Is BMO’s 2025 Valuation Justified After a 130% Five Year Surge?

- If you are wondering whether Bank of Montreal is still a smart buy after such a strong run, you are not alone. This article will explore whether the current price makes sense or not.

- The stock has climbed 2.5% over the last week, 3.2% over the past month, and is up 28.5% year to date, with a 33.4% gain over 1 year, 69.7% over 3 years, and 130.7% over 5 years, which has clearly caught investors' attention.

- Recent headlines have focused on Bank of Montreal's ongoing integration of past acquisitions and its strategic push in North American commercial and wealth management. Investors see these areas as important to sustaining growth. At the same time, changing expectations around interest rates and the broader Canadian banking sector have helped reframe both the upside potential and the risks reflected in the current share price.

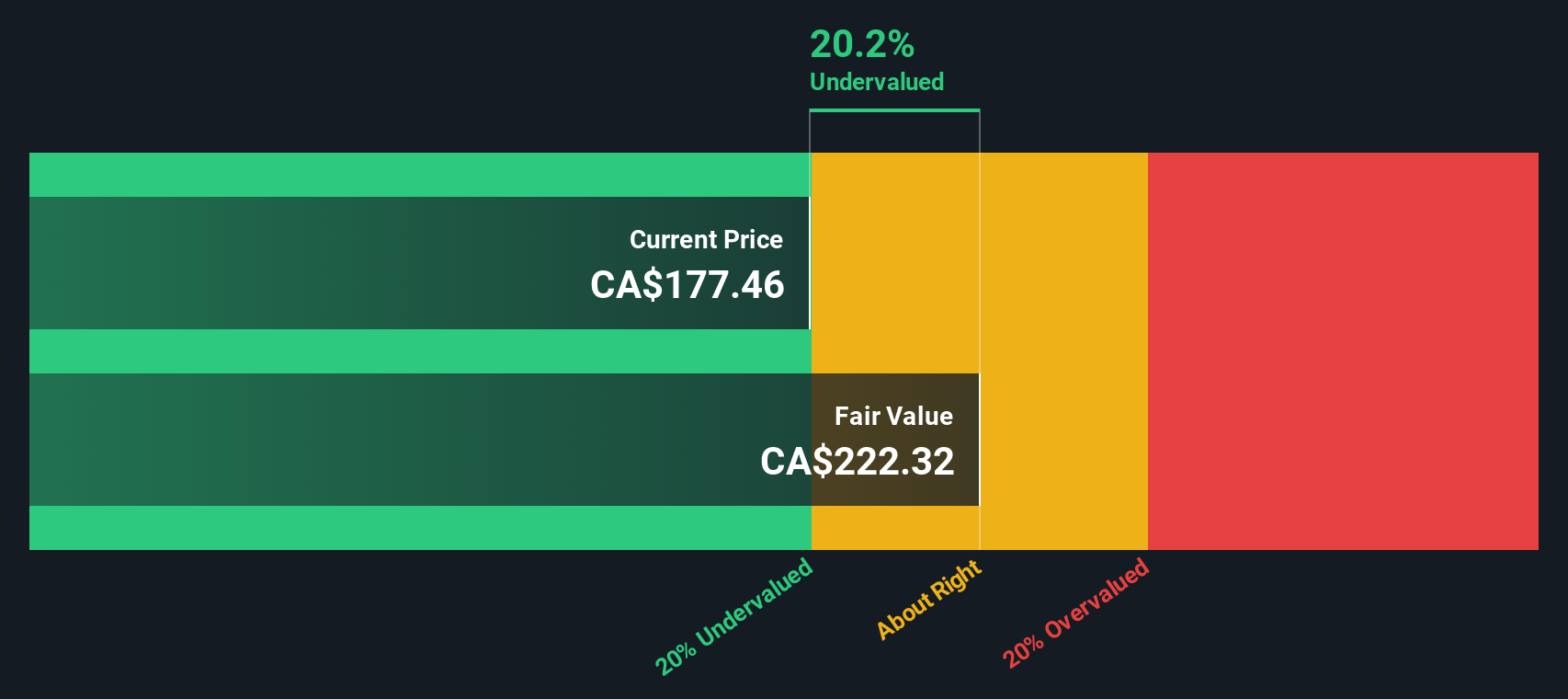

- Despite the strong performance, Bank of Montreal currently scores just 2/6 on our valuation checks, suggesting it only looks undervalued on a couple of metrics. Next, we will break down what different valuation approaches say about BMO and introduce a more insightful way to think about value by the end of this article.

Bank of Montreal scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of Montreal Excess Returns Analysis

The Excess Returns model looks at how much value Bank of Montreal can create above the return that shareholders require, based on its profitability and book value per share. Instead of focusing on cash flows, it evaluates whether the bank can consistently earn more on its equity than its cost of equity.

For Bank of Montreal, the book value is CA$122.02 per share, with a stable book value estimate of CA$119.80 per share, based on weighted future estimates from 10 analysts. Its stable earnings are projected at CA$14.62 per share, derived from return on equity estimates from 13 analysts. With an average return on equity of 12.20% and a cost of equity of CA$8.68 per share, the bank is expected to generate excess returns of CA$5.94 per share, supporting a premium over book value.

This framework leads to an intrinsic value estimate of CA$251.93 per share, implying the stock is about 28.7% below its fair value. On this basis, Bank of Montreal appears undervalued relative to this estimate of its long term return potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank of Montreal is undervalued by 28.7%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

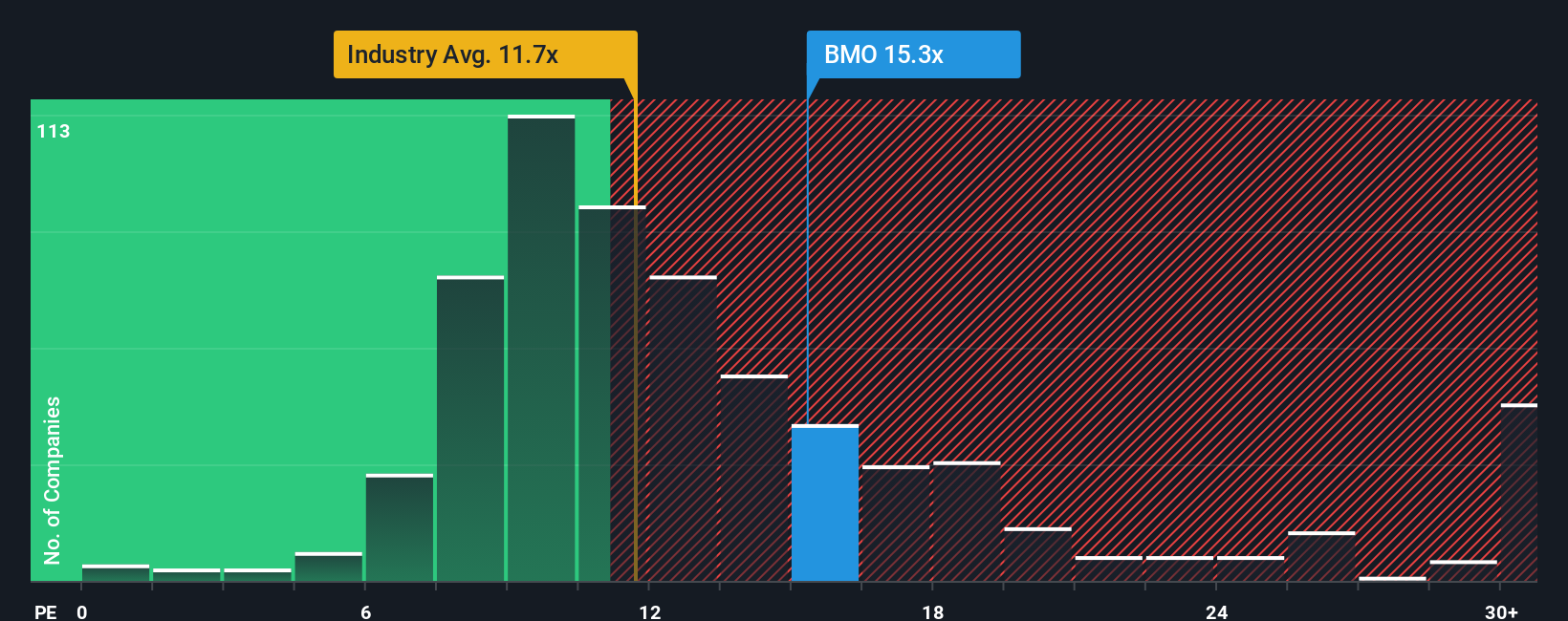

Approach 2: Bank of Montreal Price vs Earnings

For a mature, consistently profitable bank like Bank of Montreal, the price to earnings (PE) ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher risk usually call for a discount.

Bank of Montreal currently trades at about 15.46x earnings. That is slightly above its peer group average of 15.02x and well above the broader Banks industry average of 10.88x, suggesting the market is already assigning BMO a quality or growth premium. To refine this view, Simply Wall St calculates a Fair Ratio of 14.70x, which reflects what its PE arguably should be after adjusting for its specific earnings growth outlook, risk profile, profit margins, industry position and market capitalization.

This Fair Ratio is more tailored than a simple comparison with peers or the industry because it incorporates BMO's fundamentals rather than assuming all banks deserve the same multiple. Comparing the Fair Ratio of 14.70x with the current PE of 15.46x indicates the shares are trading at a modest premium to what fundamentals alone would suggest.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1456 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of Montreal Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page where you connect your story about a company with a concrete forecast for its future revenue, earnings, margins and ultimately fair value. You can then compare that fair value to the current share price to decide whether to buy, hold or sell, while the Narrative automatically refreshes as new earnings, news or guidance arrives. For Bank of Montreal, one investor might build a bullish Narrative around successful U.S. branch sales, credit recovery and digital growth to justify a fair value closer to the upper analyst target of about CA$180. A more cautious investor, focused on macro and credit risks, may anchor their Narrative around slower growth and compressed margins, landing nearer the low end around CA$151. Both perspectives can coexist transparently on the platform, giving you a more dynamic, story driven way to invest than any single PE ratio can offer.

Do you think there's more to the story for Bank of Montreal? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal