focus on earnings. At roughly 49.3 times earnings versus 25.4 times for global health care REITs and a 41 times fair ratio, today's multiple leaves less margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LTC Properties Narrative

If this interpretation does not quite align with your view and you would rather dig into the numbers yourself, you can build a tailored narrative in just a few minutes: Do it your way.

A great starting point for your LTC Properties research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If you stop at LTC, you could miss opportunities hiding in plain sight. You can use the Simply Wall Street Screener to help with your next move.

- Explore potential multibagger upside by targeting these 3625 penny stocks with strong financials that already back their low prices with real financial strength.

- Position your portfolio in the next tech wave by focusing on these 25 AI penny stocks involved in the development of intelligent technologies.

- Seek a more stable income stream with these 13 dividend stocks with yields > 3% that aim to pay you regularly over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal