CSP (CSPI) Q4: Narrower Trailing Losses Test Bullish Profitability Narrative

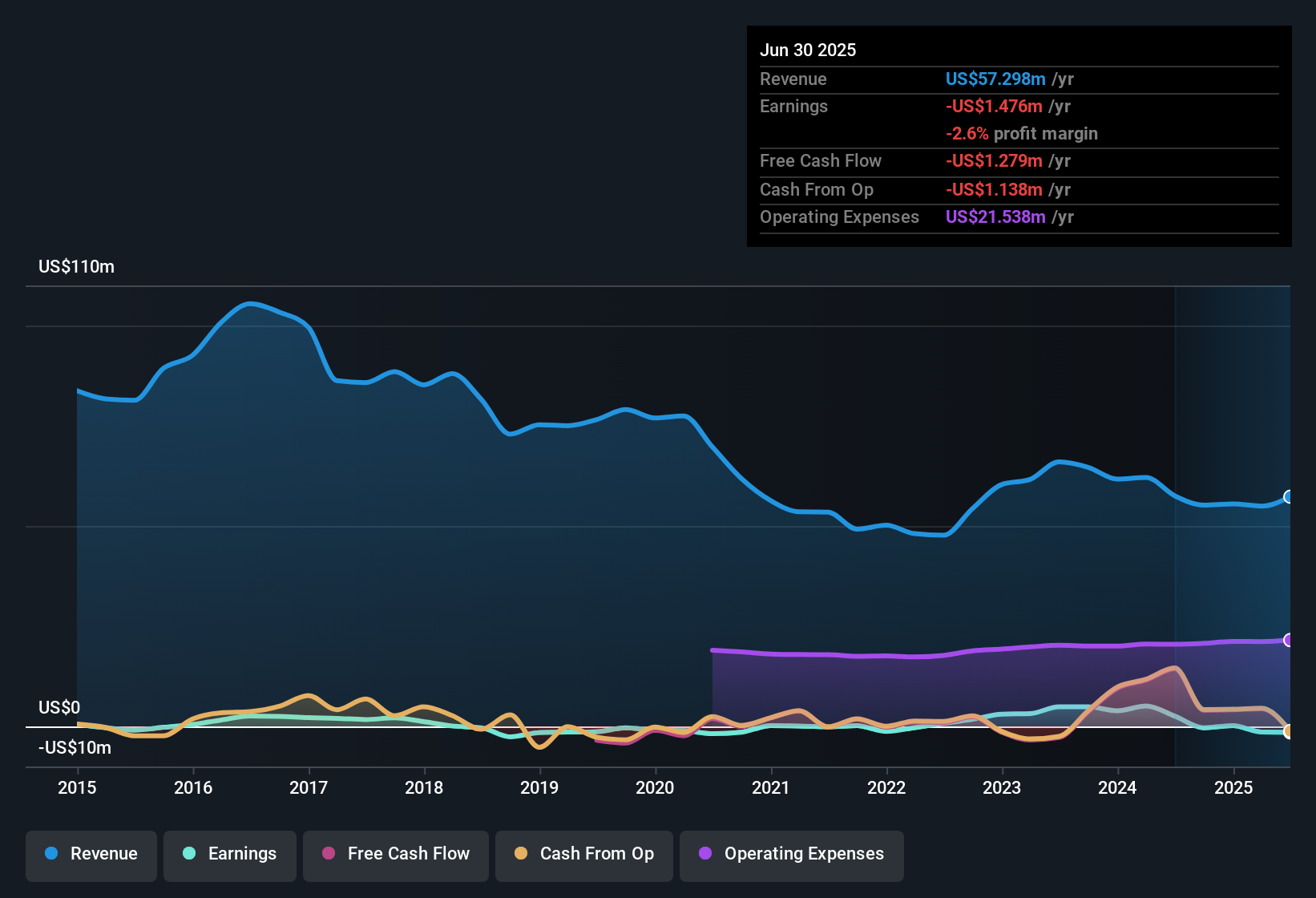

CSPI (CSPI) has just wrapped up FY 2025 with fourth quarter revenue of about $14.5 million and a basic EPS loss of roughly $0.02, while trailing 12 month revenue sits near $58.7 million with a small net loss of about $0.1 million. The company has seen quarterly revenue move in a fairly tight band between roughly $13.1 million and $15.7 million over the last year, with EPS swinging from a $0.05 profit in Q1 2025 to modest losses in the subsequent quarters. This sets up a story that is really about how efficiently each dollar of sales is translating into profit.

See our full analysis for CSP.With the headline numbers on the table, the next step is to see how this shape of revenue and thin losses lines up against the dominant narratives around CSPI's growth potential and profitability trajectory.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow On TTM Basis

- Over the last twelve months, CSPI generated about $58.7 million in revenue and a small net loss of roughly $0.1 million, translating to trailing Basic EPS of around negative $0.01.

- What stands out against the bullish view of gradual improvement is that the data shows losses have narrowed at about 12.6 percent per year over five years. Yet the latest trailing numbers still show a slight loss, not a clean move into profitability, even after quarters like Q1 2025 with $15.7 million revenue and $0.44 million net income.

- Supporters can point to the shift from a $1.57 million loss in Q4 2024 to a $0.19 million loss in Q4 2025 as evidence that the path toward breakeven is visible in the quarterly pattern.

- At the same time, critics can note that the trailing net loss of about $0.09 million shows the business is hovering around breakeven rather than clearly establishing sustained profits.

Revenue Holds Steady Around $58 Million

- On a trailing basis, revenue has moved in a relatively tight range between roughly $55.2 million and $58.7 million, with the latest twelve month total at about $58.7 million, while individual quarters in FY 2025 ran between about $13.1 million and $15.7 million.

- Viewed through an improving profitability narrative, this steady revenue base means the market is watching how well CSPI turns roughly mid teens quarterly revenue into earnings. This is especially relevant as Q1 2025 delivered positive EPS of about $0.05 while the following three quarters slipped back into small per share losses between roughly $0.01 and $0.03.

- Optimists can highlight that the latest trailing net loss of about $0.09 million is far smaller than the $1.48 million loss implied by the Q3 2025 trailing snapshot, suggesting operating discipline is playing a role even without big revenue jumps.

- On the other hand, the pattern of profits in only one of the last four quarters shows that consistent cost control still has to catch up to this stable revenue base before the bullish case looks firmly backed by the numbers.

Valuation Caught Between P S And DCF

- CSPI trades at about 2.1 times sales, which is lower than peers at roughly 13.1 times and slightly below the US IT industry around 2.5 times. Yet the $12.65 share price sits well above a DCF fair value of about $1.85 on the trailing inputs.

- For a bearish narrative that worries the stock is pricing in too much, the contrast between a low sales multiple and a DCF value far below the market level creates a clear tension. This is particularly notable since the company remains marginally loss making on a trailing basis despite the 12.6 percent annual reduction in losses over five years.

- Skeptics can argue that trading at more than six times the cited DCF fair value looks demanding given the trailing net loss of about $0.09 million and negative EPS near $0.01.

- Countering that, others may point to the relatively modest 2.1 times sales ratio versus peers as a sign that if earnings can tip decisively into positive territory, the market may be valuing the revenue line conservatively rather than aggressively.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on CSP's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternative Opportunities

CSPI's valuation looks stretched against its thin, inconsistent profitability and slight trailing loss, leaving little margin for error if progress stalls.

If that trade off feels uncomfortable, use our these 911 undervalued stocks based on cash flows to quickly focus on companies where more compelling cash flow backing supports the current share price and upside narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal